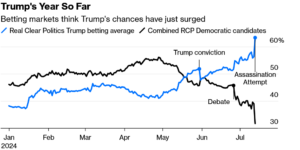

Wow, it is amazing how quickly tides have changed. Look at the chart above of the betting market on the next presidential election right after the assassination attempt. Fast forward and another twist happened over the weekend with President Biden stepping down and handing the reigns to VP Harris. Recent polls put the new match up much closer.

What does the entrance of Harris vs Trump mean for real estate and interest rates today and over the next several years? Which one is better for real estate? Remember, there has historically been an “October surprise” so regardless of your choice, there is a long way to go to before the election.

Election much closer now with Harris

I would have never predicted the past events from an assassination attempt to a sitting president dropping out of the race, this election has and will be one for the history books. Based on recent polls as I was writing this article, most put Harris higher than Biden in a match up vs Trump and into an almost statistical dead heat. My thoughts are that it will be at least a month or so before we have better numbers on Harris and the next presidential debate could once again radically alter the equation. Note, the numbers can and will fluctuate hugely between now and the election so we will need to all stay tuned.

Trump vs Harris one big theme in common

Regardless of your presidential candidate preference, there is one big theme that both would have in common, increased deficits. The way they would accomplish the increased deficits would be different.

Trump would have lower revenue collection by lower taxes, but at the same time spending would stay elevated on the big drivers, social security, medicare, Medicaid, etc… There would be cuts to other spending to offset some of the tax increases, but there would still be a net increase in the deficit

Although we haven’t seen exact policies from Harris, it is a safe bet that she will be similar to the Democratic platform in her policies. After the Harris announcement the long-term treasury market was trending with higher yields which is a good indication of her predicted policies. Harris would increase government spending further while also increasing taxes via various wealth taxes and corporate taxes. At the end of the day the increased taxes will still be overrun by increased government spending leading also to higher deficits.

Although there is considerable debate about which one would be better for the economy, in regard to deficits, there is no clear winner as both policies would lead to deficits.

Why care about deficit spending for predicting interest rates?

Remember the federal reserve does not set interest rates, the market “sets” long term rates like the 10 year treasury which is the driver of real estate mortgage rates. As deficits continue to increase the supply of bonds must also increase as the government will have to sell more bonds to finance the ever larger deficits.

As supply of bonds increases, just like everything else in economics prices decrease. The decrease in prices means that interest rates must increase or stay at the current lofty levels.

What does the chart mean for short term interest rates?

With all the speculation on the next president, it should give the federal reserve pause to do much on interest rates, the thinking is that there will be one cut in September of .25 and then likely they will sit tight until after the election unless something major starts breaking. Unfortunately the 25 basis point September rate reduction is already factored into the treasury market so don’s foresee any additional big changes in rates lower unless there is a huge problem with the labor market.

What happens to mortgage rates the remainder of the year?

The Predicted Fed cut unlikely to materially change real estate in 2024. With the market pricing in one, maybe two rate cuts this year, the impact will be muted. Even if I assume the market has not factored the second cut in, this will lead to mortgage rates in the 6.5%-7% range for the remainder of 2024.

Furthermore I think the federal reserve will be very wary of possibly rocking the boat one way or another prior to the election so they will be very conservative on their cuts to not exert any influence one way or another.

Long term rates higher

Check out the charts below, there has been a huge jump in expectations for long term rates. I’m not exactly sure why the large jump recently, but it is definitely profound that surveyors now think there will be huge jumps in long term inflation that is substantially higher than we have seen in recent years. If the survey is correct and long term inflation settles considerably higher then rates will have to move up from here to help quell the inflation risk.

On a side note, I’m not convinced on the accuracy of the survey of expected inflation, but nonetheless it is pointing in the wrong direction for the market.

What does higher for longer mean for residential real estate?

Prior to Covid, if interest rates basically doubled, you would see a huge correction in real estate prices. We have not seen this yet as wage growth remains strong and the unemployment rate stays low. Currently prices are flat/increasing which is the opposite of what I would expect.

Just because residential real estate is appreciating now does not mean it will continue. Unfortunately the real estate party will not last forever, the longer rates stay high eventually unemployment will pick up and real estate will ultimately reset.

What does higher for longer mean for commercial real estate?

The party is already over for many commercial properties, especially in the office sector. Higher interest rates combined with higher vacancies and lower rental rates are the death knell for many properties.

The Trepp Commercial Mortgage-Backed Securities (CMBS) Delinquency rate for all commercial properties rose to 4.66%, up from 4.51% in December and just 2.94% in January 2023. That represents a 59% increase in the past year.1

Trepp CMBS Research. “CMBS Delinquency Rate Resumes Rise to Start 2024, Office Delinquency Rate Jumps.”

Office properties remain the most troubled sector of the commercial property market, as they did throughout last year. Delinquencies in that space rose to 6.30% in January, more than three times the rate of 1.86% in the same month a year ago.

The big changes in commercial real estate are just getting started. Higher for longer will continue resetting commercial property prices lower. Look for this trend to only accelerate with high interest rates.

Summary

Regardless of the presidential candidate, we are in store for higher mortgage rates due to increased deficit spending coupled with increased expectations for longer-term inflation. Both factors will keep rates substantially higher for considerably longer than the market is anticipating.

The most impacted segment will be commercial properties as we are already seeing this in the office market and spilling into the apartment market as rates make many of the deals done during the era of ultra low rates unworkable. The reset is just beginning in the commercial sector and look for this to accelerate into next year.

On the residential side, the impacts have been muted, but eventually the golden handcuffs of low rates will ease as unemployment normalizes. Although I don’t foresee a 2008 reset, there is a high probability of a 10-20% drop in prices in many markets.

The key takeaway is that whoever is president, it looks like deficits are here to stay and in turn higher interest rates. Although 2008 is not in the cards, the longer interest rates stay high, the higher the probability of a larger reset both in real estate and the general economy.

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender