Anytime you turn on the news you hear about high house prices and that the culprit is that supply has not kept up with demand. Is supply really the main culprit of housing prices or did something else that occurred during Covid radically alter the market? Will house prices continue higher in the long run or will this trend reverse course?

What happened during Covid to the mortgage market

Covid was an interesting economic experiment by the federal reserver that I do not think will be judged highly when we look back in a few years. The Federal Reserve was worried about the economy and so they took two drastic steps:

- Federal reserve dropped rates to basically zero which pushed down borrowing costs

- Fed bought mortgage bonds: to ensure liquidity in the market, the federal reserve went on a buying spree buying both treasuries and mortgage bonds to further drive rates down

These two events radically altered the mortgage rates driving fixed rates down to below 3% which is the lowest I’ve seen in the last 30 years for a 30 year fixed rate mortgage.

Low rates drastically increased buying power

As rates dropped to historic lows as you can see from the tables someone making 125k per year could now afford an almost 700k home that is at the same time paying all their other debts. In actuality during Covid they could afford even more as the government suspended student debt payments which further increased their buying power.

As more people could now buy more properties, the demand greatly increased for 700k properties like in the example above. Because of the low rates they could now afford a house worth 80% more than before

Demand issue which led to the supply issue

The media has put the chicken before the egg. The root cause of higher prices is substantially increased demand due to historically low interest rates driven by the federal government. This is the opposite of what we hear in the news each day. It is demand that has created the supply issue that we saw during covid

We will start to see this play out more in the upcoming year as supply increases due to a decline in demand. This will occur even as new construction drastically slows down.

Rising rates led to an affordability issue

Just 15.5% of homes for sale were affordable for a typical U.S. household, the lowest share since Redfin started tracking this a decade ago. A home is deemed affordable if the estimated mortgage payment is no more than 30% of the average local monthly income.

Affordability plunged 40% from before the pandemic, and 21% from just last year. Redfin says spiking mortgage rates were a key reason why.

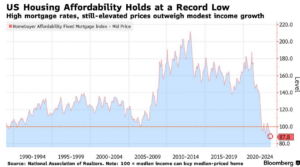

Affordability just hit record lows as interest rates remained substantially higher than the Covid lows

Ironically the low rates increased inflation

It is a bit ironic that the federal reserve in their quest to help the economy ended up stoking a huge amount of inflation. As housing prices have risen, rents in turn have increased substantially rising the cost of living/inflation substantially.

As a result of the housing inflation, to bring inflation down, the federal reserve has substantially increased rates which has tapered demand substantially and led to the affordability issues we are facing today.

Increased supply will not help affordability much

Almost every city has a plan to increase supply to in theory help with affordability. Unfortunately with building costs as high as they are due to huge jumps in materials, wages, land, etc… it is not possible in many cities to build houses that are affordable without huge subsidies.

Will real estate prices fall

The only way to have more affordability is to have lower prices. As interest rates stay higher for longer than the market anticipates, there will eventually have to be a reset in prices as there will be substantially less demand at the current price points.

We are not seeing large increases in supply due to the lock in effect of the ultra low interest rates of the past, but eventually the market will start to move due to employment changes, kids, divorce, death, etc…. It could take several more years to fully see the real estate market loosen up, but eventually it will happen.

Summary

The real culprit of higher real estate prices is not supply it is demand driven due to ultra low interest rates due to the federal reserve policies that allowed prices to get bid up substantially. As interest rates have risen, we are now seeing housing prices flatten and even fall in some markets. This is due to a lack of demand due to higher interest rates that is pricing buyers out of the market. As shown in the example above, it would take a salary of 125k to afford a 390k house.

Take a market like Denver where the median home price is almost 600k, most people are unable to afford a house in this market which is leading to declines in prices. Over the next several years prices will reset as rates remain higher and prices are out of reach for most buyers. It is ironic that in a few years we are going to be talking about an oversupply and falling prices.

The trend of higher rates will not reverse quickly as a huge drop in rates would lead to an increase in housing prices again and in turn put more pressure on inflation. Remember housing makes up about a third of the consumer price index so the federal reserve must ensure that inflation in housing does not flare back up.

Additional Reading/Resources

- https://www.npr.org/2023/12/24/1221480443/most-homes-for-sale-in-2023-were-not-affordable-for-a-typical-u-s-household

- https://www.bloomberg.com/news/articles/2023-09-08/us-housing-affordability-remains-at-a-record-low-nar-says

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender