by Glen | Mar 13, 2020 | General real estate financing information, hard money, Hard Money Commercial Lending, Hard Money in the News, Housing Price Trends / Information, interest rates, private lender, Private Lending, Process/Loan Submittal, Program Details

First, I hope everyone is doing okay with everything going on. As many banks and other lenders pull back thru the pandemic and the mortgage rate increase we are still funding. We fund and hold all of our loans in cash without leverage so we will continue to...

by Glen | Feb 25, 2020 | interest rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money

We are at an interesting crossroads in the economy. The Federal Reserve and economic data show that the economy is very strong with consumer spending and confidence at all-time highs. At the same time the bond market is portraying a different picture after a new...

by Glen | Jan 11, 2020 | interest rates, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation

Yes, it is hard to believe but you, along with me and millions of others, are actually making mortgage rates go down and therefore real estate relatively less expensive. How is this possible? How are your thoughts influencing long term rates and in turn real...

by Glen | Jul 10, 2019 | Hard Money Lending, Housing Price Trends / Information, Real Estate economic trends, Real Estate Trends, Real estate Valuation

I took the pic after the 4th outside of Breckenridge, CO (has nothing to do with the article, but thought you would enjoy). Last week the US June jobs report was released that toppled all expectations. After a week May report the job numbers in June did not disappoint...

by Glen | May 10, 2018 | commercial hard money, Commercial Loan Servicing, Real Estate Trends, Real estate Valuation, Small Balance Commercial Lending

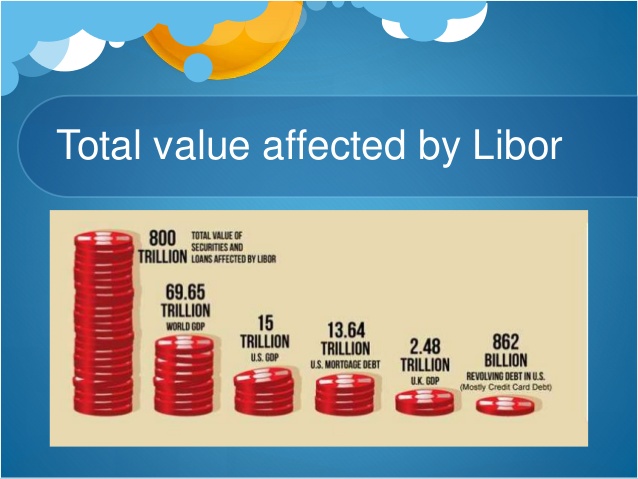

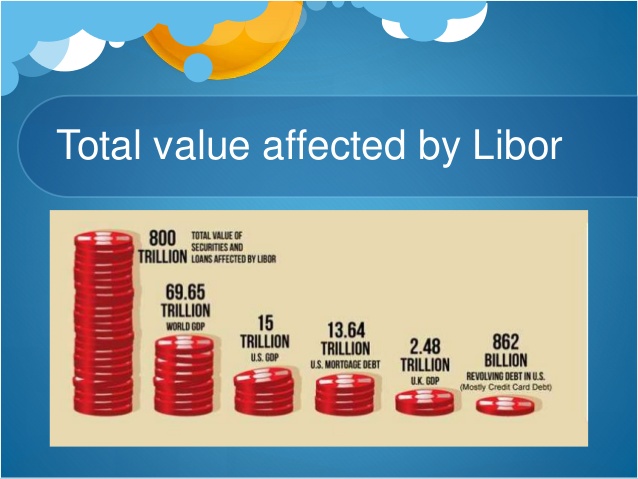

Last year it was announced that Libor will be phased out by 2021. Why is this such big news? According to a fed survey almost 45% of mortgages are linked to Libor and the vast majority of jumbo loans are Libor based. In total there is about 862 billion...