The economy is currently in a “transition” phase. To determine if the sun is setting on our current cycle, it is critical to watch for leading indicators of where we might be heading. One of the strongest predictors of a recession is consumer purchases of one particular item. What is the indicator? Why have sales dropped 34% this year? What does this mean for real estate?

Recreational Vehicle sales:

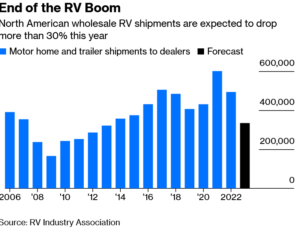

RV wholesale shipments are expected to retreat in 2023 in the face of challenging economic conditions, according to the Spring 2023 issue of RV RoadSigns, the quarterly forecast prepared by ITR Economics for the RV Industry Association (RVIA).

The new forecast projects 2023 RV shipments to range from 324,300 to 344,000 units next year with a mid-point of 334,100 units, a 32% decline from the 493,300 wholesale shipments in 2022.

RV sales a Leading Indicator for the economy and real estate:

RV sales are a leading indicator of the economy as they are a fully discretionary purchase for many Americans covering various economic tiers from the smaller less than $10,000 tow behind trailers to the $300,000 house on wheels.

Consumers usually stop buying expensive, big-ticket discretionary items like RVs when money starts to tighten and higher interest rates start to bite . As such, economists watch for declines in the RV sector for signs of a downward-turning economy.

Companies are already reacting to the slowdown

More than 80 percent of recreation vehicles sold in the U.S. are produced in Indiana, and roughly 65 percent of that production takes place in Elkhart County, according to the RV Industry Association. RV manufacturing giant Thor Industries Inc., posted consolidated net sales of $2.35 billion in the second quarter of fiscal 2023, which ended January 31, a 39.4 percent decline compared to $3.88 billion in the second quarter of fiscal 2022 and a 14 percent decline from the $2.73 billion in revenues in the second quarter of fiscal 2021. RV companies are beginning to react to the slowdown in consumer demand with headcount reductions. This slowdown will eventually flow through to other industries.

What is causing the huge decline in RV sales?

- Tons of demand pulled forward: North American Towable RV net sales were down 58.2 percent for the second quarter of fiscal 2023 compared to the prior-year period. The decrease was driven primarily by a 64.6 percent decrease in unit shipments, partially offset by net selling price increases and a change in product mix. The decrease in unit shipments is primarily due to a softening in current dealer and consumer demand in comparison with the unusually strong second-quarter demand in the prior-year quarter, which included independent dealers restocking their lot inventory levels.

- Consumer confidence: Consumer’s are becoming more weary of large purchases, we saw this in declining sales at places like Home Depot in their recent earnings. Auto prices another durable good are also starting to soften

- Interest rates: RV’s are very interest rate sensitive. If someone is going to buy a 100k RV, with rates rising, they are paying another 5-8k a year just in interest costs. Furthermore, financing is becoming a bit harder as many lenders are tightening their standards.

- Shift to services over goods: The big shift back from everyone buying durable goods is finally underway. This is not unexpected and will likely accelerate over the next 12 months as budgets become tighter.

How do RV sales Impact on real estate

The RV industry is confirming a common trend that the pandemic craziness is coming to an end. Not everyone is going to buy an RV and work remotely for eternity. For example, in real estate the surge to remote rural areas is quickly reversing. Even though it is not exactly as it was prepandemic, people are migrating back around larger/mid size cities.

RV sales impact on the economy Not as bad as the headline numbers suggest

If you are in the RV industry or looking to sell an RV, the numbers are absolutely brutal. But, for the general economy the headline numbers are considerably scarier than reality. As mentioned above, thousands of sales got pulled forward and many “newbies” bought RVs. Now that times have changed, old habits have emerged and people would rather take a trip to Europe as opposed to drive around in an RV, this has led to even more supply coming online in the used market. I think it will take years for this “camping/glamping” cycle to subside which will lead to huge pain in the industry, but the sky is not falling on consumer demand on everything so don’t worry about a 2008 repeat at this juncture.

Summary

The number one indicator of how the economy will perform is how people “feel” about the economy. Unfortunately, a “feeling” is very difficult to directly measure so we must look to indicators like RV sales that capture the consumers economic mood. With sales of RVs falling 34%, consumers are clearly showing with their wallet that they have a different feeling on the economy.

Although consumers keep spending on services, this changing mood will flow through the economy and real estate along with other large purchases will continue slowing. The depth of the consumer pullback and when it fully occurs is the million-dollar question that will shape the next economic cycle. At this juncture all we know is that it will happen in the future, my gut is saying 2025 is when the fireworks start as rates will remain higher than the market is anticipating which will lead to a further slowdown in RV sales and ultimately real estate.

Additional reading/resources

- https://www.bloomberg.com/opinion/articles/2023-05-26/road-trip-bugatti-carrying-rv-is-a-sign-of-our-expensive-times?srnd=premium

- https://gazette.com/business/an-economic-warning-sign-rv-sales-are-slipping/article_431d95d8-c2a1-11e9-bb1c-3be413c6b46a.html

- https://www.wsj.com/articles/one-countys-rv-industry-points-to-recession-around-the-bend-11566207001

- https://www.wsj.com/articles/thor-industries-cuts-guidance-as-demand-for-recreational-vehicles-cools-43f339a2

- https://www.indystar.com/story/money/2019/08/18/recession-elkhart-indiana-rv-recreational-vehicle-shipments-economy/2021354001/

- https://rvbusiness.com/rv-wholesale-shipments-expected-to-hit-334100-in-2023/

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender