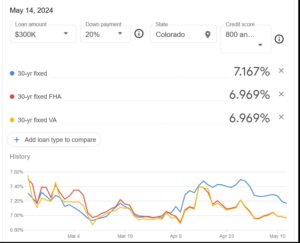

When I was writing this article mortgage rates were hovering right around 7%. At the same time economists are predicting a sharp decline in mortgage rates and a booming 2024 real estate market. On the other hand, the chart above shows a much different picture. Where do mortgage rates head the remainder of this year? Will we see substantial drops with the anticipated rate cuts by the federal reserve? What should you do to get the best rate in 2024?

What is the market predicting on long term rates?

Lower mortgage rates in 2024 — NAR is predicting the average will be 6.3% by the fourth quarter, down from 7.8% in 2023’s final three months — will entice more owners to give up the super-low rates they got during the pandemic and put their homes on the market, Yun said. That will cause the inventory of properties for sale to climb about 30% from 2023’s all-time low, he said.

Wells Fargo economists have a rosier outlook than NAR, predicting the average 30-year fixed rate will fall to 6% by the end of 2024, close to the Mortgage Bankers Association’s forecast of 6.1%. Fannie Mae, the largest mortgage financier, has the least optimistic outlook of the major forecasters, predicting the average will be 6.5% by the end of the year.

At mid year the predictions from economists have radically changed. Fortunately my predictions are about where they were at the beginning of the year as I’m not buying the soft landing and sudden drops in inflation we saw at the beginning of the year.

There are two drivers of long-term rates: Inflation expectations and Market Forces:

Mortgage rates are not set by the federal government. They are driven by the market and future expectations. Below are the two main drivers of interest rates.

- Inflation Expectations: One of the major drivers Treasury pricing is driven by future expectations on inflation. Is the economy going to grow and are prices going to rise? Currently inflation expectations are heading in the right direction which is giving some reprieve to interest rates. But, at the same time other market forces (supply and demand of treasuries) seem to be working in the opposite direction. Furthermore, the recent inflation readings have shown rising prices once again basically reversing the progress made earlier in the year. The wildcard is that inflation seems to be “stickier” than anticipated so the federal reserve will not be cutting rates as soon or as much as the market had anticipated.

- Market Forces: This refers to basic supply and demand. Demand is driven by investors in the US along with many investors and countries abroad that park their money in US treasuries due to the safety and liquidity. The large demand for treasuries has increased prices and therefore kept yields (rates) at historic lows. On the flip side is supply. The more supply of treasuries, the lower the price and the higher the yield (remember they move in opposite directions). The borrowing needs of the US will continue to grow with deficit spending. The non-partisan congressional office (CBO) has confirmed this as well with deficits predicted to swell in the coming years

- Supply: The supply of treasuries will continue growing rapidly as the government continues deficit spending. Unfortunately both major parties seem to be content with deficit spending as there has both parties will ensure deficits well into the future. The bigger budget shortfalls will add to the more than $10 trillion-plus rise in federal debt over the next decade that the Congressional Budget Office is already forecasting.” Treasury issuance will continue to rise as the budget shortfall increases. In a nutshell, supply will continue to increase which will drive prices down and yields up. We are seeing this in the recent 30 year treasury auction

- Demand: At the same time supply is starting to rise, the demand for treasuries is starting to wane. As the soft landing narrative takes hold there has been less of a flight to “safety” assets like treasuries. If we do avoid a recession, then demand for treasuries should remain about flat or decrease while supply will continue increasing.

What is causing the drastic swings in mortgage rates?

It has been tough to keep track of the huge swings we are seeing in the mortgage market. There are two primary drivers of the large price swings supply/demand pulls and mortgage demand.

- Supply/Demand pulls: 10-year treasury buyers are trying to figure out if demand or supply will end the tug of war. Recently treasuries were overrun with worries about supply which drove up the yields demanded. Currently supply is the question on everyone’s mind as deficits continue. Look for the supply to continue to ramp up over the year which will overtake demand on the longer dated maturities.

- Risk Premium: From the chart above on 30year treasuries, the market is worried about where long term rates go from here. The chief concern is supply of treasuries due to a huge deficit that shows no signs of easing. As supply increases ultimately prices will be pushed down and yields will increase. Mortgage buyers therefore are putting in a risk premium for the longer dated securities as there is a fear that over the long term rates will settle substantially higher.

Predicted Fed cuts unlikely to materially change real estate in 2024

Although the industry is predicting a swift turn around towards the end 2024, I’m skeptical of any big swings in real estate as volumes look to remain anemic. Even with the federal reserve anticipated cuts, it looks to keep interest rates around 6.5%- 7.5%. By historical standards, 6% is about normal, but it is still almost double what it was a year or so ago. With rates remaining high, affordability continues to be problem.

Furthermore I think that the market is already pricing in the future cuts predicted for 2024 as the federal reserve has already telegraphed these cuts well in advance which means our current rates of around 7% are likely not far off what they will be at year end.

On the positive side, we should start to see more supply coming online in 2024 as life happens and the lock in effect of the lower rates starts easing. This should take some pressure off prices but should not lead to a drastic movement in prices one way or the other.

What should you do to get the best rates in 2024?

With rates moving rapidly from day to day, what should you do? First, full disclosure, I’m not giving financial advice so talk with your bank or mortgage broker if you have questions. Based on the market there could be some opportunities for lower rates:

- Look at a variable rate product: I don’t foresee rates going much higher than they are today so it might be wise to look at an adjustable rate product to get a lower rate and buy you time for rates to fall further. I would look at 3/1 or 5/1 options as this should provide ample time to see where the market heads. Unfortunately as of this writing some of the shorter term maturities were trending higher than the fixed rate options so you will need to be careful if it is even worth the risk to go into a shorter term product.

- Be flexible on when you lock in your rate: I would be hesitant to lock in a rate too early as the market is moving quickly. You need to be flexible when you lock to take advantage of big dips in rates. There should be some opportunities in 2024 as the data is all over the place and can move the markets quickly.

Summary:

The biggest positive about interest rates is that for now the highest mortgage rates should be behind us. On the flip side, don’t buy the hype that mortgage rates are going to rapidly fall as longer-term treasuries are painting a much tougher picture for mortgage rates.

Look for rates to move maybe half a point in 2024 and this move could be in either direction meaning rates could increase half a percentage or fall a half a percentage depending on upcoming inflation data. Unfortunately, with the huge deficit spending by both parties, rates likely will remain in this range for a while which will continue to impact affordability and in turn the real estate market.

With rates not coming off much, look for 2024 to continue the trends of 2023 with lower volumes and prices coming off a little bit. I don’t foresee a huge price reset the last 6 months of the year as the economy stays in a holding pattern. Definitely not bad news, but also not a roaring come back as the national association of realtors is predicting.

The real question is what happens in 25 if rates continue to remain high. Will this cause a reset in prices and the general economy? We will have to wait and see in 2025 but it definitely looks like something big could happen next year.

Additional Reading/Resources:

- https://www.fairviewlending.com/why-are-mortgage-rates-rising-again/

- https://www.forbes.com/sites/kathleenhowley/2024/01/05/mortgage-rate-forecasts-for-2024-signal-a-comeback-for-real-estate/

- https://www.wsj.com/livecoverage/stock-market-today-dow-jones-11-09-2023/card/demand-for-30-year-treasurys-proves-weak-sending-yields-surging-oIJ5kBDb2sytqyspLC6x

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender