by Glen | Dec 12, 2022 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Private Lending, Property Valuation

In 2023, NAR Chief Economist Lawrence Yun expects home sales to decline by 7%, while the national median home price will increase by 1% in his recent 2023 market update. On the flip side the most recent federal reserve economic commentary classifies the current...

by Glen | Oct 31, 2022 | 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans

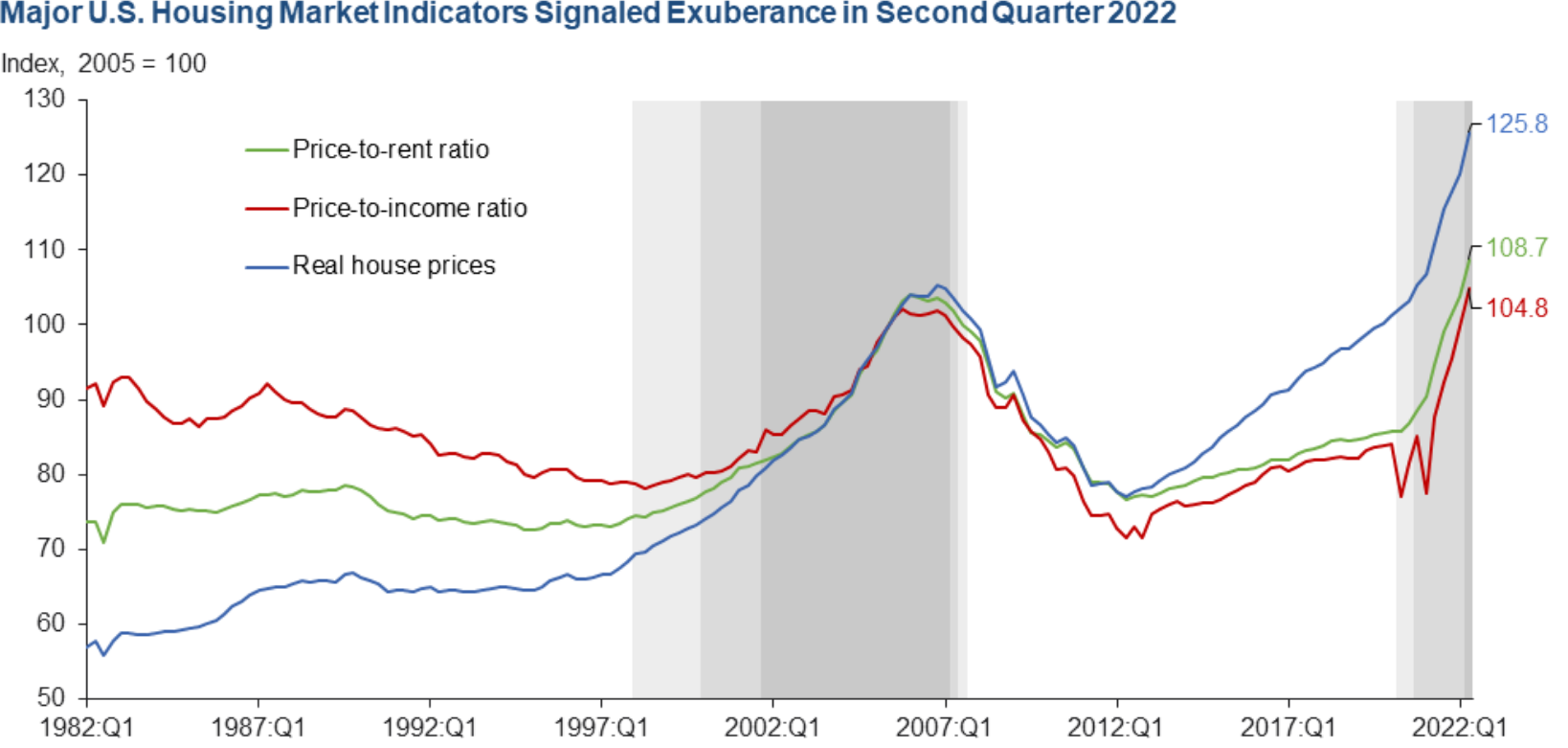

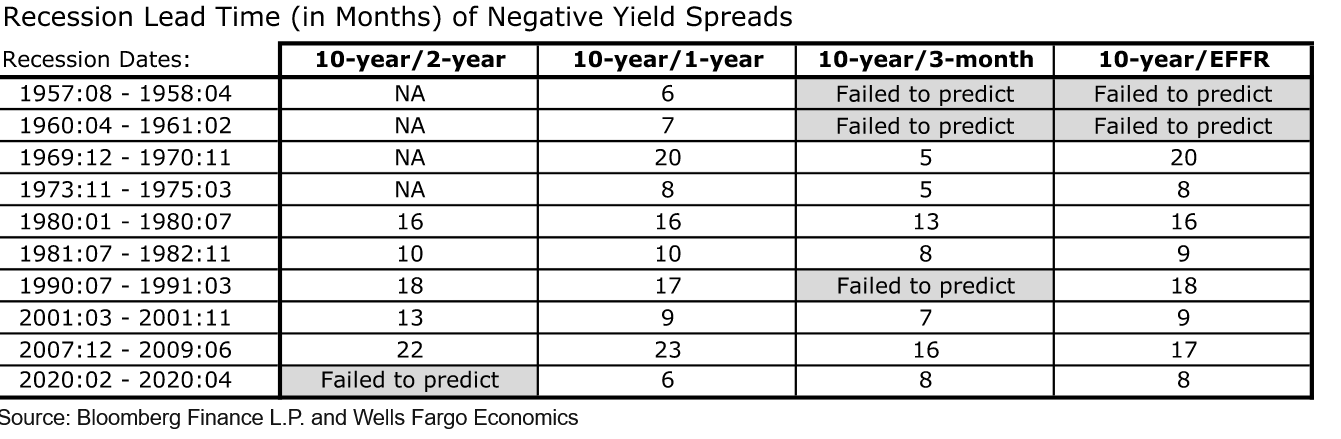

There is pretty much a universal theme that there will be a recession in the future. It is like saying that it might rain sometime in the next month. It doesn’t help you much without knowing approximately when it will rain and if it will be a light sprinkle or turn...

by Glen | Aug 1, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

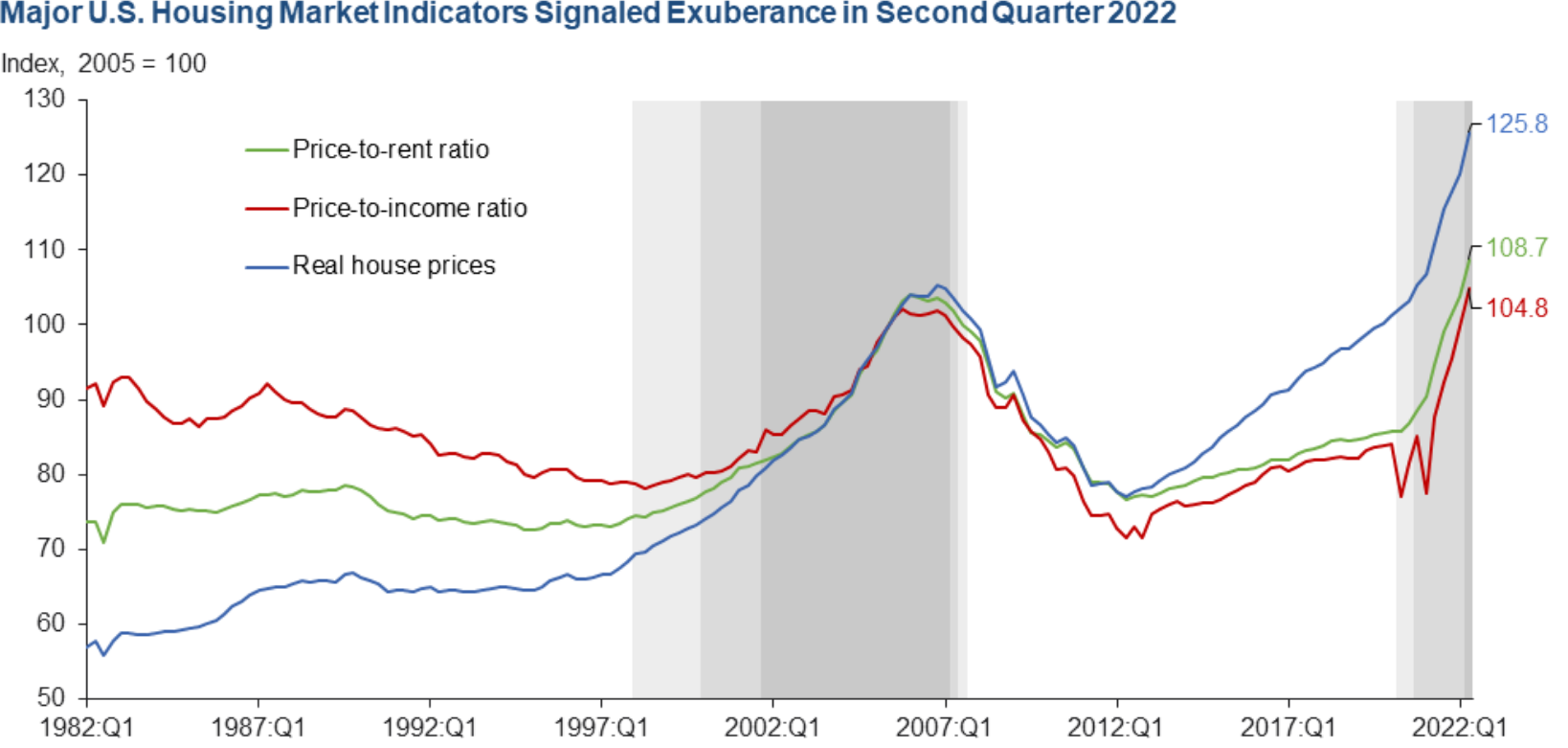

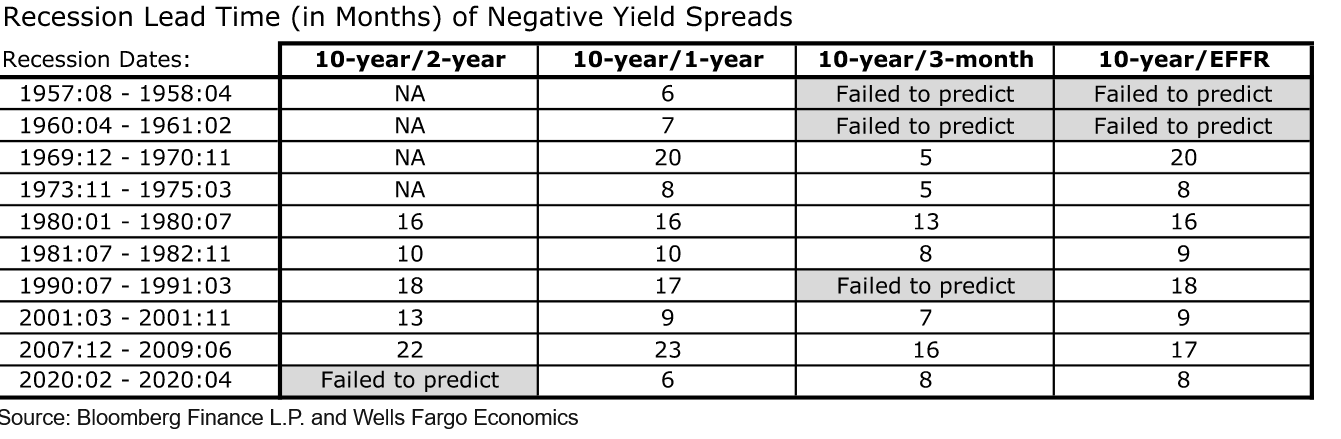

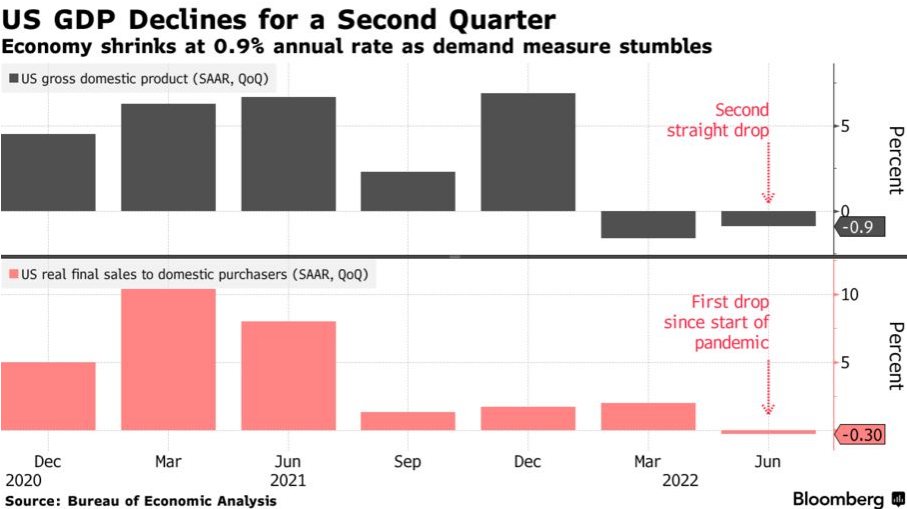

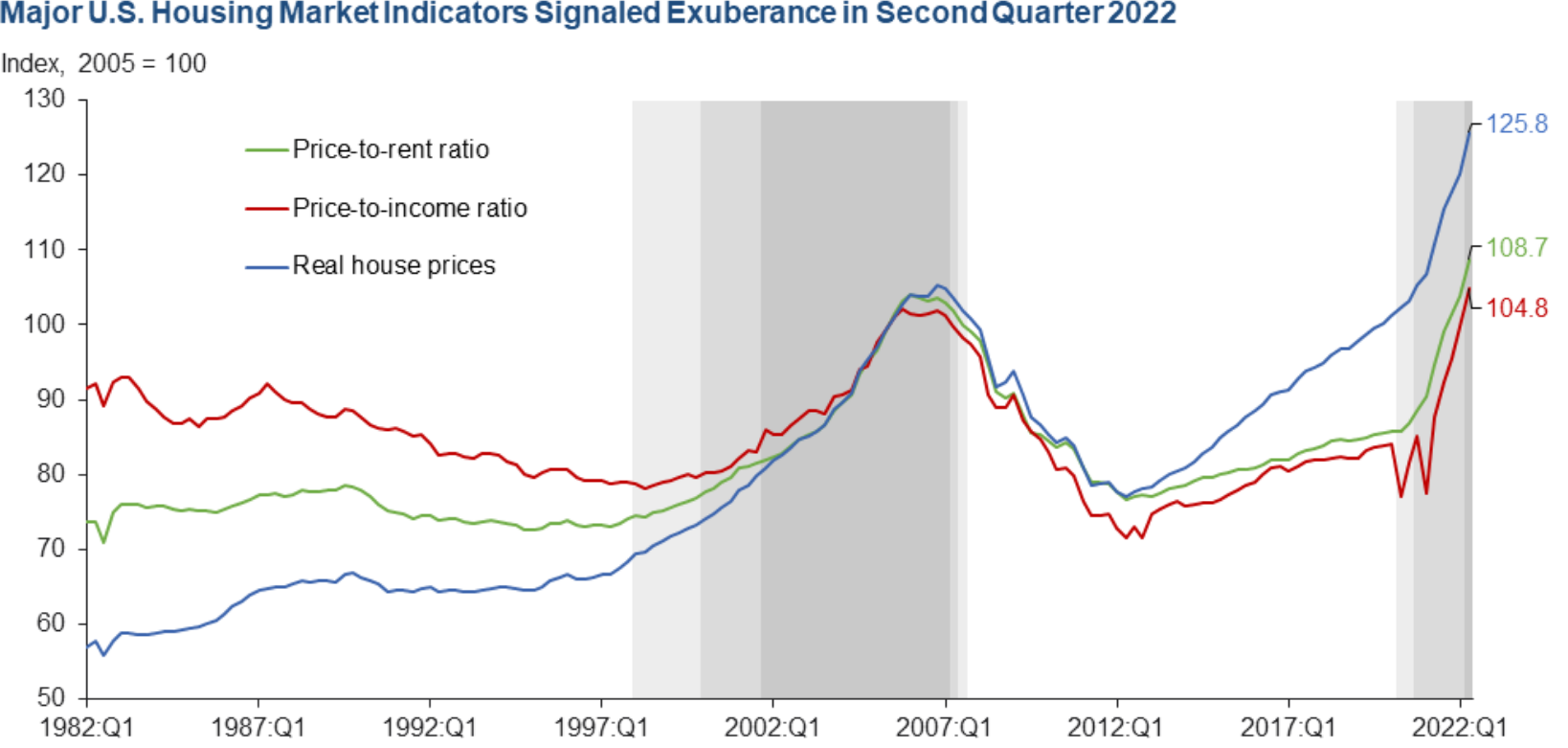

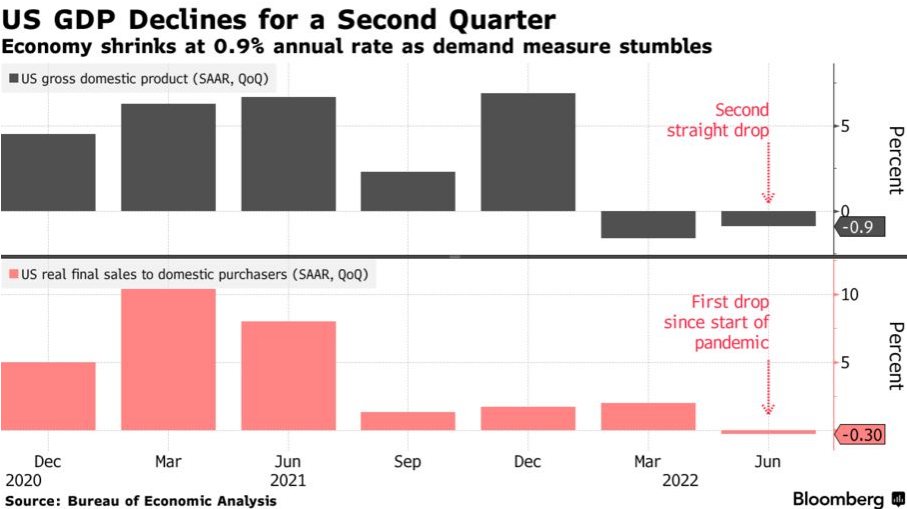

What a week it has been in the economy. The federal reserve is still struggling to contain inflation and as a result increased the fed funds rate .75%. After the announcement stocks roared back in a huge “relief” rally and mortgage rates plummeted. Shortly after,...

by Glen | Jul 25, 2022 | 2022 real estate predictions, 2022 stock market correction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Property Valuation, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, residential lending valuation

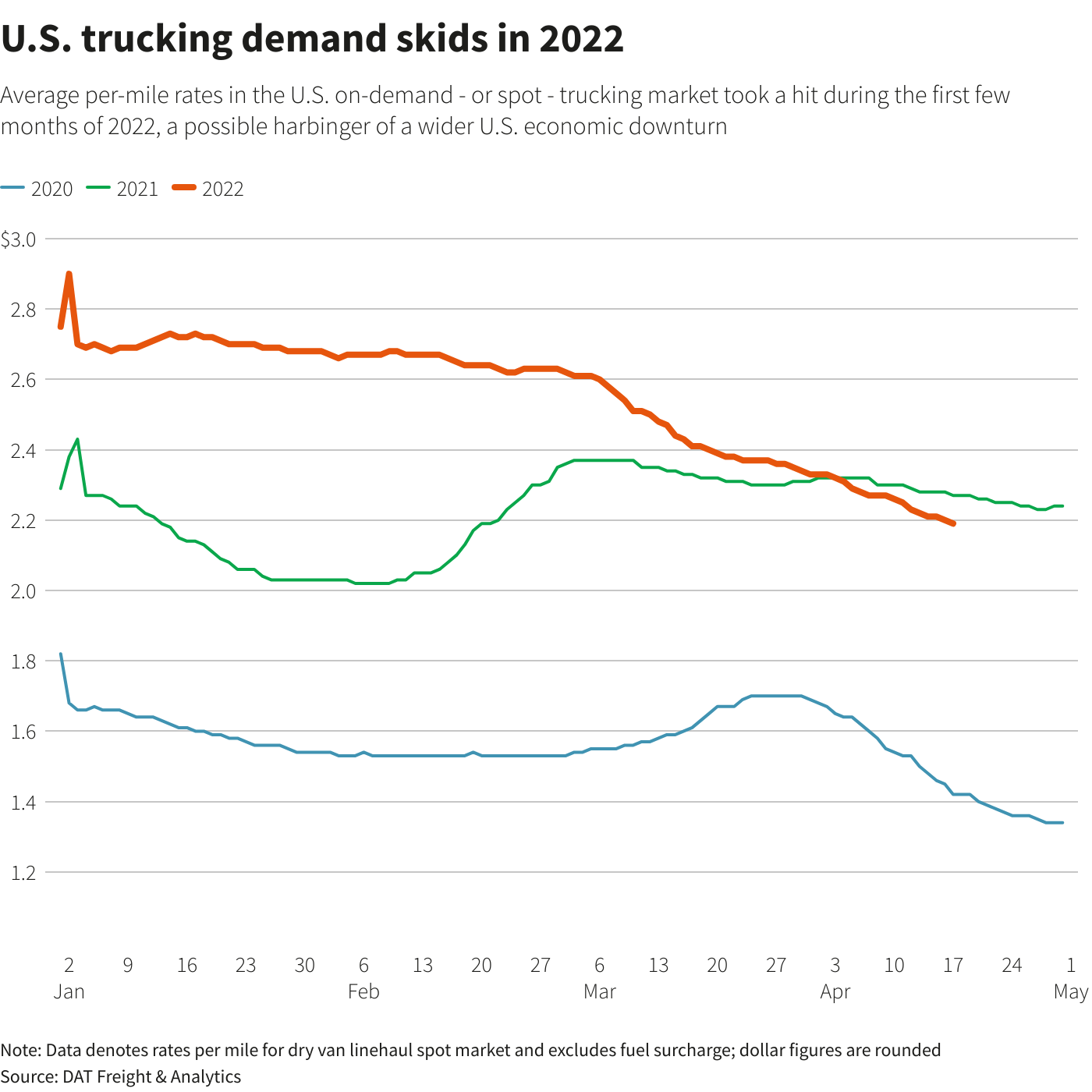

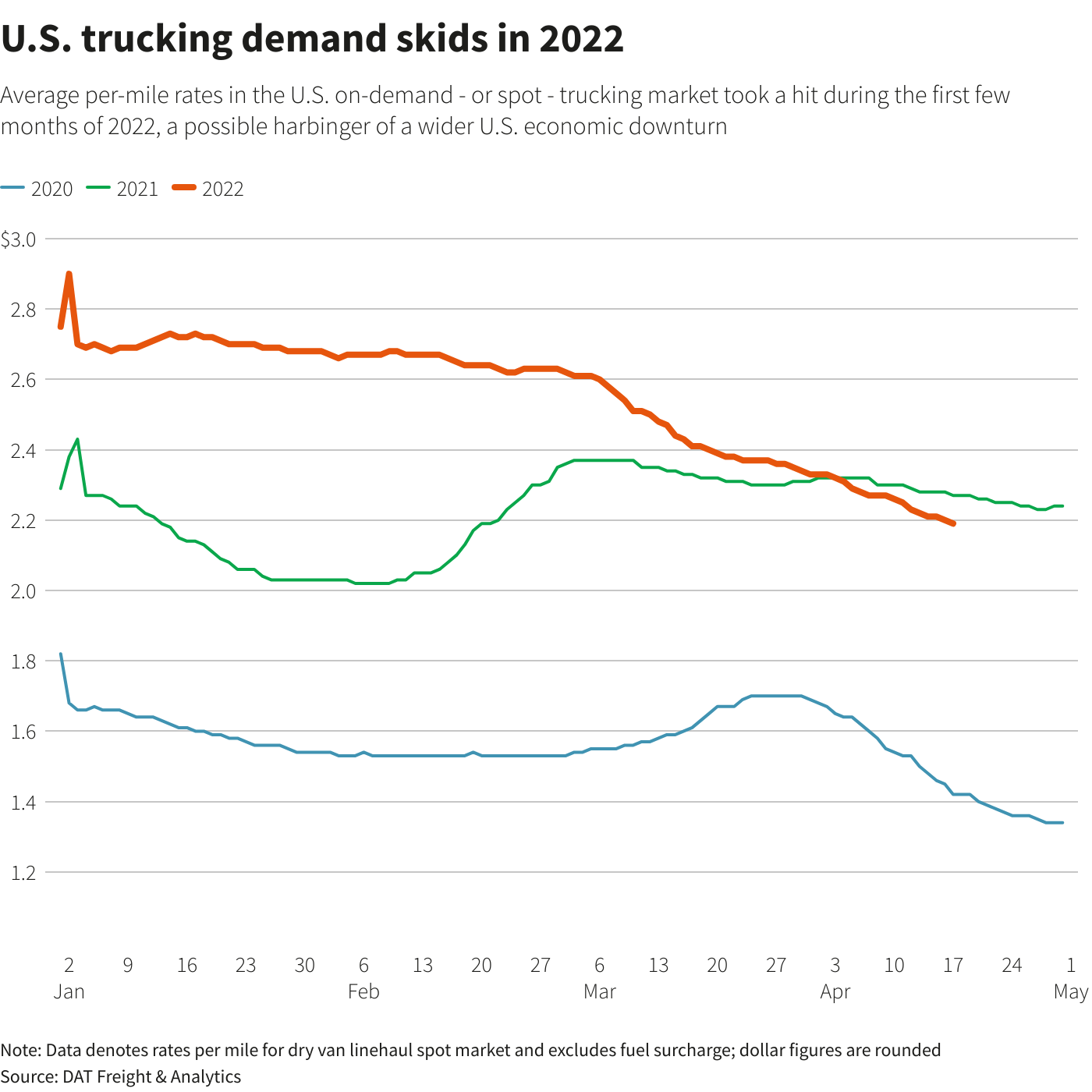

There has been an unexpectedly sharp downturn in demand to truck everything from food to furniture since the beginning of March and rates in the overheated segment that deals in on-demand trucking jobs – known as the spot market – are skidding. Why are...

by Glen | Jul 18, 2022 | 2022 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial hard money, Denver Hard Money, General real estate financing information, Georgia hard money, Government Bailout, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

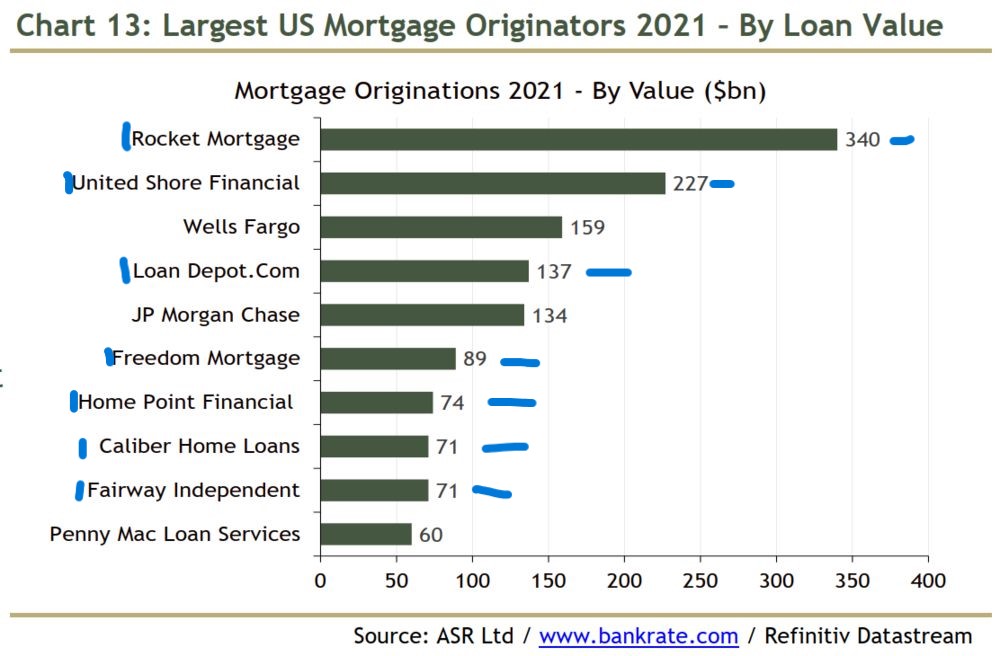

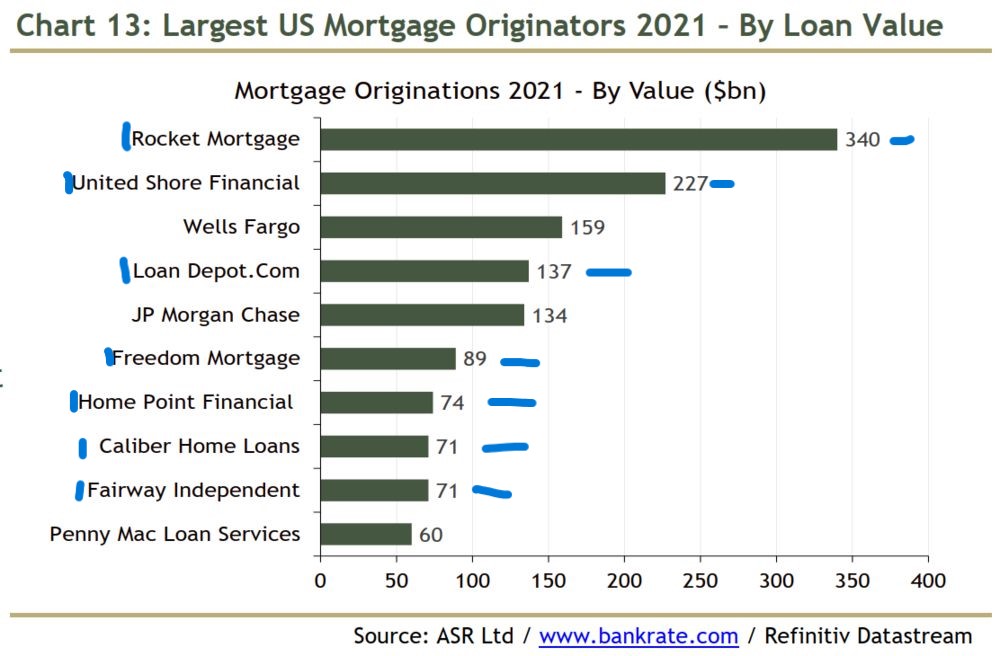

The federal government in their quest to shore up the mortgage market in 2008 has created some new risks to the housing market. Non bank lenders now make up 74% of the origination volume with only 3 banks even making the list. What does this mean for the mortgage...