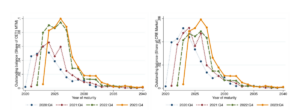

There is a mantra being used in small/regional banks that is “survive until 2025”. In essence the theory is that rates will drop precipitously and basically “bail out” many banks’ portfolios. Banks are in turn pushing out maturity dates hoping for a market bail out. Unfortunately, the chart above is sounding alarm bells at the federal reserve. Is the economy ready for a “maturity wall”? Should we all be banking on survive until 25?

What is Extend and Pretend?

The Federal reserve is seeing what I have been feeling for a while. Banks have put the brakes on lending due to capital constraints, the impetus is that their existing portfolio is not performing as planned so they have extended the loans. Essentially banks have been kicking the can down the road. Here is what the federal reserve data shows:

“We show that banks “extended-and-pretended” their impaired CRE mortgages in the post-pandemic period to avoid writing off their capital, leading to credit misallocation and a buildup of financial fragility. We detect this behavior using loan-level supervisory data on maturity extensions, bank assessment of credit risk, and realized defaults for loans to property owners and REITs. Extend-and-pretend crowds out new credit provision, leading to a 4.8–5.3 percent drop in CRE mortgage origination since 2022:Q1 and fuels the amount of CRE mortgages maturing in the near term. As of 2023:Q4, this “maturity wall” represents 27 percent of bank capital.”

I’ve been seeing this firsthand in our portfolio as our call volumes are off the charts as banks have pulled back significantly. Many deals that should be done by banks are not being funded due to constraints attributable to the “pretend and extend” mantra.

What is happening now that is making bank survival difficult?

The extend and pretend was put in place by banks to essentially survive until the market recovers as regional and small banks hold the vast majority of commercial real estate loans.

There are two primary drivers that are making it hard for many small/regional banks to survive

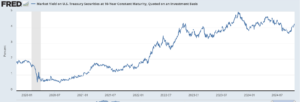

- Interest rates making treasury portfolio worth less: Remember as interest rates rise, mortgage bonds fall. As rates have risen and stayed higher for longer, banks holdings of government bonds/treasuries has declined. This is not an immediate issue until they need liquidity and have to sell. Unfortunately, as rates stay higher for longer this exponentially increases the probability that banks will have to sell their bonds at a loss.

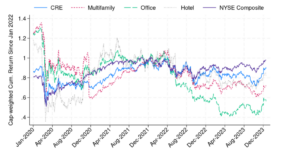

- Commercial properties declining in value due to rates/occupancy/higher interest rates: Small community banks and regional banks are the largest lenders on commercial properties. As rates have risen the value of commercial properties has declined. This is occurring as a result of capitalization rates increasing which in turn leads to lower prices. Higher interest rates are not the only issue for commercial real estate as there is substantial vacancies now in office, retail, and even light industrial properties. All these factors are leading to huge declines in commercial property values and ultimately losses to the lenders on these same properties.

Why did bankers pick 2025 as the recovery year?

Last year, most economists were predicting a continued decline in interest rates and in turn an easing of interest rates by the federal reserve. This would ultimately lead to a recovery in the value of bonds as rates declined. Furthermore, the theory was that commercial real estate would rebound due to the lower rates. The banks surmised that they could just wait out this downturn as there will be a swift recovery in 2025.

How accurate are these predictions of a swift recovery in 2025?

Unfortunately, the wait until 25 mantra is not going exactly as planned. We are seeing inflation continue to stay well above the federal reserve target of 2% along with huge deficit spending which in turn is leaving long term rates considerably higher than predicted. Furthermore, the pace and quantity of interest rate reductions has radically changed with many predicting that interest rates are ultimately going to settle considerably higher than anticipated.

Furthermore, as we can see so far this year, inflation is proving substantially stickier than originally anticipated and 10 year treasuries continue to fall while long term interest rates continue to rise.

What happens to banks and other lenders when these predictions falter?

I can say with 100% certainty that 25 will not be a recovery year for commercial real estate due to much higher interest rates than were predicted. As interest rates settle at much higher rates than anticipated we will see banks start to falter. The longer interest rates stay high, the higher the probability of catastrophe in the banking sector and in turn commercial real estate. The federal reserve is now getting worried, in their new study they note:

” The results so far show that weakly capitalized banks have extended-and-pretended their impaired CRE mortgages since 2022:Q1 and that this behavior has crowded out the origination of new CRE and new C&I credit. In this section, we show that this extend-and-pretend behavior has also led to an ever-expanding “maturity wall”, namely an increasing volume of CRE loans set to mature in the near term—which, as we later argue, represents a meaningful financial stability risk.”

Look at the chart below, there was clearly an inflection point earlier this year and treasury rates are not heading higher and almost double what they were 4 years ago; this is a huge problem for the extend and pretend mantra.

The impending maturity wall

It is not looking good for commercial real estate and in turn banks. Look at the chart above, there is a huge maturity wall in 25 and 26 as banks have moved these out by extending. Unfortunately this has further concentrated the risk into a two year window.

Now, look at the chart below of commercial valuations. Although they recovered off their pandemic lows on average the values are still about 30% below early 2020 levels with some property types like offices worth maybe a third of the value in early 2020.

The fed study highlighted the risk of the contagion effect as maturities come due at the same time, eventually banks will have to face the music but it will likely be substantially worse as nobody has faced the music yet and everyone will be together in the next two years.

Watch out in 2025

Although the stock market is at record highs, consumer spending is robust, and almost every economist is touting the “soft landing” of the economy, commercial real estate could throw a wrench in all these rosy predictions. The maturity wall of commercial loans is real and will eventually have to be reckoned with. At the same time commercial values have plummeted and interest rates have remained much higher than the markets anticipated.

These factors are a deadly cocktail for a pending correction in commercial real estate. It is looking more probable that sometime in 25 or 26 we will see this play out due to the maturity wall. Banks that have continued pushing out their problem loans will eventually have to face the music at the same time everyone else is also looking for a chair which could lead to a contagion effect as noted in the fed report. With the impending maturity wall now is definitely the time to buckle your seatbelt for some turbulence ahead.

Additional Reading/Resources

- https://www.newyorkfed.org/research/staff_reports/sr1130.html

- https://www.fairviewlending.com/why-are-home-prices-still-rising/

- https://www.fairviewlending.com/what-does-higher-for-longer-mean-for-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender