by Glen | Sep 4, 2023 | 2023 real estate prediction, 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, if there is a recession what happens to real estate

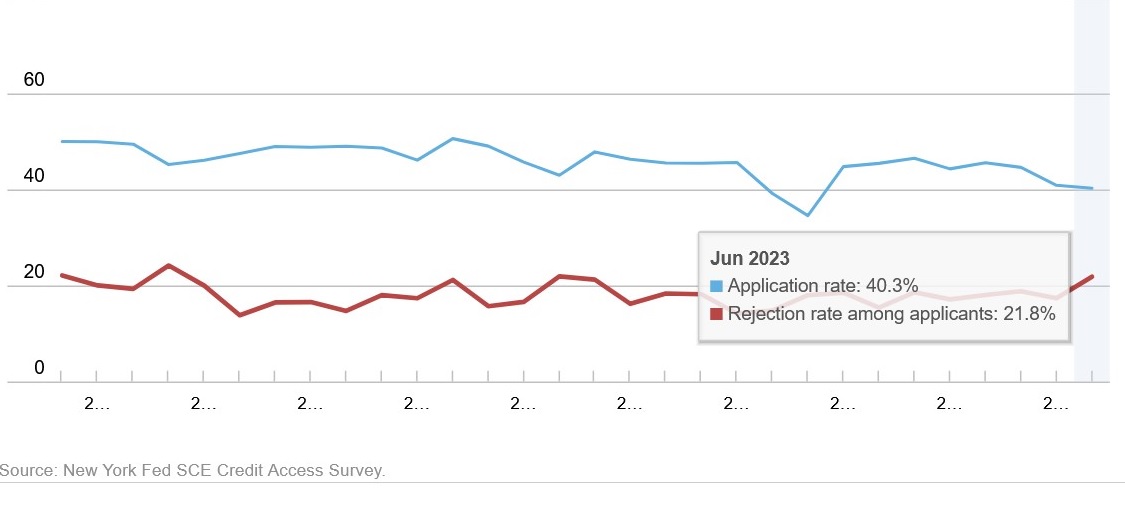

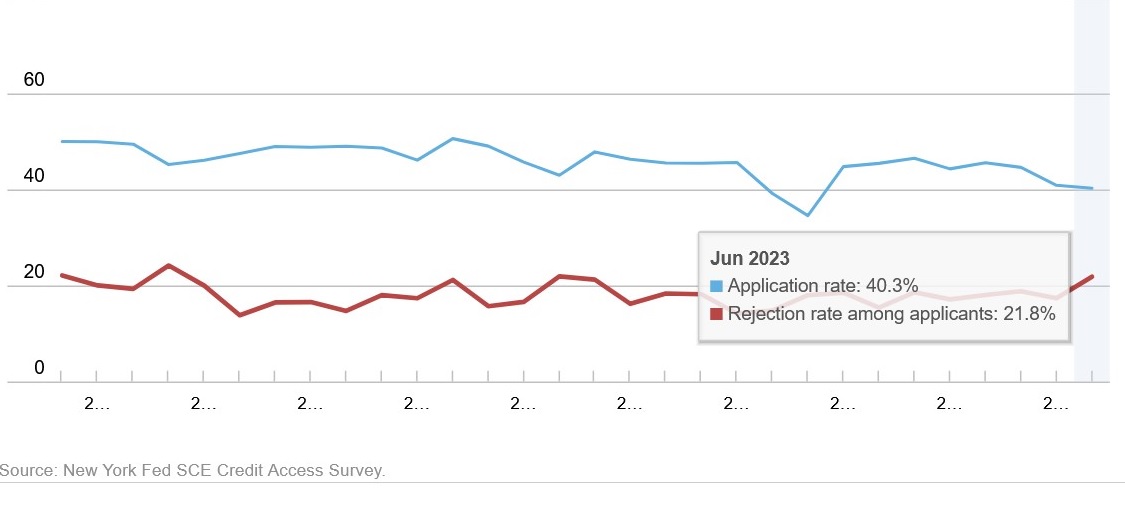

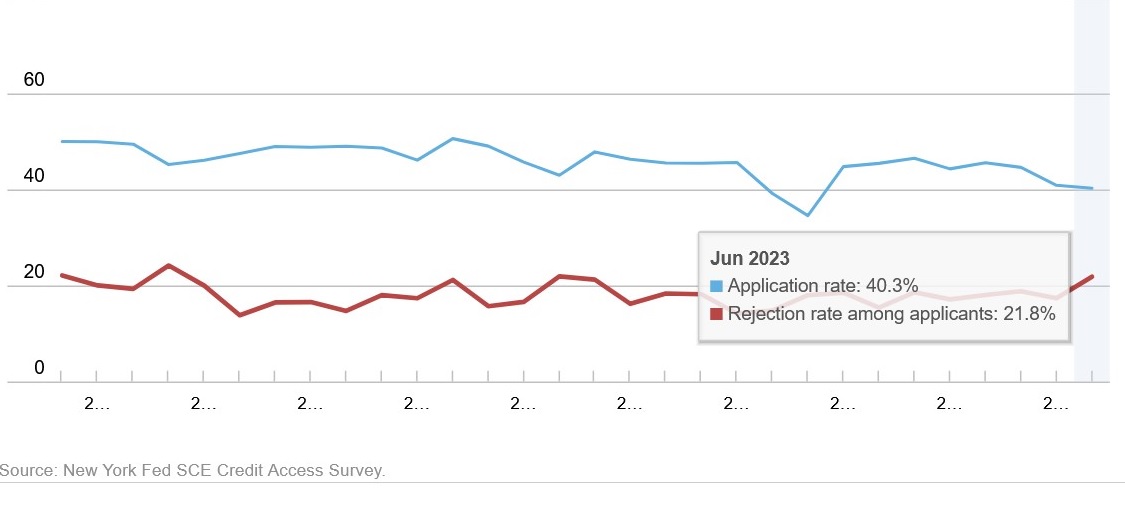

It was already difficult for businesses and households to borrow money earlier this year — but after the collapse of three US regional banks and a cascade of rate hikes by the Federal Reserve, getting money has become considerably harder. What does the decline in...

by Glen | Nov 21, 2022 | 2023 real estate prediction, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Commercial Lending valuation, credit scoring, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, real estate investing, Real Estate Trends, Residential hard money, residential lending valuation

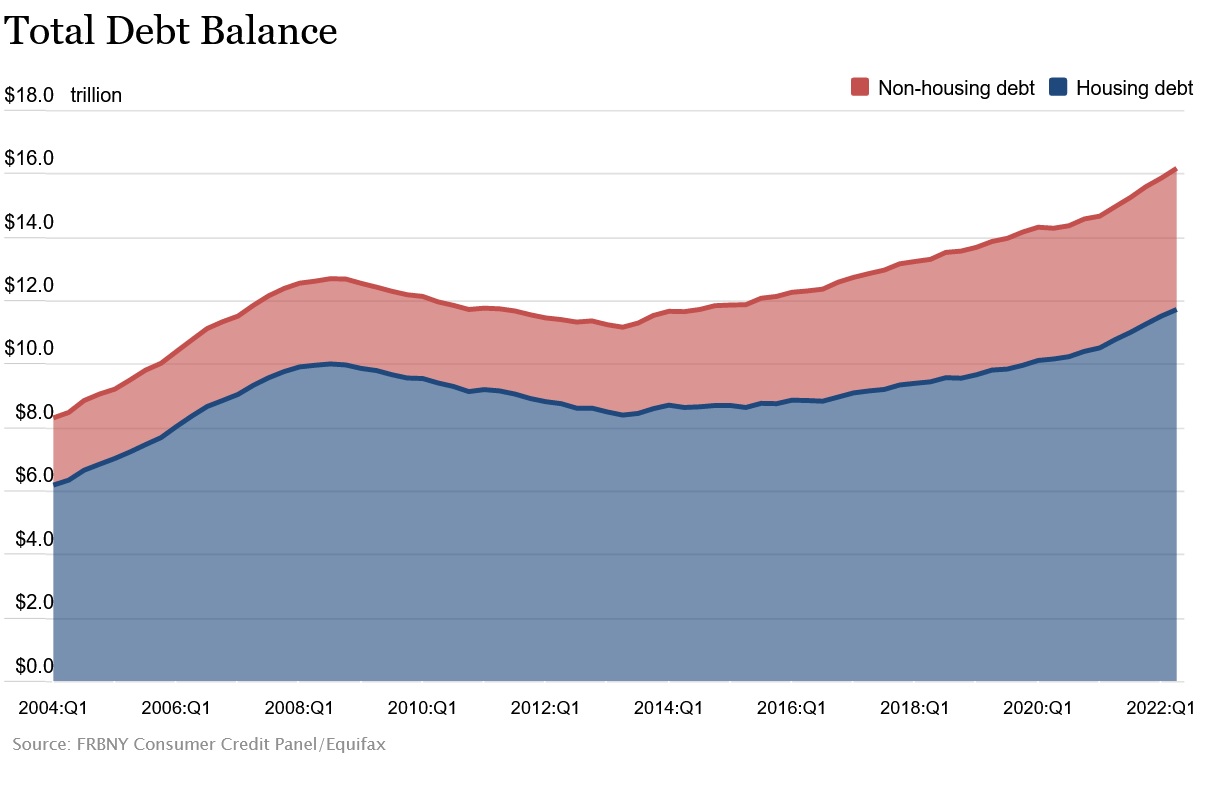

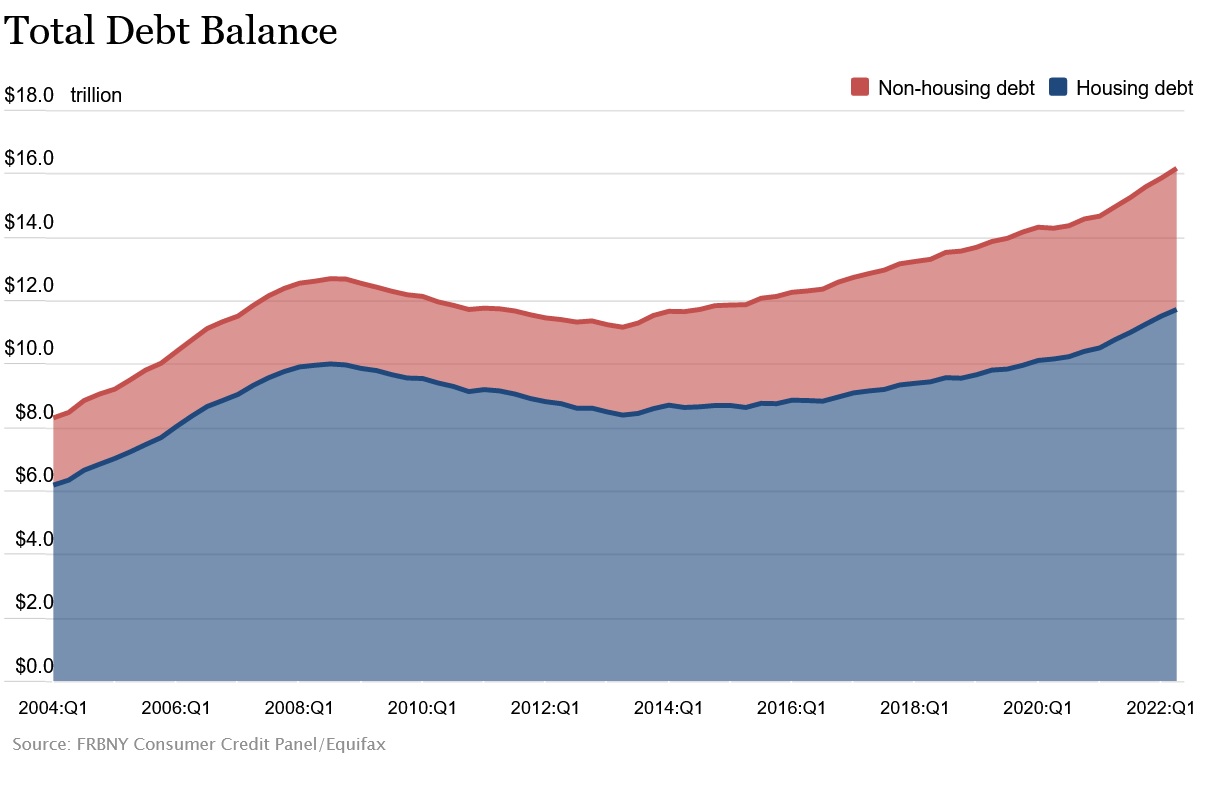

The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the...

by Glen | Oct 10, 2022 | 2022 real estate predictions, 2022 stock market correction impact on real estate prices, 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Commercial Lending, Hard Money in the News, Hard Money Lending, hard money loans, Housing Price Trends / Information, interest rates, mortgage rates, Property Valuation, Real Estate Trends, Real estate Valuation

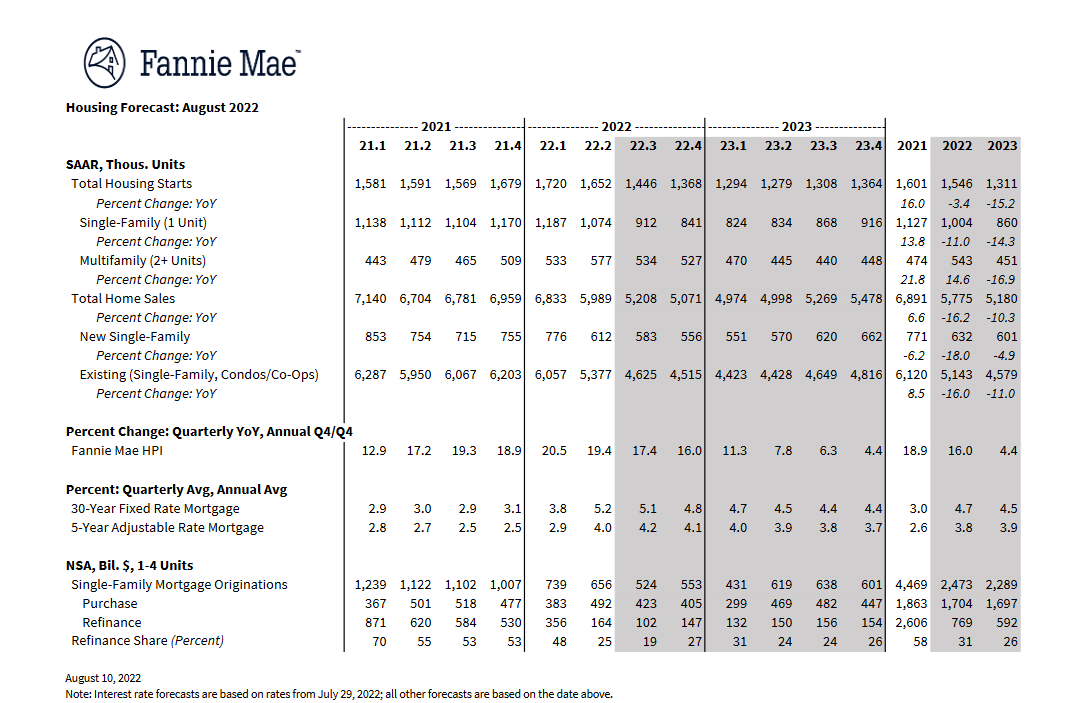

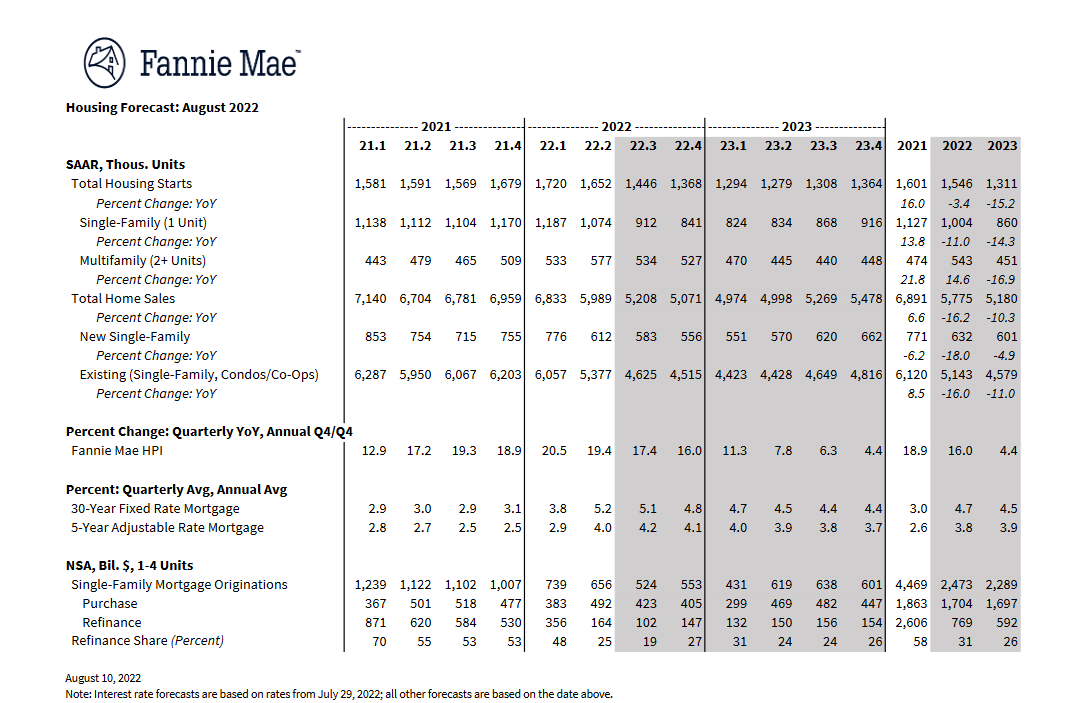

It will get much worse for the housing market and the mortgage industry. That’s the takeaway from a group of economists at Fannie Mae who slashed their forecast for 2022 home sales this week. Federal Reserve chairman Powell recently threw even more cold water on their...

by Glen | Jun 6, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Government Bailout, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

One of the world’s bubbliest real estate housing markets is tilting from sellers to buyers with dizzying speed. Canadian home prices fell for the first time in two years as a rapid rise in interest rates looks set to threaten one of the world’s hottest housing...