by Glen | Dec 23, 2024 | 2025 real estate predictions

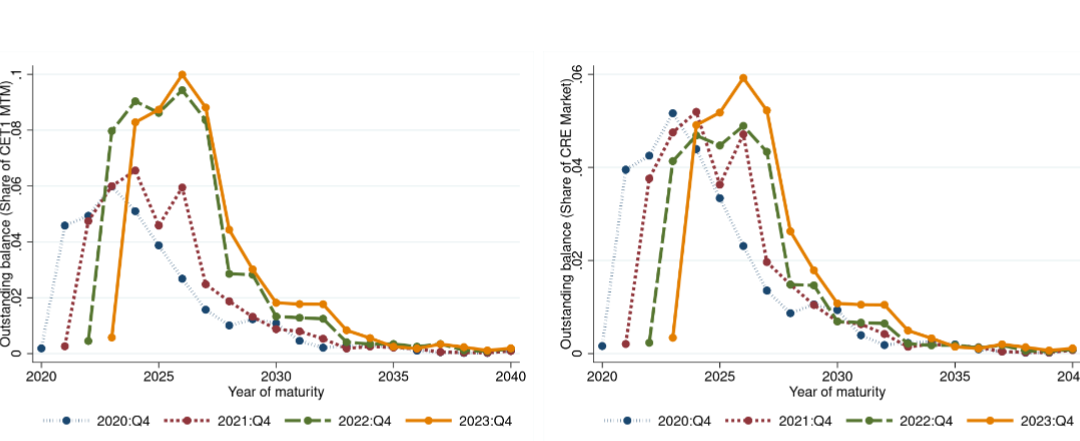

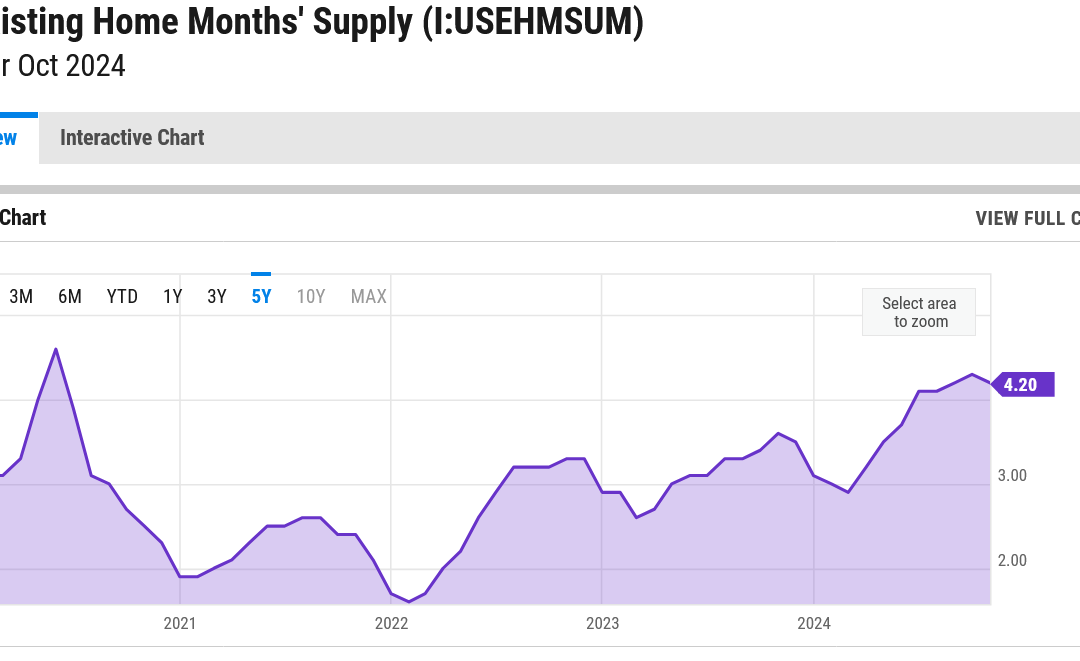

2024 was set to be the big recovery in real estate with rates lowering setting us up for a great 25. Instead, rates are hovering around 7%, inventory is rising, and long term treasuries are pointing to higher rates for longer. What does this mean for 25? ...

by Glen | Dec 16, 2024 | 2025 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, if there is a recession what happens to real estate, mortgage rates, Private Lending, real estate investing, Real Estate Trends, Real estate Valuation

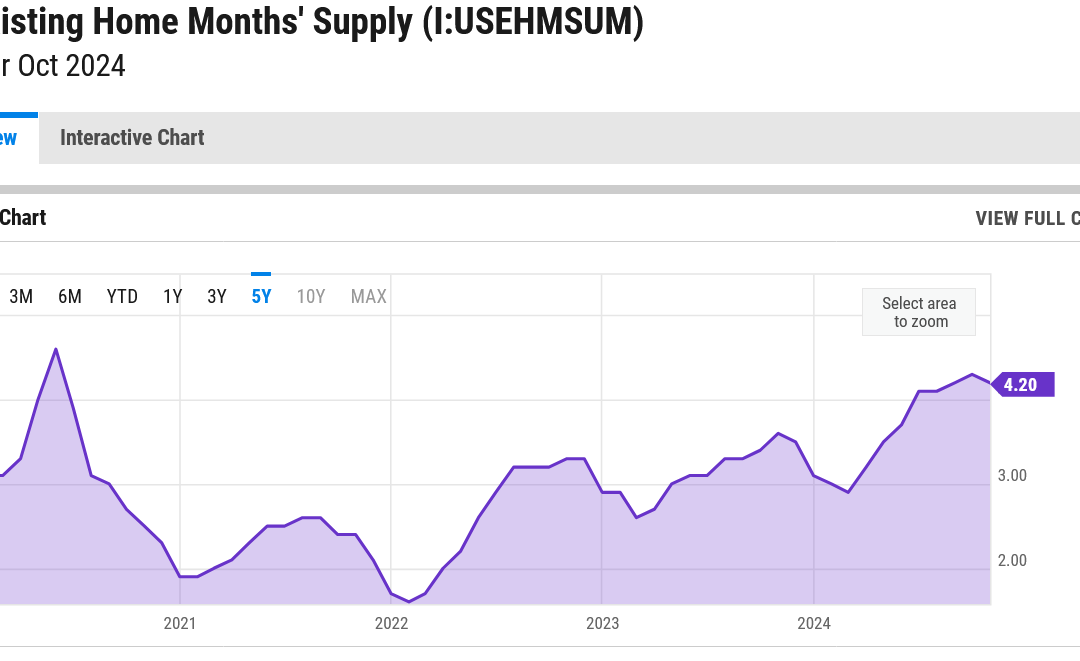

When I was writing this article mortgage rates were hovering right around 7%. At the same time economists had been predicting a sharp decline in mortgage rates and a booming 2024 real estate market as the fed has cut rates. On the other hand, the chart above...

by Glen | Dec 9, 2024 | 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Bank failures, Colorado Hard Money, Denver Hard Money, Georgia hard money, hard money, Housing Price Trends / Information, Housing shortage, if there is a recession what happens to real estate, Private Lending, Property Valuation, Real Estate Trends, Real estate Valuation, Realtor

The chief economist of the National Association of Realtors, Lawrence Yun, has released his 2025 and 2026 predictions for residential real estate and they were a huge surprise. What is Yun predicting for real estate prices, interest rates, and appreciation? How...

by Glen | Dec 2, 2024 | 2024 election real estate impacts, 2024 mortgage rates, 2025 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, commercial hard money, Commercial Lending valuation, commercial private lending, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money

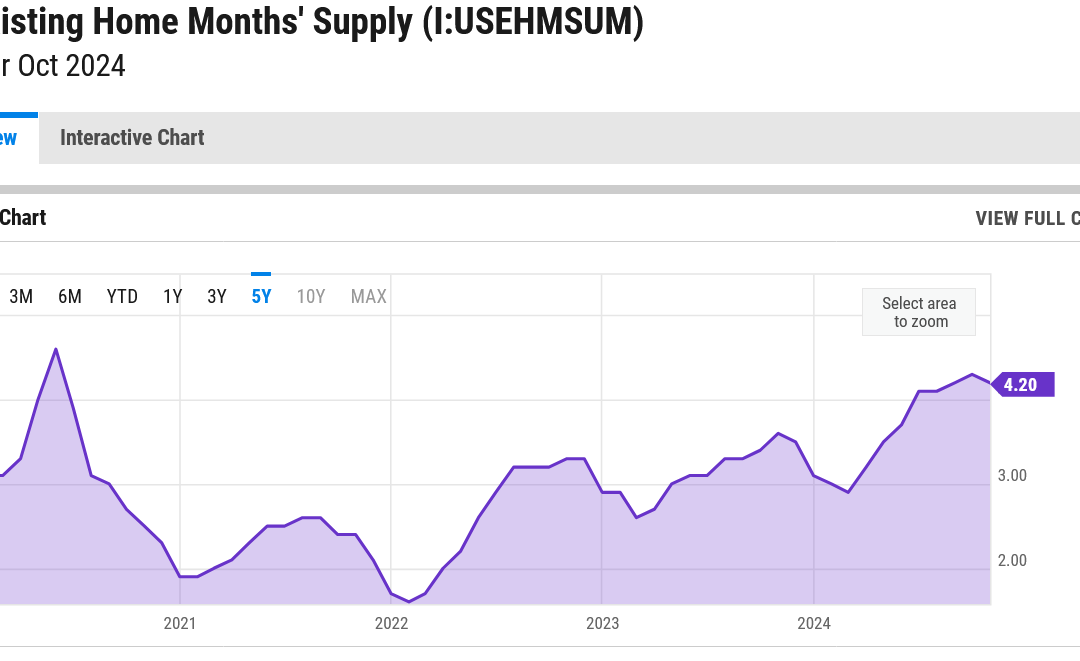

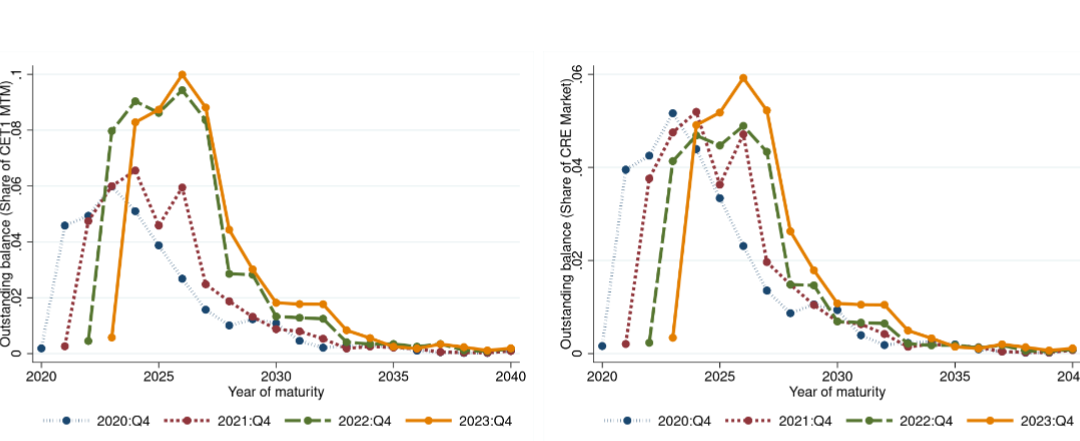

There is a mantra being used in small/regional banks that is “survive until 2025”. In essence the theory is that rates will drop precipitously and basically “bail out” many banks’ portfolios. Banks are in turn pushing out maturity dates hoping for a market bail out....

by Glen | Nov 25, 2024 | 2024 election impact on real estate, Hard Money Commercial Lending, Hard Money Lending, hard money loans

As everyone departs for the Thanksgiving holiday, I wanted to wish you safe travels and a happy holiday season. Although it has been a challenging year for many in real estate due to much higher interest rates than anticipated and much lower sales volumes, there is...