Although it is impossible to predict the future unless you were a star in the movie back to the future , history does provide a good indicator of what might happen. With all the recession talk recently it is important to relate the current economic environment back to a similar period to see what happened and what the outcome was then. In real estate the two most recent recessions were in 2007 and 1990. What period does our current economy most closely relate to? If we use this period as a roadmap what does this mean for real estate? How will this cycle end?

Our current cycle?

We are currently somewhere near the tail end of the current economic cycle. Volatility has picked up and stocks have declined around 15% since the peak. Inflation remains low, consumer spending is robust, and the federal reserve is continuing a tightening policy. The talk of the town has transitioned from will there be a recession to when will there be a recession to now what will the recession look like. To get a sense of what the could be in store it is important to look at the last two cycles for hints

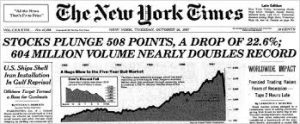

The 1990 crash

Real home prices peaked in 1989, the actual recession hit in 1990, home prices fell 7% from the peak until the end of 1990, the recession ended in the spring of 1991 but real U.S. home prices continued to fade for years until they bottomed out in 1997, down 14% from the 1989 peak eight years earlier. It would take another 5 years for prices to come back to their pre-recession prices a full 13 years just to break even.

- Cause: Deregulation of the Savings and Loan industry allowed for a huge expansion of commercial lending. At the same time, rates rose quickly due to inflationary pressures. This led to failure for almost 40% of all Savings and Loan institutions along with numerous insurance companies and other institutions that held considerable mortgage debt (Wikepedia did a nice article on the S&L crisis)

- Creation of the Resolution Trust Corp (RTC) by the government in 1989 to liquidate assets taken over from the failed Savings and Loan’s. As the RTC took possession of assets to liquidate, private investors had a unique opportunity to buy quality assets at depressed levels. This was an overhang on the market through mid 1995

- Length: 13-14 years for real estate to cycle back to 1989 levels

- Shape: The 1990 crash was a long and slow wide U shape that went down slowly, bounced along the bottom and then finally began to slowly come back

- Pain: Long and slowly prices dropped around 14% during the cycle on average

The 2007 crash

The last recession was profound. I had a front row seat and it felt like getting hit by a bus. The market collapsed suddenly leaving many firms bankrupt. During this correction, prices fell by 25 to 50% depending on location. In many markets it would take around 7 years for prices to come back to their pre-recession lows.

- Cause: The subprime crisis was the culprit behind this epic crash. Money was loose along with lending standards. Loans were “stripped” into various tranches and sold throughout the world as securitized debt. This debt was new and complex. When the music stopped everyone finally figured out what they had bought, and it didn’t end well.

- Length: This cycle took around 7 years in most areas of the country to recover to pre-recession lows

- Pain: There was quick and extreme pain in this correction with prices plummeting up to 50% in many cities. This recession was one for the record books

- Shape: The 2007 crash was a very well-defined V, prices went down quickly and recovered quickly in most areas as well.

What will the upcoming recession look like

The market is providing some interesting signs recently on what type of recession we will have in store next. The stock market has crashed 15%+ and yet overall the economy remains healthy on the surface with unemployment low, leverage low at lenders, and inflation in check. What will derail this cycle?

- Cause: I don’t see a smoking gun like the S&L crisis or the subprime crisis. The upcoming recession’s cause is complex with many different smaller factors from international trade, to interest rates, to increased corporate debt, to political turmoil, decline in brick / mortar retail, and too much capital chasing high yields on risky corporate debt. None of these items are smoking guns, but combined they’ll lead us down the path to a recession/correction

- Length: Since there is no smoking gun/ single trigger this could be a long process similar to 1987

- Shape: My initial reaction is that this will be closer to a U shaped

- Pain: This correction likely will be long and slow with lots of volatility as we search for a “bottom”.

3 key takeaways from the recent crashes

I went to a trusted expert who had a front row seat in the last crisis and the 1990’s S&L crisis. The expert is Larry Weinberg, a partner at Fairview, who also is my father. For this article I asked him what his three key learnings were now that he has gone through the 90s crash and the 2007 crash. Below are the answers:

- Excesses in the market place can present real opportunities for those investors who have stayed disciplined throughout the years and have funds to invest

- Excess liquidity / ease of credit will ultimately create a bubble in the market. It is difficult to know exactly where the bubble is before the crash but once it happens it becomes readily apparent

- Successful real estate is needs driven as opposed to supply driven. If you go by the mantra that if you develop it and they will come you will get burned as economic cycles change. Focus on the fundamentals of real estate that is needed and in good areas and you will weather any cycle.

Why is this cycle more indicative of 1990s?

I don’t see a profound “trigger” like the 2007 crash. This cycle reminds me more of the 1990 recession where excesses built up that took a while to unwind. This cycle feels like we are just “slipping” down a hill slowly while the 2007 event felt like we got tossed of a cliff suddenly. If we use 1990 as a roadmap we are in for a prolonged period of slower growth and the pain should not be as sudden as the 2007 crash. Prices should drop 10-15% and bump along for a while until the next recovery begins. The effects of any downturn should have limited impacts on the traditional banking sector as it is well capitalized, but other “shadow lenders” could have a rough road ahead. Now is the time to heed the advice of seasoned real estate pros to ensure you weather the impending storm.

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)