by Glen | Jul 24, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Housing Price Trends / Information, interest rates, mortgage rates

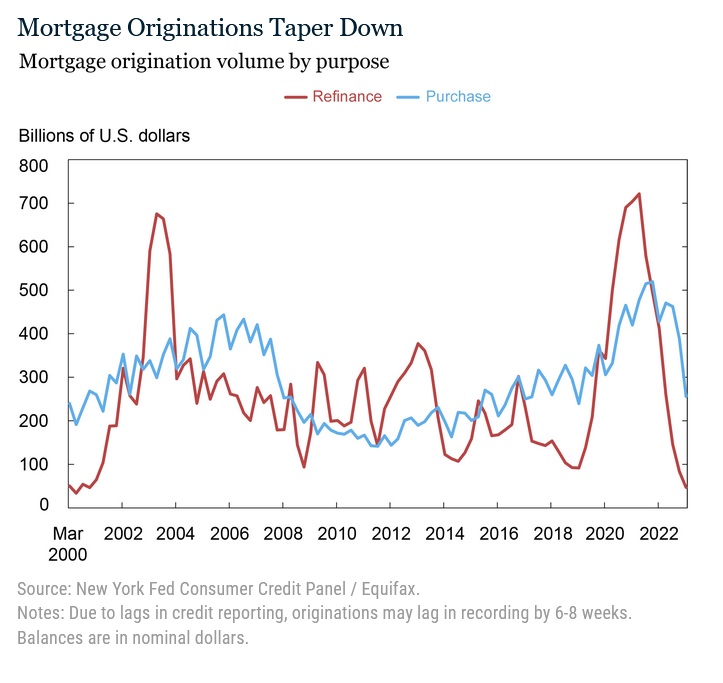

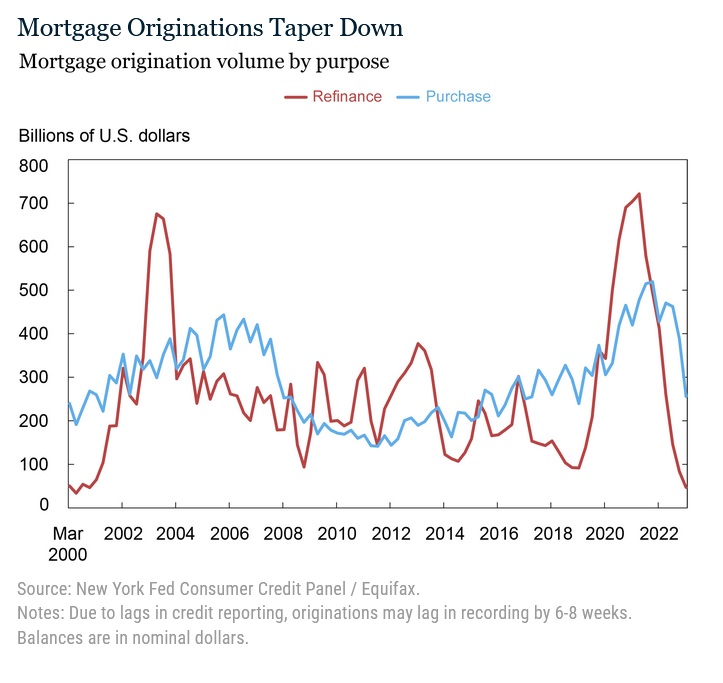

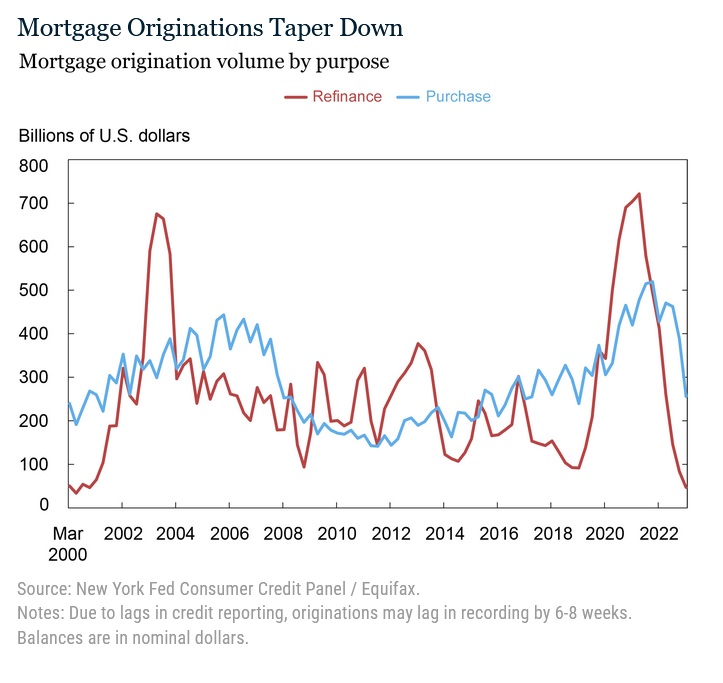

According to a recent Federal Reserve Report, fourteen million mortgages were refinanced during the COVID refinance boom, and these refinances will have effects on the mortgage market, real estate, and the general economy for years to come. An astonishing 430 billion...

by Glen | Jun 19, 2023 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, hard money, Hard Money Lending, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

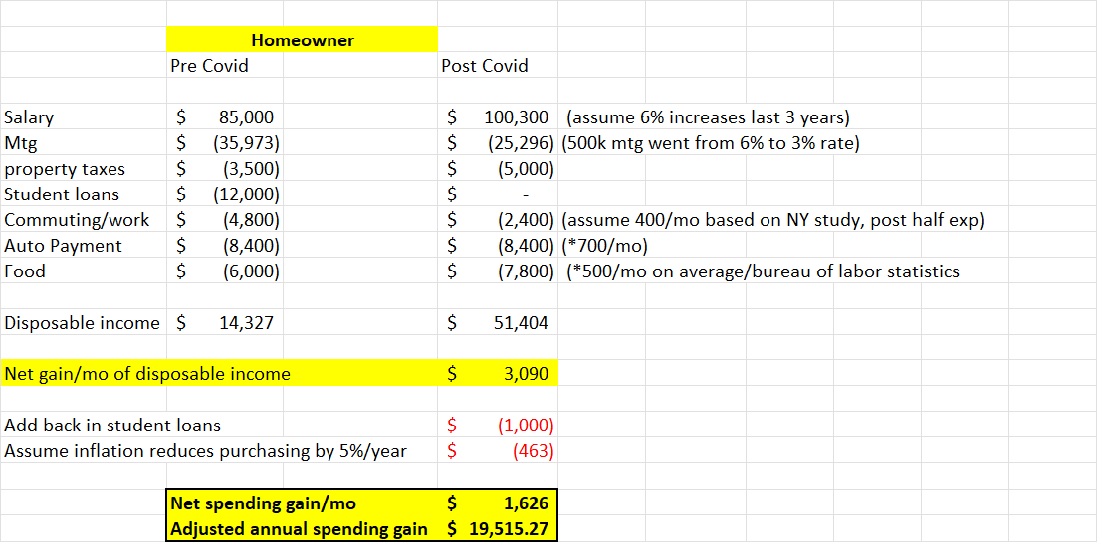

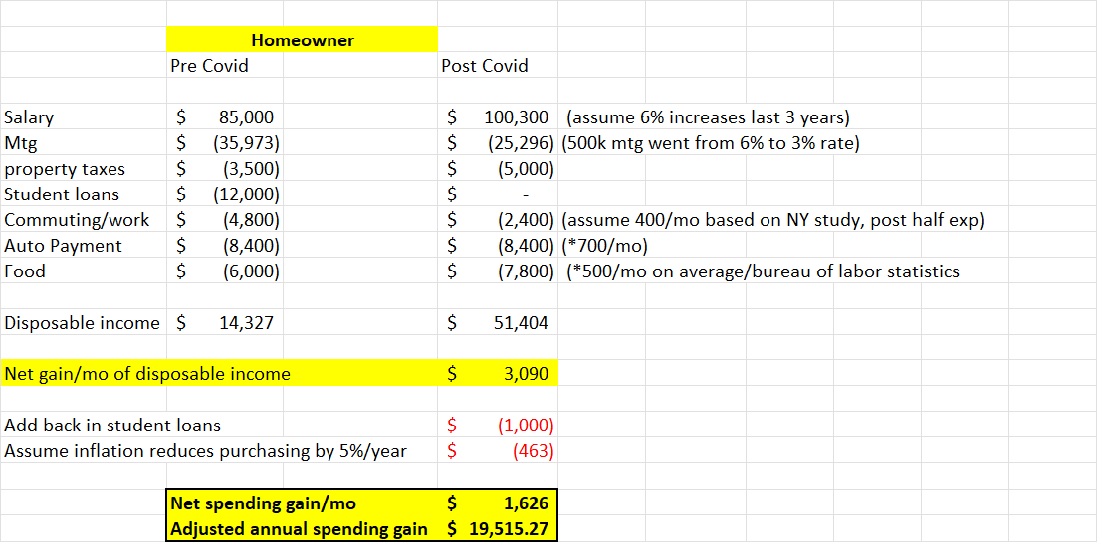

Interesting times we are in. Consumers keep spending big on services like travel and eating out, but on the flip side Home Depot just reported its first drop since the pandemic. On the other hand Target tops earnings estimates. What is driving the continued...

by Glen | Oct 31, 2022 | 2023 real estate prediction, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans

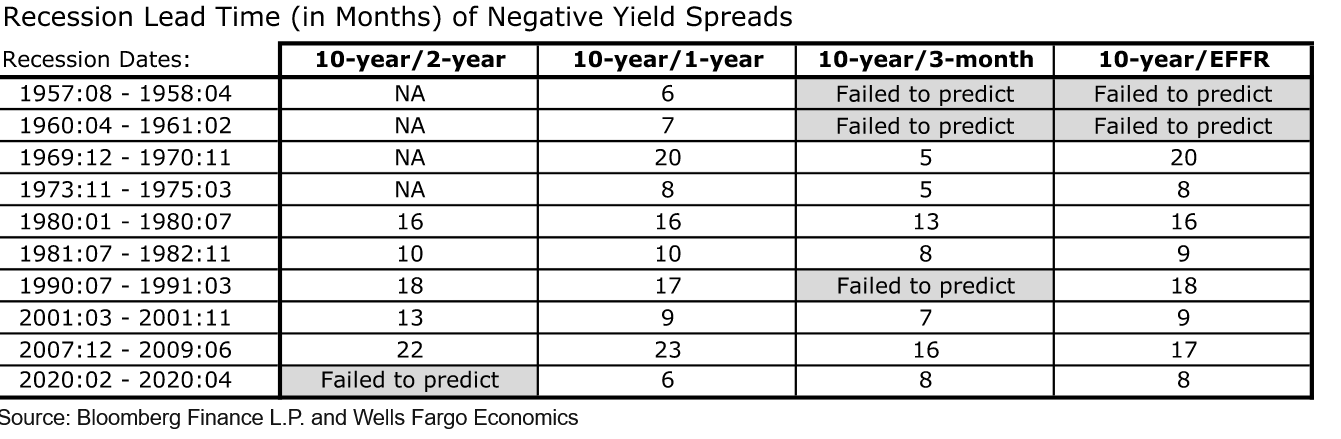

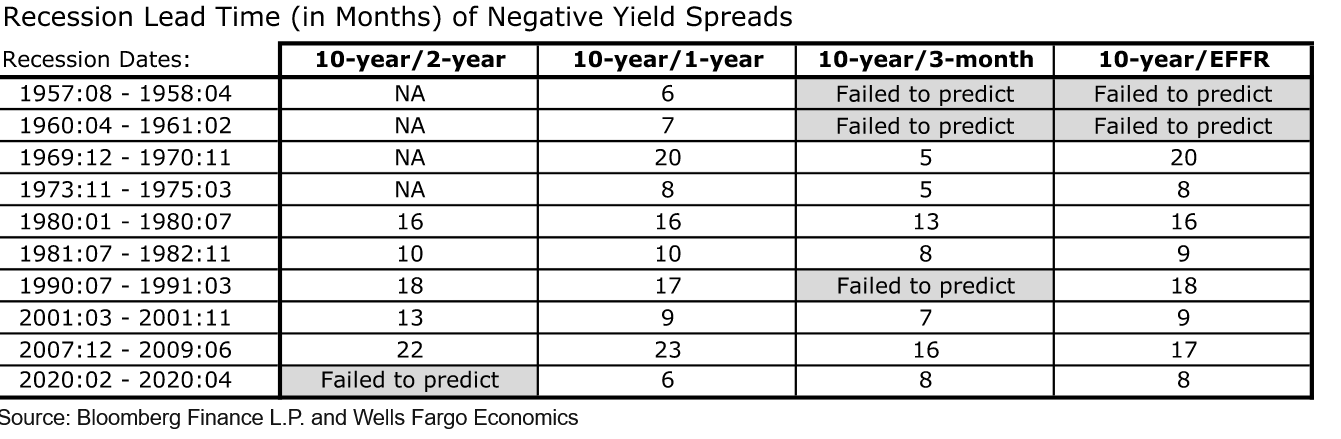

There is pretty much a universal theme that there will be a recession in the future. It is like saying that it might rain sometime in the next month. It doesn’t help you much without knowing approximately when it will rain and if it will be a light sprinkle or turn...

by Glen | Sep 26, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation

First, the pic above was the leading picture for a listing I looked at. I guess they were stressing the work from home conveniences in the office Unfortunately this could lead to some “interesting” conversations with coworkers. With the back to office trend in full...

by Glen | Jul 18, 2022 | 2022 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial hard money, Denver Hard Money, General real estate financing information, Georgia hard money, Government Bailout, Hard Money Commercial Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

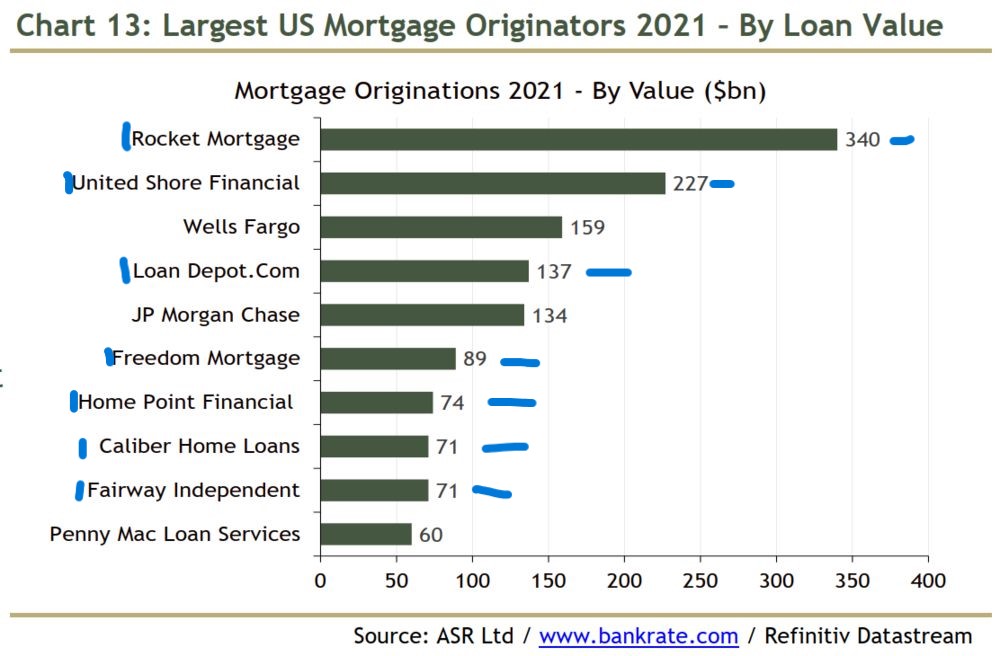

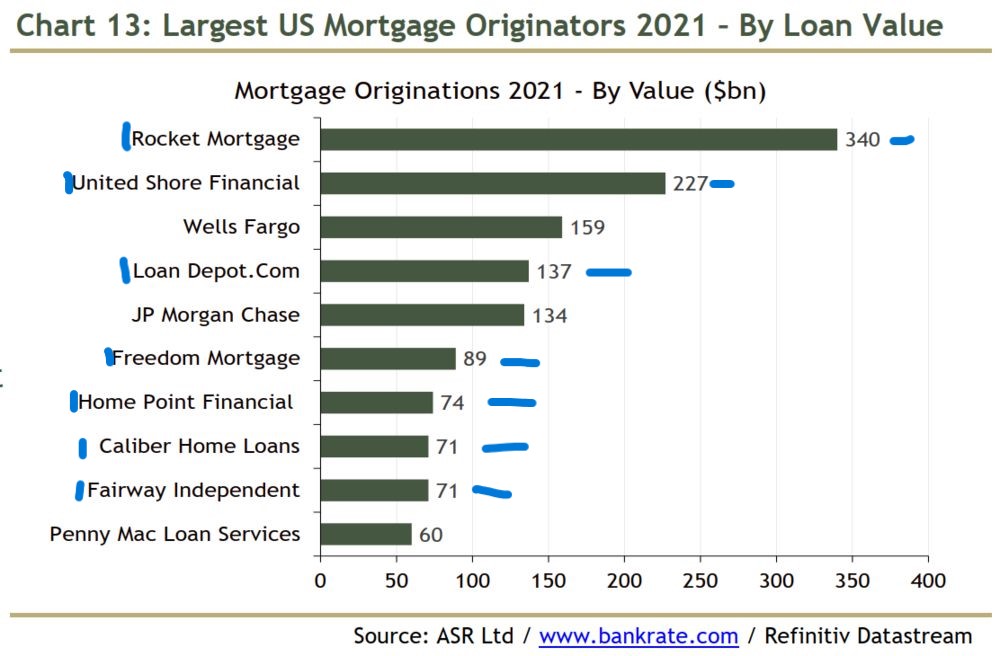

The federal government in their quest to shore up the mortgage market in 2008 has created some new risks to the housing market. Non bank lenders now make up 74% of the origination volume with only 3 banks even making the list. What does this mean for the mortgage...