by Glen | May 16, 2022 | Atlanta Hard Money, Denver Hard Money, interest rates, mortgage rates, Real Estate economic trends, Real Estate Trends, Real estate Valuation, residential lending valuation, Underwriting/Valuation, what happens to real estate in a correction

The Federal Reserve just raised interest rates .5% as expected. The market originally rallied and then plummeted 5% the next day. The fed made a colossal error and the stock and bond markets are not buying their guidance. What did the fed say at the meeting that...

by Glen | Apr 4, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Colorado Hard Money, credit scoring, Denver Hard Money, Georgia hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

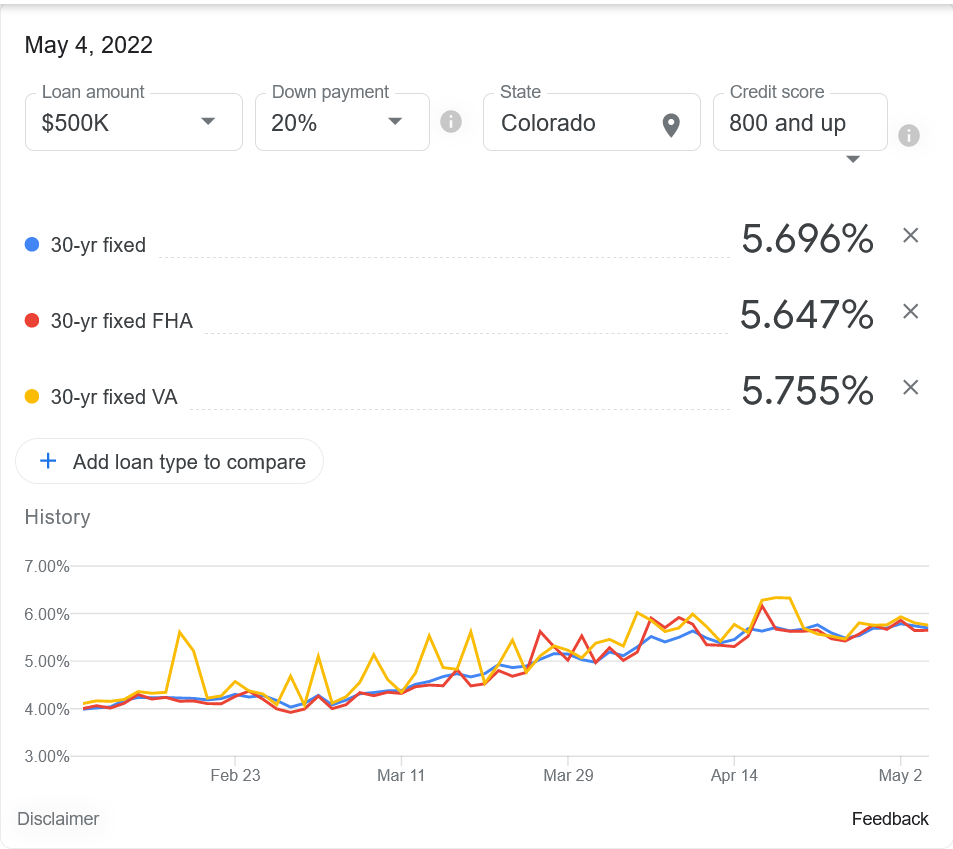

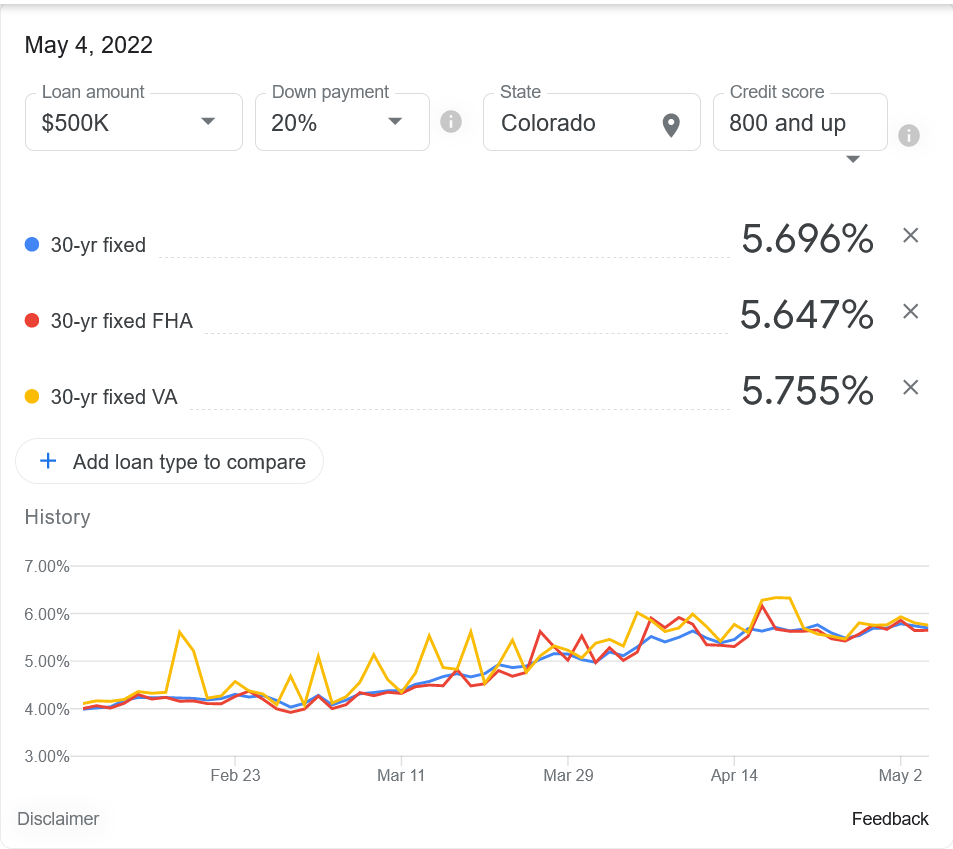

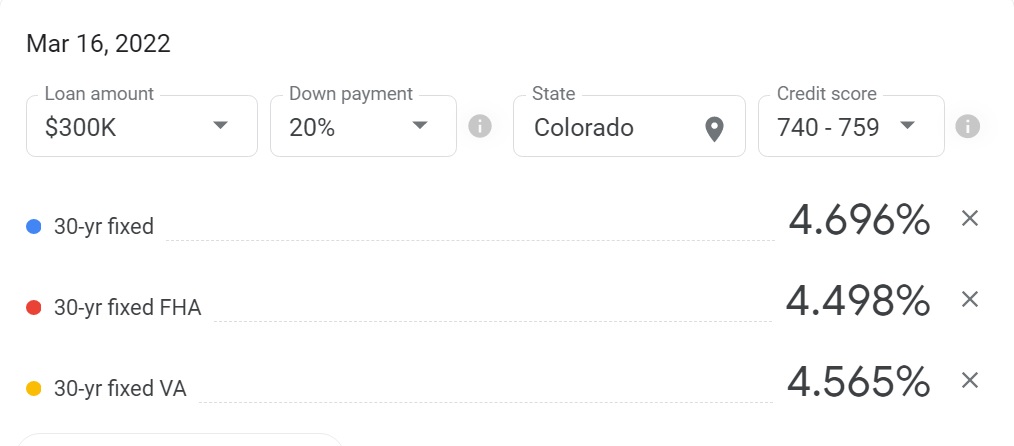

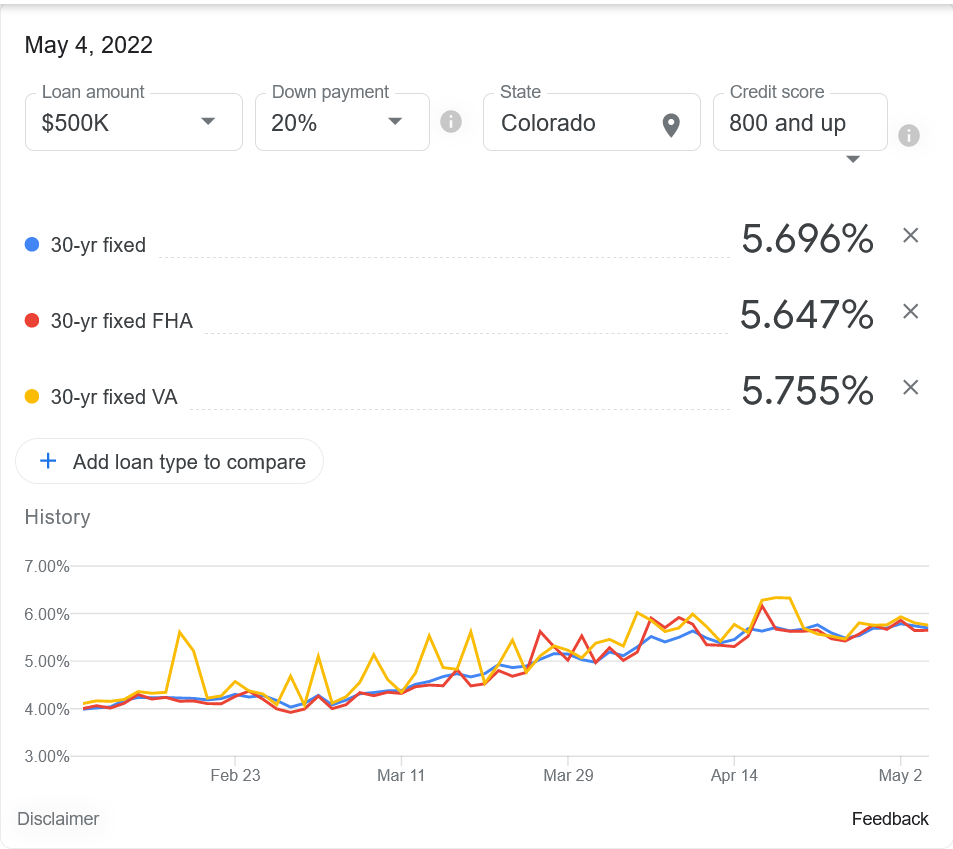

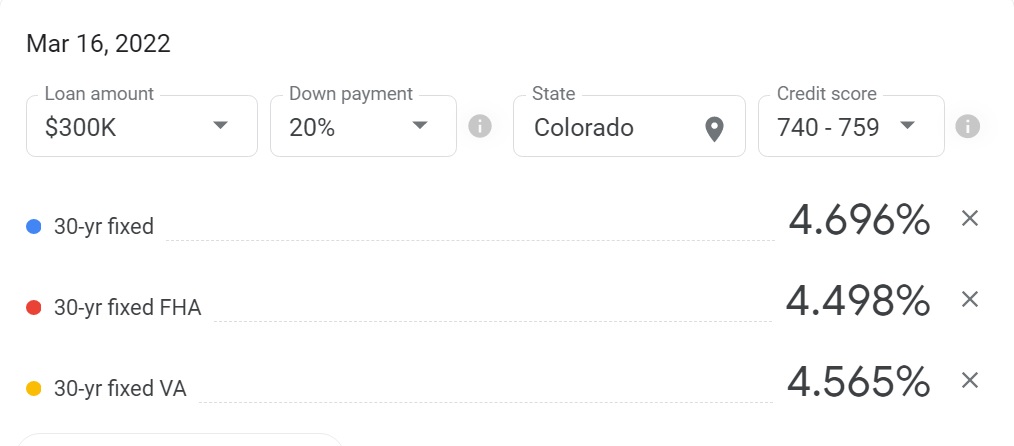

The swiftness of the changes in the real estate market are astonishing, yet not unexpected. I predicted last year mortgage rates would top 5% and they already have come close. This has led to a 60% drop in refinances and a sharp reduction in sales. What do these...

by Glen | Sep 14, 2021 | Housing Price Trends / Information, interest rates, mortgage rates

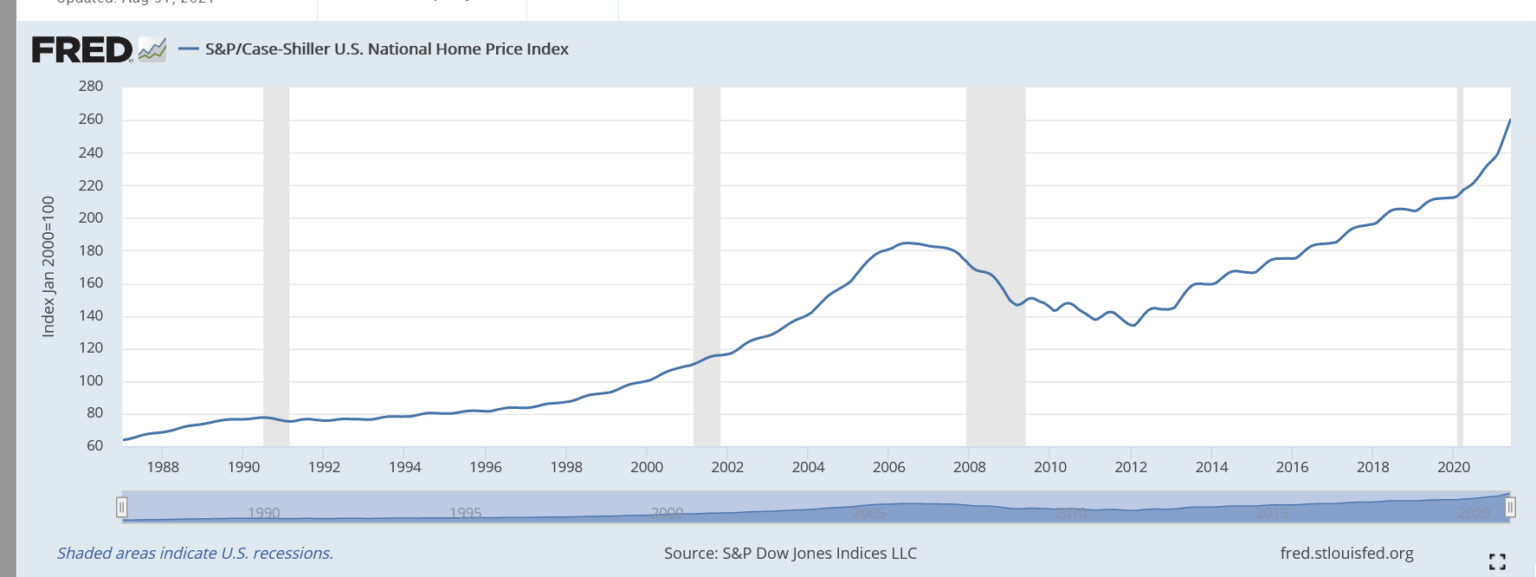

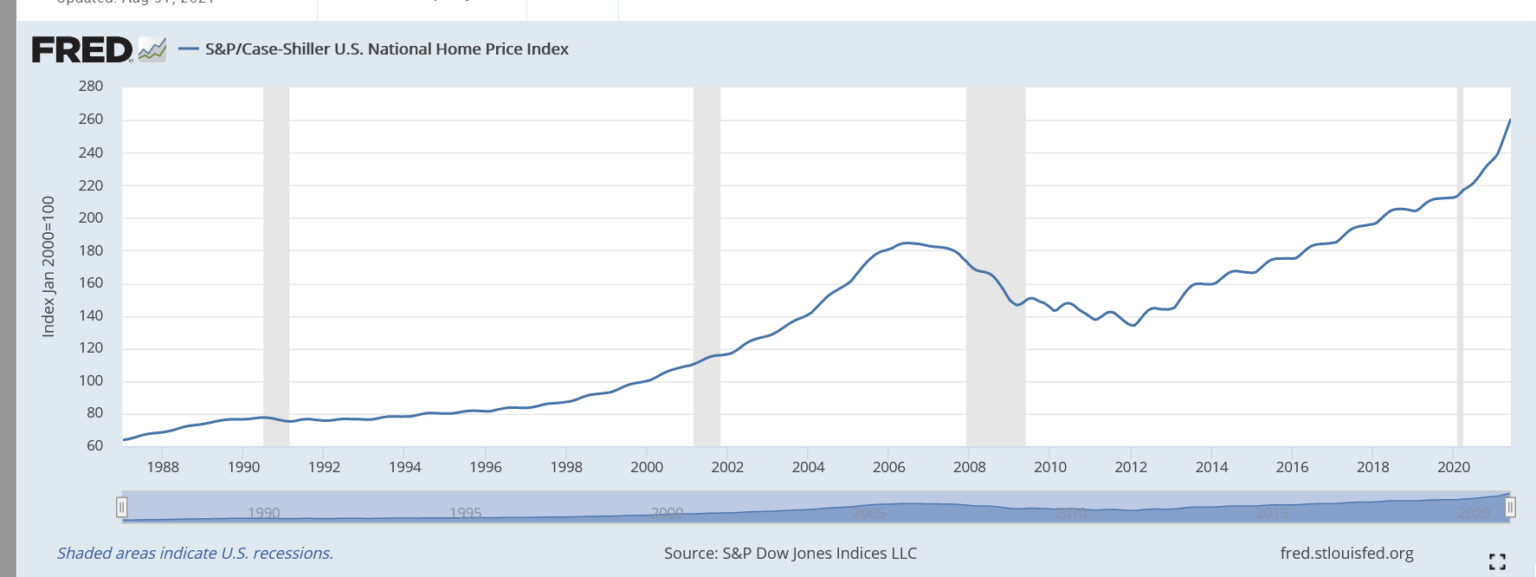

Investor Peter Boockvar, the chief investment officer at Bleakley Advisory Group, is sounding the alarm on a housing price bubble brought on by the Federal Reserve’s Covid pandemic policies which have stimulated so much demand that the supply side can’t keep up. What...

by Glen | Jul 27, 2021 | Hard Money Lending, Housing Price Trends / Information, interest rates, mortgage rates, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, Underwriting/Valuation

U.S. consumer sentiment fell sharply and unexpectedly in early July to the lowest level in five months. Consumers’ complaints about rising prices on homes, vehicles, and household durables reached an all time record. Just 30% of all consumers cited favorable home...

by Glen | Sep 15, 2020 | interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

If you have been tracking interest rates in the mortgage market, your head is likely spinning. Mortgage rates hit a record low of 3% less than a week later rates have risen again. What is causing the drastic swings? Is now the time to lock in or refinance? What did...