by Glen | Jul 3, 2023 | Atlanta Hard Money, Atlanta Private Lending, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, Private Lending

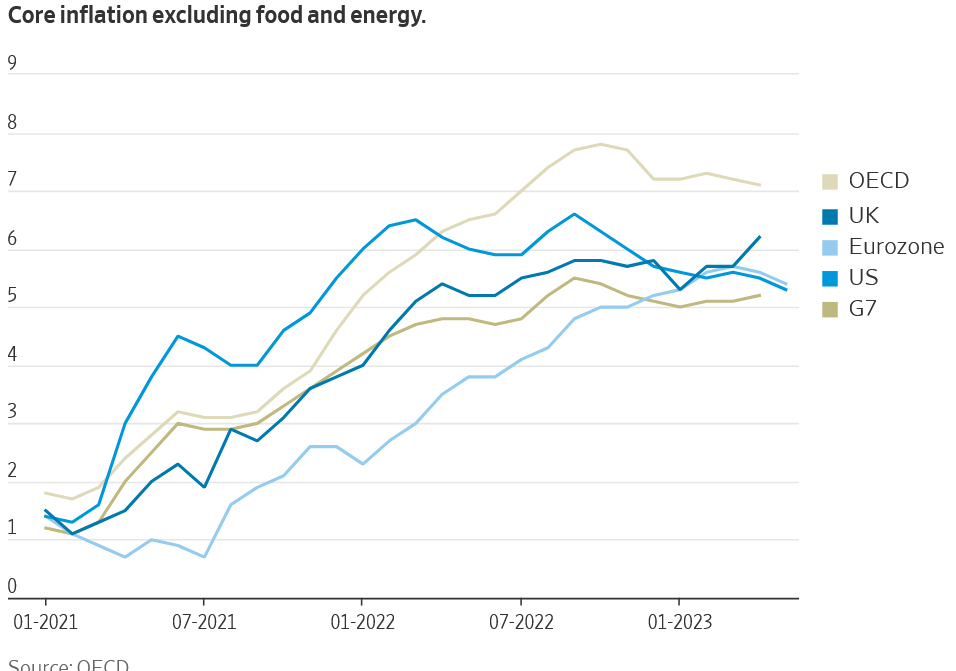

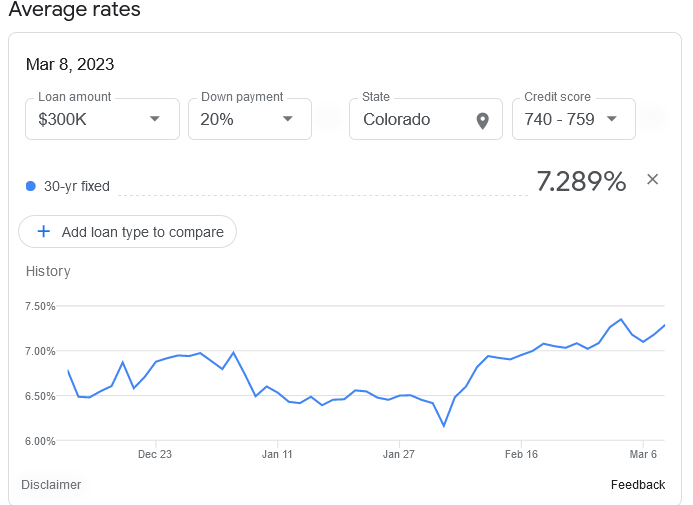

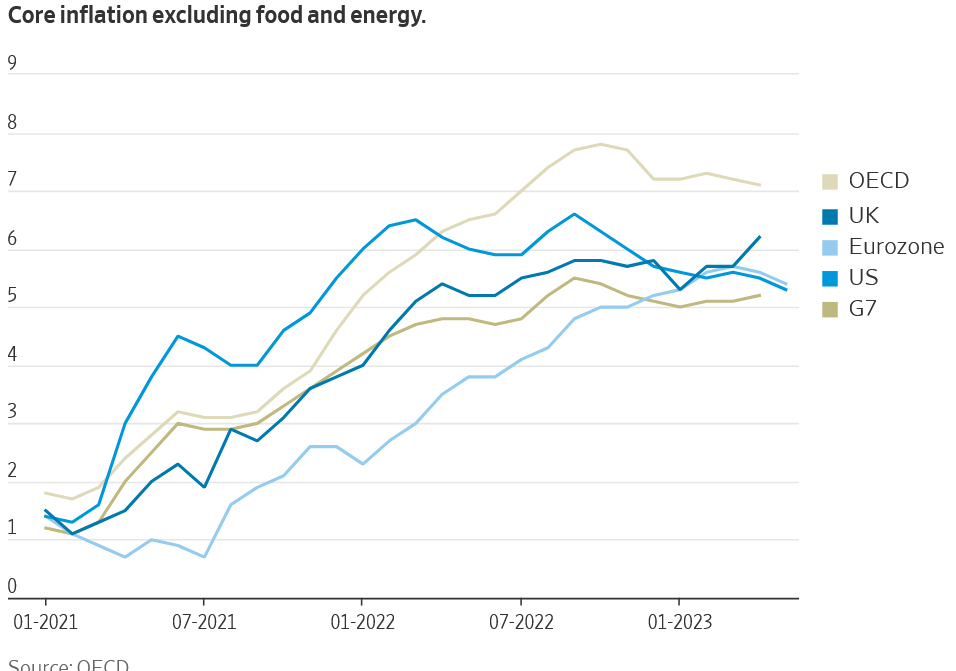

Although the market rejoiced in the recent fed “skip”, as you dig into the numbers more the outcome is a lot less sanguine. Why does inflation continue running hotter than anticipated? What does this mean for interest rates and real estate? What happens when...

by Glen | Mar 20, 2023 | 2023 real estate prediction, 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending

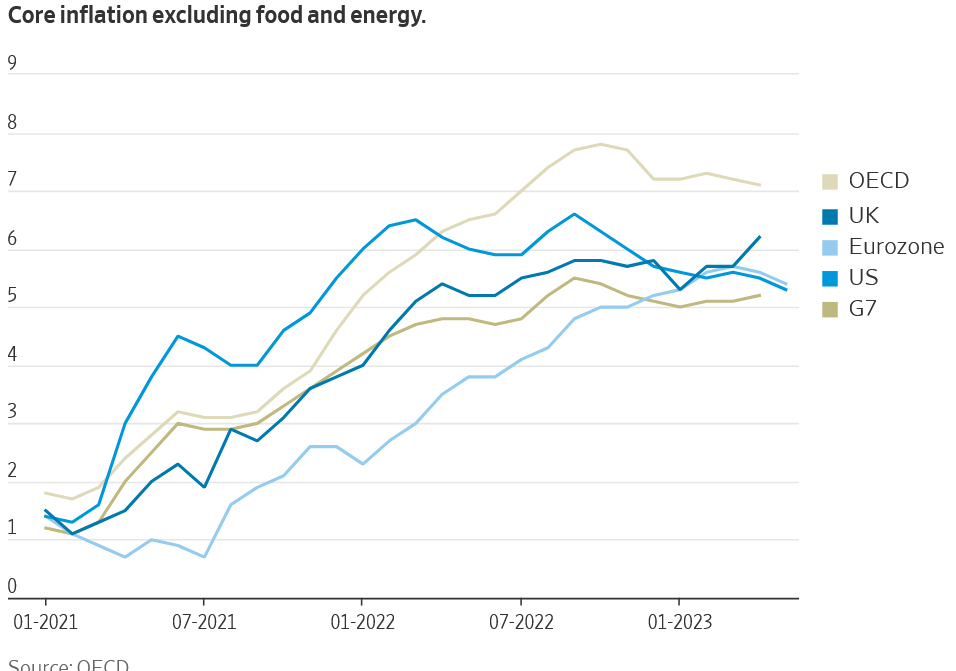

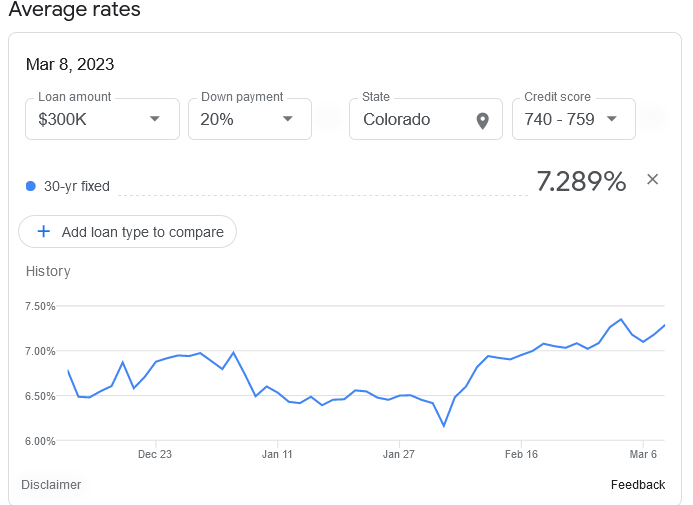

Wow, a few weeks ago rates had fallen from a peak of over 7% to almost 6%. Unfortunately the party was short lived as rates are now heading much higher. The recent jobs report was another blow out upping the odds of another half point increase at the next Fed...

by Glen | Oct 14, 2021 | interest rates, mortgage rates, Private Lending, Real Estate economic trends, real estate investing, Real estate Valuation

Happy Fall, it is hard to beat this time of year with snow up top and changing leaves in the valleys (do you know where I took this pic?) Yields for U.S. government debt posted the biggest weekly jump in months on Friday, as a selloff in bonds that commenced...

by Glen | Jan 19, 2021 | Commercial Lending valuation, commercial property trends, Denver Hard Money, General real estate financing information, hard money, Housing Price Trends / Information, interest rates

Denmark, the country with the longest history of negative central bank rates is offering homeowners 20-year loans at a fixed interest rate of zero. This is very similar to the zero percent financing on cars in the US except you are buying a house. What does this...

by Glen | Aug 19, 2020 | interest rates, Private Lending, Real Estate economic trends, real estate investing, Residential hard money

The mortgage market is an interesting animal. Long term mortgage rates traditionally track the 10 year treasury and historically trade in a very narrow band, approximately one percent higher than the 10 year treasuries. This would put mortgages today in the low 2%...