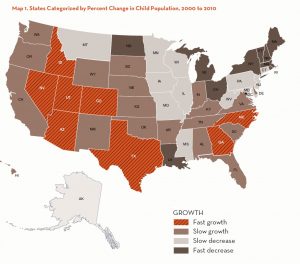

In real estate should you be following your children? The chart above shows the net gain in births by state and provides a profound picture of the future of real estate. What is the importance of the chart and why is it so important for long term real estate investing?

Why are children so important in real estate?

Adults, after all, have a habit of dying off. Someone has to replace them. For cities there are two means of replacement:

- Net migrations: Many cities grow from net migration from other areas. For example, the population of Detroit is declining. The prior residents are relocating somewhere like Denver or Atlanta that have become large magnets of migration from other cities.

- Births outweigh deaths: Births are also an important piece of a cities success. Eventually these children grow up, get jobs, buy houses, have families, etc…

Children are a more reliable predictor of real estate.

A city that can “replenish” its population from within is much more stable than one that relies on net migration. Net migration can be fickle where people flock to the next “cool” city. A thriving city will not be dependent on the “coolness” and migration from other areas as its population can maintain itself from natural births.

What can the chart tell us about real estate areas of the future?

A positive birth rate can provide long-term consistency in a city. Not only does a high birth rate provide a supply of workers in the future but it also shows long term commitment to an area. For example, it is considerably easier to move prior to kids. Before children, I hopped amongst cities and jobs with ease. Once I had children, it was much more difficult to move (anyone with kids who has “survived” a move can understand). By having children in a particular city, residents are making a long-term commitment to the area.

Cities that have long term commitments due to children will enjoy long term success as demand for real estate will continue due to increasing populations. This success will translate into a better long term real estate investment.

Two cities to watch: Atlanta and Denver why are they different?

If you look at the chart, both Atlanta and Denver have high birth rates and are also growing cities. I want to focus on these two key cities because these are our two largest lending markets and I have not only provided loans in both but also lived for over 15 years in each city.

Both Atlanta and Denver have two key items in common: jobs and higher education levels. Many markets have these same elements. For example, New York is highly educated, yet New York’s birth rate is declining. What makes Denver and Atlanta unique? They have two key elements that many markets lack, affordability and good educational systems in areas that families can afford to live in.

Atlanta is a very affordable market due to the generous zoning that allows supply to continue to increase. There is ample space left for new construction in the various suburbs that ring the city.This provides ample stock of new housing that people desire that are thinking about starting a family.

Denver is also affordable on a relative basis. I know it is crazy to think of Denver being an affordable with the median home price almost 500k! On a relative basis Denver is still affordable. Many people that relocated to Denver came from even higher priced markets like Seattle, New York, San Francisco, etc… Denver compared to many coastal markets is very affordable. For example, a comparable house in San Francisco is 1.61 million. Denver looks relatively inexpensive. Denver was recently ranked number one by US News and World report as the best place to live for large metro areas.

Although affordability is a large driver of areas attracting family creators, affordability isn’t the only reason these markets are attractive to families. It is a combination of good jobs, affordable housing, and good educational options in affordable areas. For example, in San Francisco, to be in a good school district, a family would need to spend over 1.6m. In Denver or Atlanta, you could easily spend 400k or less to be in a top performing school district. For example, Evergreen, a suburb of Denver you could spend around 400k for a house that is home to one of the top performing public high schools in the country. In Atlanta, areas like East Cobb or the North side of Atlanta offer similar opportunities with affordable housing and excellent schools.

Real Estate, like other industries, goes through booms and busts. The ability to ride through the various cycles is the key to long term success. Markets with higher birth rates will ride through real estate cycles better than most due to its built in population “replenishment” that should keep demand level and decrease the risk of population movement. Use the chart above to guide your real estate investing decisions for long term success.

Sources/Additional reading

- https://www.forbes.com/sites/joelkotkin/2014/09/11/baby-boomtowns-the-u-s-cities-attracting-the-most-families/#57e39db4ef57

- https://www.usnews.com/info/blogs/press-room/articles/2017-02-07/us-news-unveils-the-2017-best-places-to-live

- https://www.bloomberg.com/view/articles/2018-05-30/new-york-needs-more-children-not-more-wine-bars

- http://www.aecf.org/m/resourcedoc/AECF-ChangingChildPopulation-2011-Full.pdf

- https://www.usnews.com/info/blogs/press-room/articles/2017-02-07/us-news-unveils-the-2017-best-places-to-live

- http://www.westword.com/arts/twelve-reasons-why-denver-is-the-best-place-to-live-in-the-us-5114754

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).