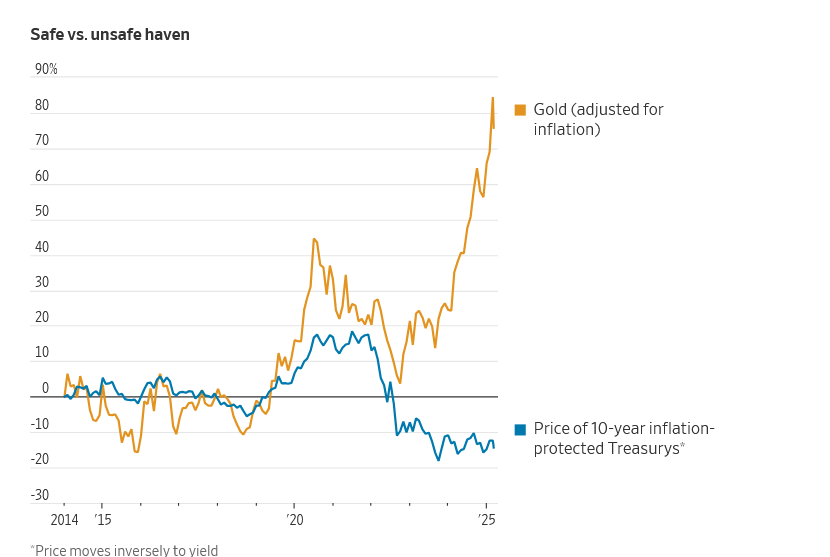

The chart above is very surprising. When the market is predicting a slowdown or a recession, gold typically rises and treasuries also rise, typically in tandem. The exact opposite is happening now as bond prices are falling and yields are rapidly increasing in the face of an economic slowdown which is leading mortgage rates to top 7%. Why are mortgage rates not following historical patterns? Will rates fall later this year? What should you do now? What does this mean for the spring real estate market?

Why is the chart so surprising on treasuries?

I was floored to see the chart above. The market has been talking about a recession, the stock market has started to falter and yet supposedly the safest asset, US government treasuries have sold off leading to huge jumps in interest rates. In every other cycle since the dawn of treasuries, as soon as recession talk began, there was a flight to safety of US government bonds which drove up prices and decreased interest rates (remember yields and prices move in inverse so as prices increase, yields/rates decline and vice versa). What is driving this huge divergence?

There are three drivers of long-term rates

Mortgage rates are net set by the federal government regardless of what the media or anyone tries to state. Long term interest rates are pegged to the 10 year treasury and driven by the market and future expectations. Below are the three main drivers of interest rates.

- Inflation Expectations: One of the major drivers of bond prices is driven by future expectations on inflation. Is the economy going to grow and are prices going to rise? Currently inflation is heading in the right direction, but the wild card are how tariffs will impact prices and if the tariffs will alter inflation going forward. Ironically every measure of inflation is declining, but inflation expectations by consumers is increasing, so it is a toss up as to where we go

- Deficit Spending: Although the DOGE is touting huge savings, at the end of the day the deficit continues to grow as the major drivers of the deficit are Medicare/Medicaid, Social Security, and Defense Spending. None of these big three have been fundamentally changed to alter the deficit path. On top of the spending, the new budget proposal doesn’t appear to move the needle much on the deficit. This will ultimately lead to continued supply of US bonds to finance all this debt.

- Market Forces: This refers to basic supply and demand. Demand is driven by investors in the US along with many investors and countries abroad that park their money in US treasuries due to the safety and liquidity. The large demand for treasuries has increased prices and therefore kept yields (rates) at historic lows. On the flip side is supply. The more supply of treasuries, the lower the price and the higher the yield (remember they move in opposite directions). The borrowing needs of the US will continue to grow with deficit spending. The non-partisan congressional office (CBO) has confirmed this as well with deficits predicted to swell in the coming years

-

- Demand: At the same time supply is starting to rise, the demand for treasuries is starting to wane. As the soft landing narrative takes hold there has been less of a flight to “safety” assets like treasuries. If we do avoid a recession, then demand for treasuries should remain about flat or decrease while supply will continue increasing.

- New factor International buyers: Along with demand, there is a new shift in the treasury market, international buyers like China, Japan, Europe, etc.. that hold billions in US debt are rethinking their investing strategies and selling debt and having less appetite at the same time supply is increasing, this is leading to lower prices and in turn higher yields.

What is causing the drastic swings in mortgage rates?

It has been tough to keep track of the huge swings we are seeing in the mortgage market. There are two primary drivers of the large price swings supply/demand pulls and mortgage demand.

- Supply/Demand pulls: 10-year treasury buyers are trying to figure out if demand or supply will end the tug of war. Recently treasuries were overrun with worries about supply which drove up the yields demanded. Currently supply is one question on everyone’s mind as deficits continue. Look for the supply to continue to ramp up over the year which will overtake demand on the longer dated maturities. At the same time, demand is declining which is a recipe for much higher rates and lower prices.

- Risk Premium: From the chart above on 30year treasuries, the market is worried about where long term rates go from here. The chief concern is supply of treasuries due to a huge deficit that shows o signs of easing. As supply increases ultimately prices will be pushed down and yields will increase. Mortgage buyers therefore are putting in a risk premium for the longer dated securities as there is a fear that over the long term rates will settle substantially higher.

Predicted Fed cuts unlikely to materially change real estate in 2025

Unfortunately the federal reserve is “stuck”. Their core mission is price stability with employment as their second mission. Unfortunately these two objectives are going to class in 25. The federal reserve will prioritize price stability even with a softening economy. Furthermore, the fed has no control over deficit spending and demand from foreign buyers. Even if the fed lowers rates, the market likely will not move much on long term rates.

Terrible timing for spring market

The surge in interest rates and teetering of the stock market could not happen at a worse time for the real estate market. The spring season is typically the busiest time in real estate. The economic uncertainty coupled with higher rates is going to put a huge damper on the real estate market this spring. This is occurring just as inventory is starting to rise, which will ultimately lead to lower prices in many parts of the country. Although I don’t see a huge reset in real estate prices, we will see substantial softening in the 10-15% range in many markets.

What should you do to get the best rates in 2025?

With rates moving rapidly from day to day, what should you do? First, full disclosure, I’m not giving financial advice so talk with your bank or mortgage broker if you have questions. Based on the market there could be some opportunities for lower rates:

- Look at a variable rate product: I don’t foresee rates going much higher than they are today so it might be wise to look at an adjustable rate product to get a lower rate and buy you time for rates to reset. I would look at 3/1 or 5/1 options as this should provide ample time to see where the market heads. Note there is a risk that rates could see a shock and head even higher so be careful on your timing of a variable rate product. Also as the spreads tighten between short and long term rates or possibly invert, it might actually be cheaper for a fixed rate. Long and short, there could be limited opportunities, but also some risk and you have to weigh the benefit at the time you lock.

- Be flexible on when you lock in your rate: I would be hesitant to lock in a rate too early as the market is moving quickly. You need to be flexible when you lock to take advantage of big dips in rates. There should be some opportunities in 2025 as the data is all over the place and can move the markets quickly. We have seen this in the last couple weeks with half a point swing within a few days. Be ready to lock as soon as you see a window as the opportunities are going to be very short.

Summary:

Don’t buy the hype that mortgage rates are going to rapidly fall as longer-term treasuries are painting a much tougher picture for mortgage rates. I’ve said for years that deficit spending is going to drive rates higher and we are seeing that play out. What I didn’t factor in was at the same time demand would pull back due to loss of confidence in the US by foreign buyers of treasuries leading to even higher rates. Don’t expect the federal reserve to ride in and save the day. These two items are going to nullify anything the federal reserve can do.

Until the US tackles its debt crisis and instills world confidence long term rates including mortgage rates are going to stay lofty. This will be a huge problem if the US does enter into a recession. There will be limited options to help the economy quickly recover which could lead to a stagflation scenario that we haven’t seen in decades. Although this is not my baseline, it is definitely a possibility as the chart above should make you nervous about where we head.

On a positive note, the market seems to be pricing in quite a bit of downside risk so hopefully there will be an upside surprise with the economy. We will get to see later this year how it all works out.

Additional Reading/Resources:

- https://www.forbes.com/sites/kathleenhowley/2024/01/05/mortgage-rate-forecasts-for-2024-signal-a-comeback-for-real-estate/

- https://www.wsj.com/livecoverage/stock-market-today-dow-jones-11-09-2023/card/demand-for-30-year-treasurys-proves-weak-sending-yields-surging-oIJ5kBDb2sytqyspLC6x

- https://www.fairviewlending.com/2025-mortgage-rate-predictions/

- https://www.wsj.com/economy/trade/us-dollar-treasury-bonds-trade-war-028e8765?mod=wsjhp_columnists_pos_1

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender