by Glen | Oct 26, 2021 | Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, commercial hard money, coronavirus 2021 real estate impacts, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Commercial Lending, interest rates, mortgage rates

Retail giants, fast-food chains, and ride-hailing companies are offering higher wages and cash payments. Referral and signing bonuses, rarely needed before to fill entry-level, low-wage jobs, are now commonplace. How will McDonald’s impact real estate prices? Will...

by Glen | Sep 9, 2021 | Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor

Last year the Department of Justice and the National Association of Realtors reached a historic pact to clear up any antitrust issues and provide greater transparency to consumers about commissions and increase competition among brokers. Everyone thought the deal was...

by Glen | Aug 6, 2021 | Atlanta Hard Money, Atlanta real estate trends, Colorado Hard Money, Denver Hard Money, Georgia hard money, Private Lending, Property Valuation, real estate investing, Real estate Valuation, Realtor, residential lending valuation

In a last-ditch effort, President Biden implemented another eviction moratorium until October 3rd. What does this mean for real estate property owners? Will this ban hold up in court? Could this moratorium be a good thing for property owners? What is...

by Glen | Jul 7, 2021 | Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Georgia hard money, Hard Money Lending, Housing Price Trends / Information, interest rates, mortgage rates, real estate investing, real estate taxes, Real Estate Trends, Real estate Valuation, residential lending valuation

I have been saying for months that rent growth would accelerate. The numbers are in and according to Corelogic, Single-family rents were up 5.3% year over year in April, rising from a 2.4% increase in April 2020. Nationally, rent growth exceeded pre-pandemic rates...

by Glen | Jun 10, 2021 | interest rates, mortgage rates, Real Estate Trends, Real estate Valuation, residential lending valuation

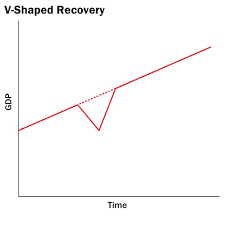

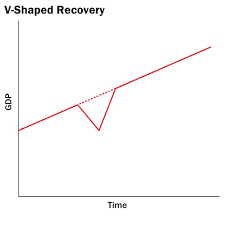

Consumer prices jump 5% in May (CPI); this is the highest movement since 2008. What does this mean for interest rates? Before getting into the details, I can quickly tell you with 100% certainty, the only way for mortgage rates to go is up. Why are mortgage rates...