by Glen | Feb 11, 2020 | Commercial Lending valuation, General real estate financing information, Hard Money Commercial Lending, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, residential lending valuation, Underwriting/Valuation

Looks like we should have smooth sailing in 2020, but the National Association of Business economists (NABE), the premier professional association for business economists counting Alan Greenspan as their past president, just released their business outlook predictions...

by Glen | Aug 20, 2019 | Real Estate economic trends, Real Estate Trends, Real estate Valuation, Underwriting/Valuation

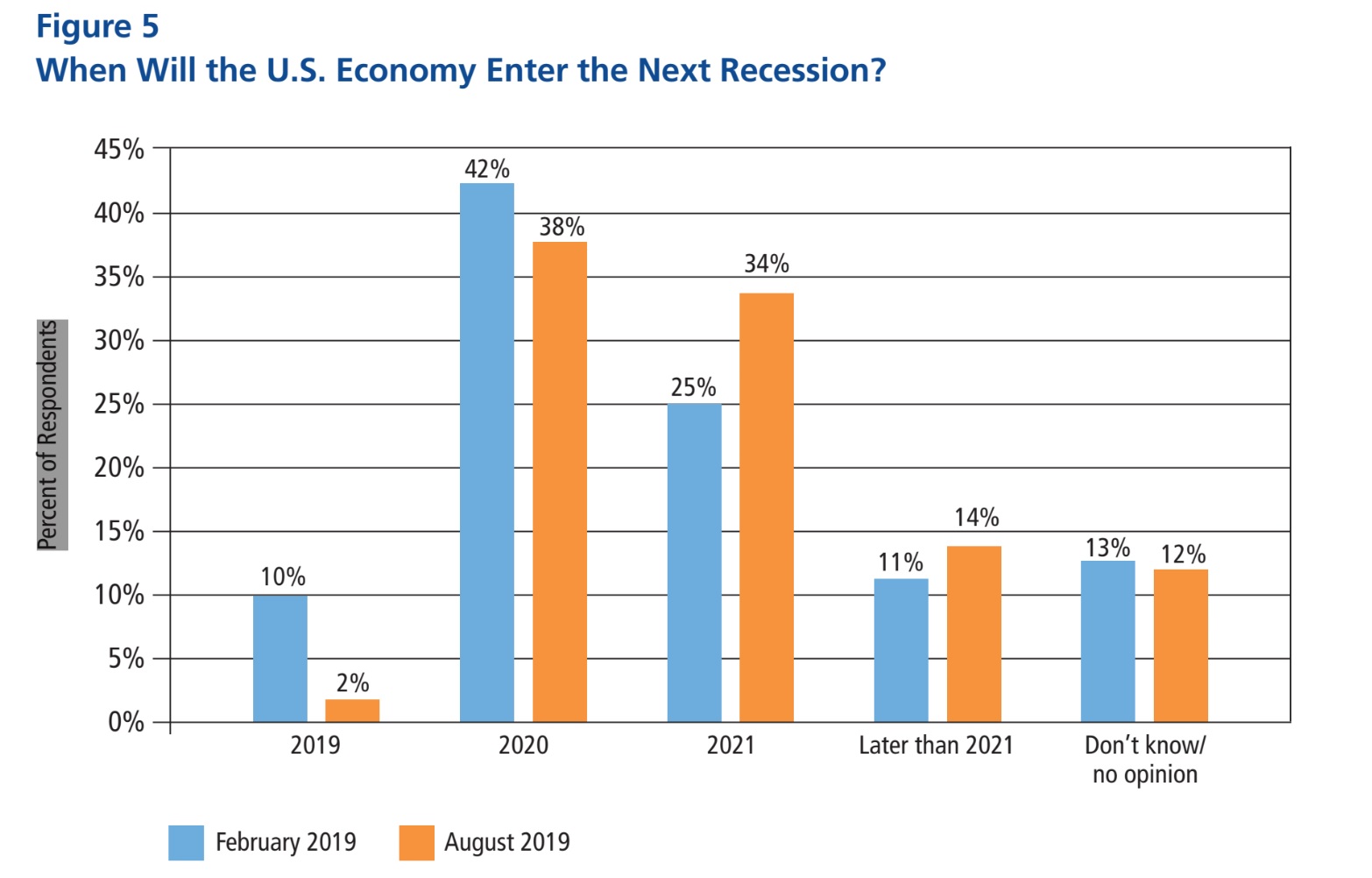

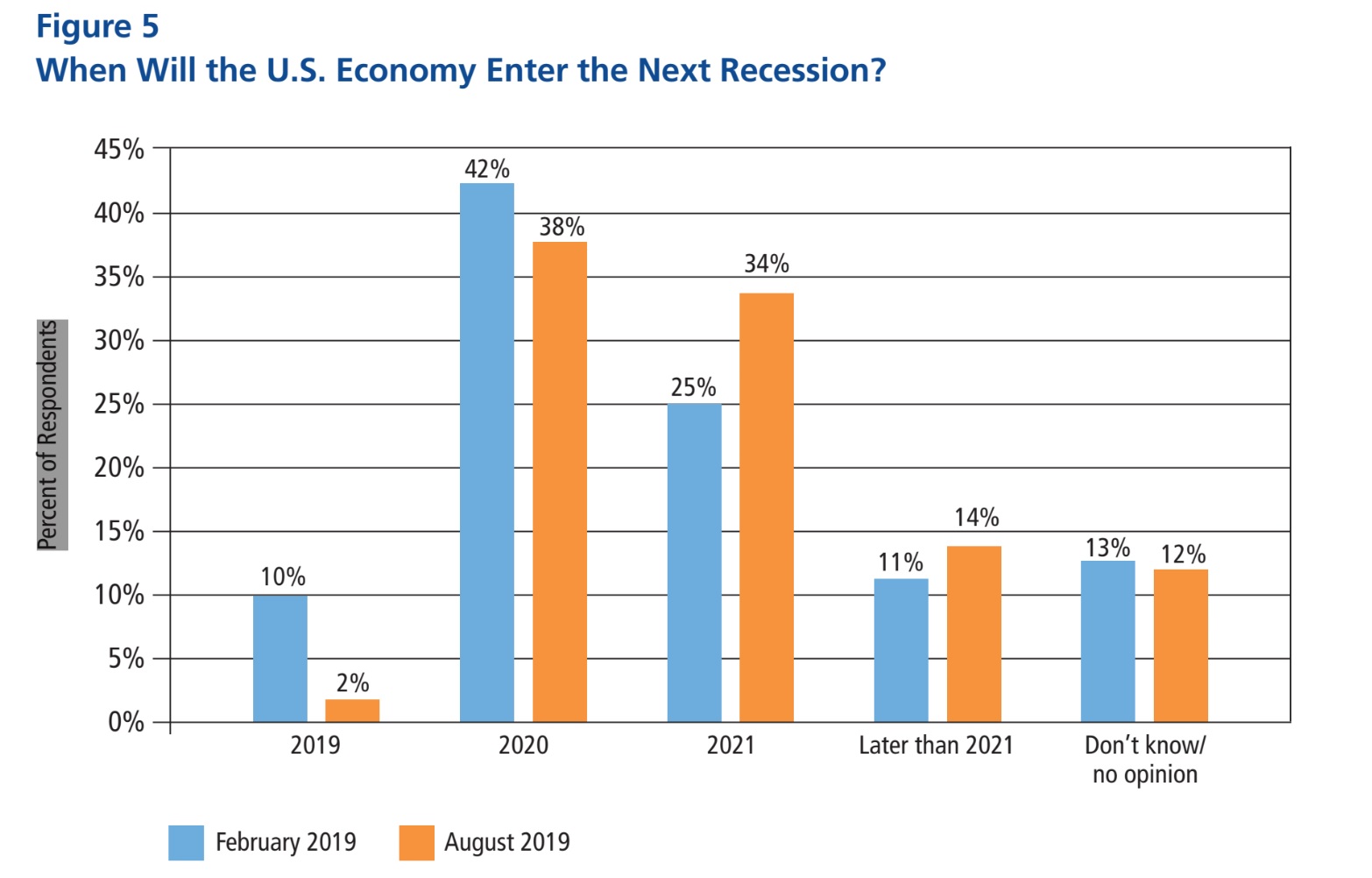

The National Association of Business economists (NABE), the premier professional association for business economists counting Alan Greenspan as their past president, just released their business outlook predictions placing the odds of a recession in the next two years...

by Glen | Apr 25, 2019 | commercial hard money, Commercial Lending valuation, hard money, Hard Money Lending, Housing Price Trends / Information, Real Estate economic trends

We are well into 2019 and recession risks seems to have faded into the rear view mirror. Is this a facade? Are we out of the woods yet? What changed? The biggest wildcard going into 2019 was the pace and number of increases from the federal reserve. What has...

by Glen | Mar 22, 2019 | Commercial Lending valuation, private lender, Real Estate Trends, Real estate Valuation

The Yield curve inverted for the first time since 2007! What does this mean and why is this so important for real estate? Can the animals predict our next “storm”? Should we all be listening to our “primal” instincts a bit more? We probably should. I was doing a...

by Glen | Jun 14, 2018 | Commercial Lending in the news, Commercial Lending valuation, Housing Price Trends / Information, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

The economy is in for a bit of a ride! The federal reserve in their last meeting changed their tone signaling two more rate increases this year as opposed to one bringing the total rate increase to four. Why is this change in tone important? What does this have to...