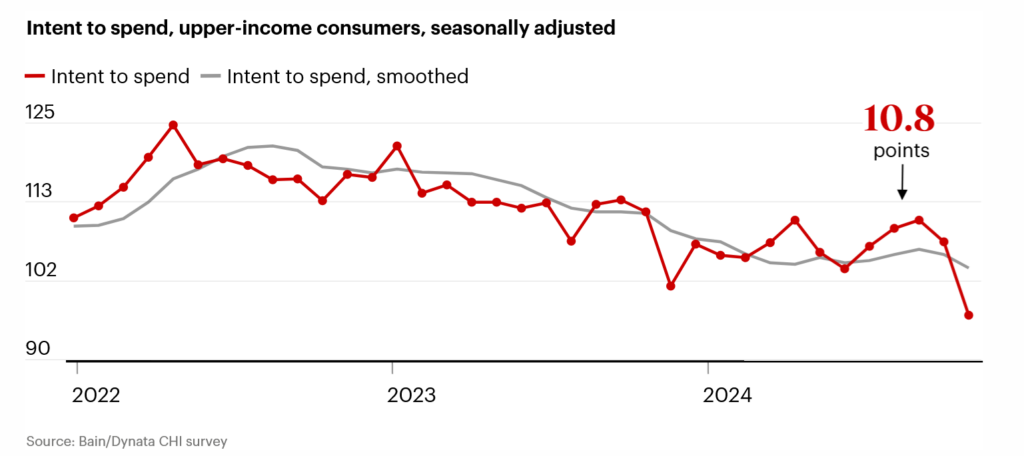

Higher income consumers are showing signs of stress. Look at the chart above, from the peak in 2022 higher end consumers intent to spend has dropped almost 25%. What does the chart mean for real estate and the general economy? Why focus on higher end consumers? What are the 5 drivers of reduced spending by higher income consumers?

What was in the data on high end consumer spending?

As we exit the crucial holiday spending season, the chart above shows that upper-income consumers’ spending intent deteriorated sharply, with a 10.8-point fall in January.

This drop in upper-income spending intentions comes on the heels of a smaller 3.2-point fall in December. Alongside a sharp, parallel back-to-back drop in this group’s composite outlook score—of 2.6 points and 3 points in December and January, respectively—this decline looks significant. This is especially true since the same trend is not mirrored by other income groups.

- Delinquency rates for borrowers with incomes of $150,000 are near their highest level in five years, according to a new study by VantageScore.

- Consumers are being cautious with credit. Credit utilization dropped in December last year.

- High earners ‘intent to spend’ decreased in January, which could be a warning sign for the economy.

Why are higher end consumers pulling back on spending?

Those consumers making greater than 150k/year are also getting hit by huge jumps in other expenses. Here are a few key drivers of the pullback

- Student loans: after almost 5 years of no student loan payments, the restart will crimp many high income spending power

- Insurance costs: We have seen huge jumps in both auto and property insurance costs which are slowly eating into disposable income.

- Mortgage costs: Mortgage costs are roughly double just a few years ago with prices remaining high, this is leading to a huge jump in shelter costs for high income consumers.

- Auto costs: Every car price has shot up from the cost effective sedan to the sportscar, coupled with higher borrowing costs, high end consumers are paying substantially more for their autos

- Credit card debt. Credit card debt costs have roughly doubled from the pandemic lows meaning yet again, budgets are getting tighter as more disposable income is going to servicing existing debt.

Why should you watch high end consumers?

We see a worrying signal recently coming from upper-income earners; their intent to spend is down, and that worries us, given their disproportionate share of discretionary spending in the United States,” said Brian Stobie, a senior director at Bain and Company, a global management consulting firm.

Long and short high income earners, those making more than 150k, are the largest drivers of the economy so when they pull back this could point to a bumpier road ahead for the economy.

What happens to real estate prices/volumes in 2025

With high end consumers pulling back, the next item they will pull back on is real estate. You will see more high-end consumers staying put due to the huge jump in interest costs. Furthermore, new buyers will pull back as well as renting is now cheaper than owning in many markets after you factor in interest expense, property taxes, property insurance, maintenance, etc…

Summary

Consumers making greater than 150k/year are one of the largest cohorts of real estate buyers and sellers. The graph above is foretelling a change in the economy as high-end consumer choices will ultimately ripple through to every other group.

Real estate in 2025 will be further impacted by the pullback of the high end buyer. This will lead to more prospective sellers staying put and not trading up along with many prospective buyers opting to rent as opposed to buy based on the huge jumps in costs.

However this plays out, look for real estate prices to stay flat/slightly decline and sales volumes to continue at an anemic pace. The wild card is how swift the pullback will be by high end consumers and will it ultimately lead to a larger reset in the economy.

Additional Reading/Resources

- https://www.bain.com/insights/us-consumer-health-indexes/

- https://www.cnbc.com/2025/01/27/higher-income-american-consumers-are-showing-signs-of-stress-.html

- https://www.fairviewlending.com/the-largest-buyer-of-mortgages-predicts-big-changes-to-house-prices/

- https://coloradohardmoney.com/2025-best-colorado-ski-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender