house prices

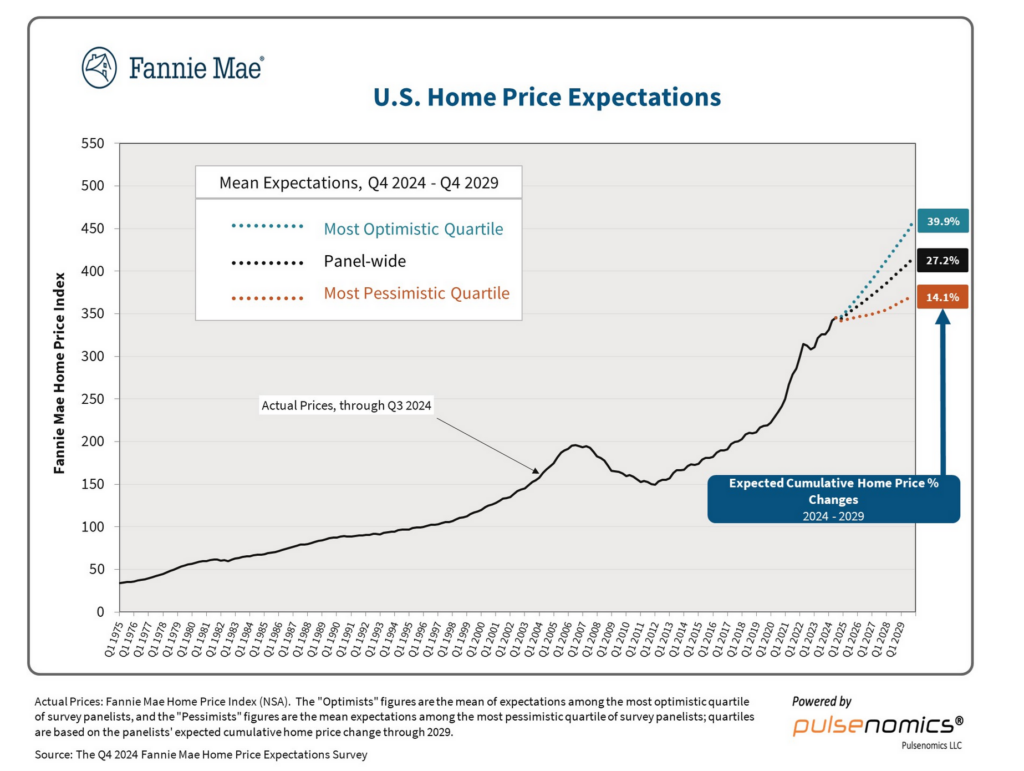

Fannie Mae, one of the largest buyers of residential mortgages has some profound predictions. Will house prices continue their upward trend through 2030? How accurate are the predictions below? How can house prices continue in such a linear fashion? Will interest rates influence the chart above? Is there a more accurate prediction of house prices?

What are in the Fannie Mae predictions on house price increases?

“While home price growth is expected to ease next year, HPES panelists’ big-picture view for 2025 appears to be little changed compared to 2024, with most seeing another year of elevated mortgage rates and weak home sales,” said Mark Palim, Fannie Mae Senior Vice President and Chief Economist. “We share our panelists’ view that home price growth is likely to decelerate next year, as the mix of continued elevated mortgage rates and the run-up in home prices of the past four years will likely continue to strain affordability and remain an impediment to many would-be homebuyers.”

Terry Loebs, founder of Pulsenomics, added: “Although a significant majority of experts expect the nationwide home value appreciation rate will diminish from recent levels, the panelists’ annual average projected price increase through 2029 is still well above expectations for economy-wide inflation

Will home prices continue to increase in 2025?

Regardless of prices, real estate is already in a deep recession, with closing volumes down close to 20 year lows. At the same time interest rates are remaining above 7% (as of this writing).

I’ve heard for the past several years, wait until 25, this is when rates were supposed to fall substantially and give the residential and commercial real estate markets a boost. Here we are on the cusp of 25 and it looks like rates and in turn real estate will remain “stuck” for a bit longer.

Remember on the predictions above, if inflation is around 3%, then the “real” inflation adjusted appreciation is only .8%, remember the safest assets, US government bonds, are yielding almost 5%, so real estate is significantly trailing returns of even the safest assets.

How accurate are the real estate predictions for 2025?

2025 looks to be more of 2024, but likely will not happen exactly as economists have planned. Unfortunately, there are more negative than positive risks for real estate heading into the second half of 2025.

In the first half of the year, I do not see the bottom dropping out of prices. There will be some softening with prices staying steady or even dropping a little, some markets will hold steady while others could still increase further. The real test comes in the second half of the year when consumers face the onslaught of bills from credit cards and buy now pay later for all the spending.

Furthermore, interest rates will remain much higher than the market is currently anticipating, which will ultimately lead to a rough year for real estate in 25 similar to 24.

2026 to 2030 is where I disagree strongly

If I look at the chart above of housing appreciation and see the huge changes in prices since the 2008 correction it is hard to believe that housing prices will continue to increase in a linear fashion into perpetuity. Regardless of what the market is predicting, the odds of a recession and/or correction in the next 5 years is 100%. There are currently so many excesses in the economy from the stock market, housing market, consumer debt, commercial debt, etc.. that will eventually ripple through the economy

I think we will see a reset in prices starting 2026 as inventory continues to increase while rates remain about where they are. This will lead to even more affordability issues and ultimately less demand. Furthermore, the lock in effect will continue to wane as there is a reset in the employment market with many high paying jobs eliminated/outsourced due to efficiency/cost savings. Look no further than Amazon:

In a bid to curb costs, Amazon laid off 27,000 corporate workers last year and continues to make cuts. More streamlining could be on the way as Amazon aims to thin its management ranks. Amazon CEO Andy Jassy told employees in Sept. 16 memo that the company will “increase the ratio of individual contributors to managers by at least 15% by the end of Q1 2025,” as part of his push to reduce overhead and get Amazon moving faster. Analysts with Morgan Stanley wrote in a report this month that this could lead to $2 to $4 billion in savings in 2025, with a reduction of around 14,000 employees.

The same trends we are seeing at Amazon are happening in other high paying companies: Over the last couple of months, Google has made cuts to its marketing, cloud and security teams in Silicon Valley, as well as in its trust and safety unit. Google is far from alone. Dropbox this week announced it will lay off 20% of its global workforce.

What are my long term predictions for 26-30

The million dollar question is when will the economy face the music of higher interest rates and overvalued assets? Furthermore, when will the commercial real estate extend and pretend be dealt with? My gut says that odds are high of a reset sometimes in 26 which will lead to a decline in commercial and residential prices. For 26-30, look for appreciation to be in the 3-5% range at best which is close to its historical average and also in line with long term predictions for the stock market.

Summary

Do not buy the hype that miraculously real estate will continue an upward trajectory through 2030. The probability in real life of this playing out is zero. The economy has a ton of excesses from high asset prices, commercial real estate loans, buy now pay later, huge increases in consumer debt,etc… all of this will eventually be dealt with in the economy as interest rates remain considerably higher than ever predicted due to huge government deficits.

Ultimately the market will address the excesses and higher interest rates will trigger a reset in asset prices from stocks, houses, commercial real estate, etc… Ultimately there will be a correction that eliminates the excesses in the economy. We saw this in 08 and we have seen this in every economic cycle. The next five years will not defy gravity with everything continuing to increase.

Look for real estate in 2025 to kick along similar to 2024, while 2026 is when I foresee a much bigger change in the economy with commercial real estate finally coming to terms with enormous losses. Stay tuned for how this plays out, but in the interim do not drink the Kool aid that Fannie Mae is predicting with blue skies into perpetuity.

Additional Reading/Resources

- https://www.fanniemae.com/research-and-insights/surveys-indices/home-price-expectations-survey-hpes?

- https://www.fairviewlending.com/big-real-estate-rebound-for-2025/

- https://www.fairviewlending.com/will-commercial-real-estate-fall-2025/

- https://www.cnbc.com/2024/11/01/google-employees-pressure-execs-at-all-hands-for-clarity-on-cost-cuts.html

- https://www.geekwire.com/2024/amazon-corporate-headcount-drops-year-over-year-as-tech-giant-aims-for-efficiency/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender