As suspected the March consumer price index came in hotter than expected which should be no surprise to anyone buying groceries, going out to eat, or traveling, everything is considerably more expensive and there continues to be insatiable demand. What does this mean for interest rates and real estate? Why is the market not buying what the federal reserve is selling? Will the economic train eventually slow?

March CPI report exceeds again

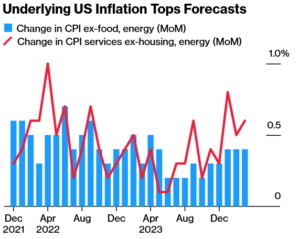

A measure of underlying US inflation topped forecasts for a third straight month, signaling persistent price pressures that will likely delay any Federal Reserve interest-rate cuts until later in the year.

The so-called core consumer price index, which excludes food and energy costs, increased 0.4% from February, according to government data out Wednesday. From a year ago, it advanced 3.8%, holding steady from the prior month.

Economists see the core gauge as a better indicator of underlying inflation than the overall CPI. That measure climbed 0.4% from the prior month and 3.5% from a year ago, an acceleration from February that was boosted by higher energy prices, Bureau of Labor Statistics figures showed.

Should be no surprise that inflation running hot

I do not believe any of the economists predicting the sharp decline in interest rates are living in the same world the rest of us are. If you go anywhere airports are packed, restaurants are packed, and there seems to be insatiable demand. Above is a pic of a menu I took; can you believe the prices? Even with the high prices, the line was out the door! At the end of the day the spending keeps rising even with the higher interest rates and shows no signs of slowing down.

Federal reserve does not control mortgage rates:

First, it is important to note that the federal reserve does not directly control mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight. In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way. We can see this in practice, after the March CPI, bond prices fell and yields on both 2 and 10 year treasuries soared.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate. This is now very apparent as the federal reserve has pledged low rates and yet the 10 year treasury just reached its highest level in over a year.

Why are mortgage rates rising now?

Long and short, the “market” is not believing the federal reserve that inflation will quickly fall and that rate cuts are imminent, furthermore there is worry about the supply of bonds coming on the market from the recent 1.9 trillion stimulus coupled with talks of even more government spending. Below are the current drivers of rates and inflation.

- Inflation expectations: Inflation is not coming down as quickly as assumed by the market. The recent jobs report was a blow out with continued job growth along with raises double the current inflation target of 2%. Long and short the market does not believe that the federal reserve will cut as deeply or quickly as hoped only a month or so ago

- Supply of bonds: The supply of bonds is getting allot less attention than inflation expectations but is even more important that inflation expectations. With the various stimulus bills enacted, the federal government is forced to sell trillions of dollars in new bonds to finance all these items. A good way to understand this is to think of a car lot, if you are going to buy a new car and there are three hundred on the lot, your chance of getting a better deal is greatly increased due to the supply. The same for bonds, as more bonds hit the market, the prices will decrease. Remember yields work in inverse to price so as prices decrease the yields will increase which in turn leads to higher rates.

What happens to mortgage rates now?

To gauge what will happen to mortgage rates, look no further than the 10 year treasury as a guide. It clearly shows an upward trend in long term rates. As a result look for mortgage rates to likely rise further and hold above 7% for a while. Don’t be surprised if mortgage rates come close to topping 8% again sometime this year as the market has been underpricing long term rates based on the federal reserve’s statements.

What does the continued rise in rates means for the economy?

Rates will remain higher for longer which means credit card rates will increase, mortgage rates, car rates, etc… basically anything that is borrower and not locked in before the rates surged. The surge in rates will continue the “lock in” effect for real estate as it is considerably more expensive to trade up or down due to the huge surge in rates.

Hard landing increasing in probability

The longer rates stay high, the higher probability of something breaking. Although the market is predicting a 90% plus probability of a soft landing, I think this is extremely optimistic. As we can see from the continued inflation numbers, we are currently in a “no landing” scenario where the economy is still humming along at a considerably faster pace than anyone would have expected.

Look for banking and commercial real estate to continue showing huge cracks. Both banking and commercial real estate is betting on a quick drop in rates and the theory is to wait out the increase in rates now and that if they can get down the road, the asset values will improve. Unfortunately as rates stay higher longer, the probability of something bad breaking in the economy increases exponentially.

Rates are a huge risk to the economy.

As I have predicted for a while, inflation is here to stay and will be much more difficult to tame than the federal reserve and the market was anticipating. March’s CPI number should hammer this point home loudly that we have a big problem in the economy that will not be easy to resolve. The crux of the issue is continued government deficit spending that is driving up the amount of money in the economy leading to continued growth in spending. Furthermore, this spending is driving up the volume of bonds which ultimately leads to lower bond prices and higher mortgage rates.

The March CPI is a warning to the federal reserve and to the market that we are on a long path towards normalization of inflation and rates will stay considerably higher for longer. Unfortunately the market has been banking (pun intended) on rates falling to bail out the commercial real estate industry and the banking industry. As high rates are prolonged due to inflation, the probability of a recession increases exponentially, and the soft-landing narrative becomes considerably less likely.

Additional Reading/Resources

- https://www.fairviewlending.com/senate-calls-for-fed-to-lower-rates-will-the-fed-oblige/

- https://www.cnbc.com/2024/04/10/us-treasury-yields-ahead-of-consumer-inflation-data.html

- https://www.wsj.com/economy/inflation-march-cpi-report-interest-rate-239b7e5e

- https://www.bloomberg.com/news/articles/2024-04-10/us-core-cpi-rises-more-than-forecast-for-third-straight-month?srnd=homepage-americas

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender