According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion was pulled out of housing equity during this time. How is this impacting real estate today? How long will this spillover effect last? Who are the winners and losers from the great refinance boom? Will real estate prices remain high? How long?

What was in the data about refinances?

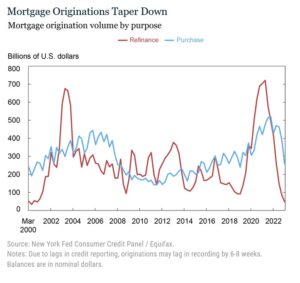

Approximately one-third of outstanding mortgage balances was refinanced during the seven quarters of the refi boom, and an additional 17 percent of mortgages outstanding were refreshed through home sales during a time of high demand for housing. Then, rates rose by 400 basis points from a historically low 2.68 percent contract rate on 30-year mortgages in December 2020 to 6.90 percent in October 2022, a swing of an amplitude not seen since the early 1980s, according to Freddie Mac’s Primary Mortgage Market Survey. By the first quarter of 2023, incentives to refinance were harder to find, and the refinance rate dropped near a historic low.

How will the pandemic refinance boom impact real estate today

I’ve been talking for the last year about the Golden Handcuffs of low rates. The recent federal reserve study came to the same conclusions: “The end of the most recent exceptionally low interest rate period leaves homeowners somewhat disincentivized to sell or change properties: Owners now looking to move will face increased borrowing costs and higher prices, with current home prices being more than 36 percent higher than they had been pre-pandemic.”

The winners from the refinance boom

Long and short, the refinance boom handcuffed millions of borrowers who have locked in record low interest rates. Until there is a big change in the economy, the days of low inventory and steady prices are upon as few will have the incentive to move.

I don’t see a large shift in pricing for a little while longer until there is a bigger shift in the economy and unemployment ticks up substantially. Once unemployment increases and the economy resets, there will be a significant loosening of inventory as borrowers are forced to sell/move.

The “losers” of the refinance boom.

The obvious outcome of the refinance boom is drastically reduced volumes on the purchase side and very few if any refinances. Mortgage professionals and realtors along with title companies rely on transaction volumes. With volumes down double digits many real estate professionals are hurting with drastically reduced commissions/paychecks.

Here is a blurb from CNBC: Under CEO Charlie Scharf, Wells Fargo is pulling back from parts of the U.S. mortgage market, an arena it once dominated. Instead of seeking to maximize its share of American home loans, the bank is focusing mostly on serving existing customers and minority communities. The shift comes after sharply higher interest rates led to a collapse in loan volumes, forcing Wells Fargo, JPMorgan Chase and other firms to cut thousands of mortgage positions in the past year.

Similar layoffs are occurring through the real estate industry at title companies, realtor offices, lenders, mortgage brokers, etc… Although the economy overall is in great shape, if you are a realtor, mortgage broker, or title company times are tough due to reduced closings.

How will the Covid refinance boom impact the general economy?

There is a huge positive byproduct of the refinance boom. Property owners have locked in ultra low rates freeing up equity and cash. According to the fed report “The improved cash flow generated by the recent refinance boom will potentially provide significant support to future consumption.”

We are already seeing this happen as rates have increased substantially I would expect spending to slow significantly but just the opposite has occurred. Spending is continuing higher primarily due to the increased cash flow generated by the large number of refinances

Summary

The pandemic refinance boom was a once in a lifetime opportunity to lock in a historically low rate. Over a third of all borrowers took advantage of the opportunity leading to a huge cash out of equity along with considerably lower payments. This cash generated from the rock bottom rates is keeping consumers spending even in the face of higher inflation and higher interest rates today.

The million dollar question is how long will this party last. At some point, inflation along with higher interest rates on cars, credit cards, etc… will usurp the savings locked in from the pandemic refinance boom. When will this occur and substantially slow spending and eventually the economy? Many are predicting sometime in 2024, almost a year later than original predictions. Until then, look for inventory to remain low, real estate prices to hold up better than anticipated, and for the spending party to roll on.

Additional Reading/Resources:

- https://libertystreeteconomics.newyorkfed.org/2023/05/the-great-pandemic-mortgage-refinance-boom/

- https://www.cnbc.com/2023/02/22/wells-fargo-lays-off-mortgage-bankers-days-after-rewarding-some-with-california-retreat.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, spending