by Glen | Jan 8, 2024 | 2024 real estate predictions, Atlanta Hard Money, Colorado Hard Money, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, Realtor, Realtor commision lawsuits

There has been a ton of talk regarding the lawsuits against the National Association of realtors, but from a practical perspective what does this mean for the market? Will buyer’s agent commissions be eliminated? One realtor association is not waiting for more...

by Glen | Jan 1, 2024 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Commercial Lending valuation, Commercial Loan Servicing, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, interest rates, mortgage rates

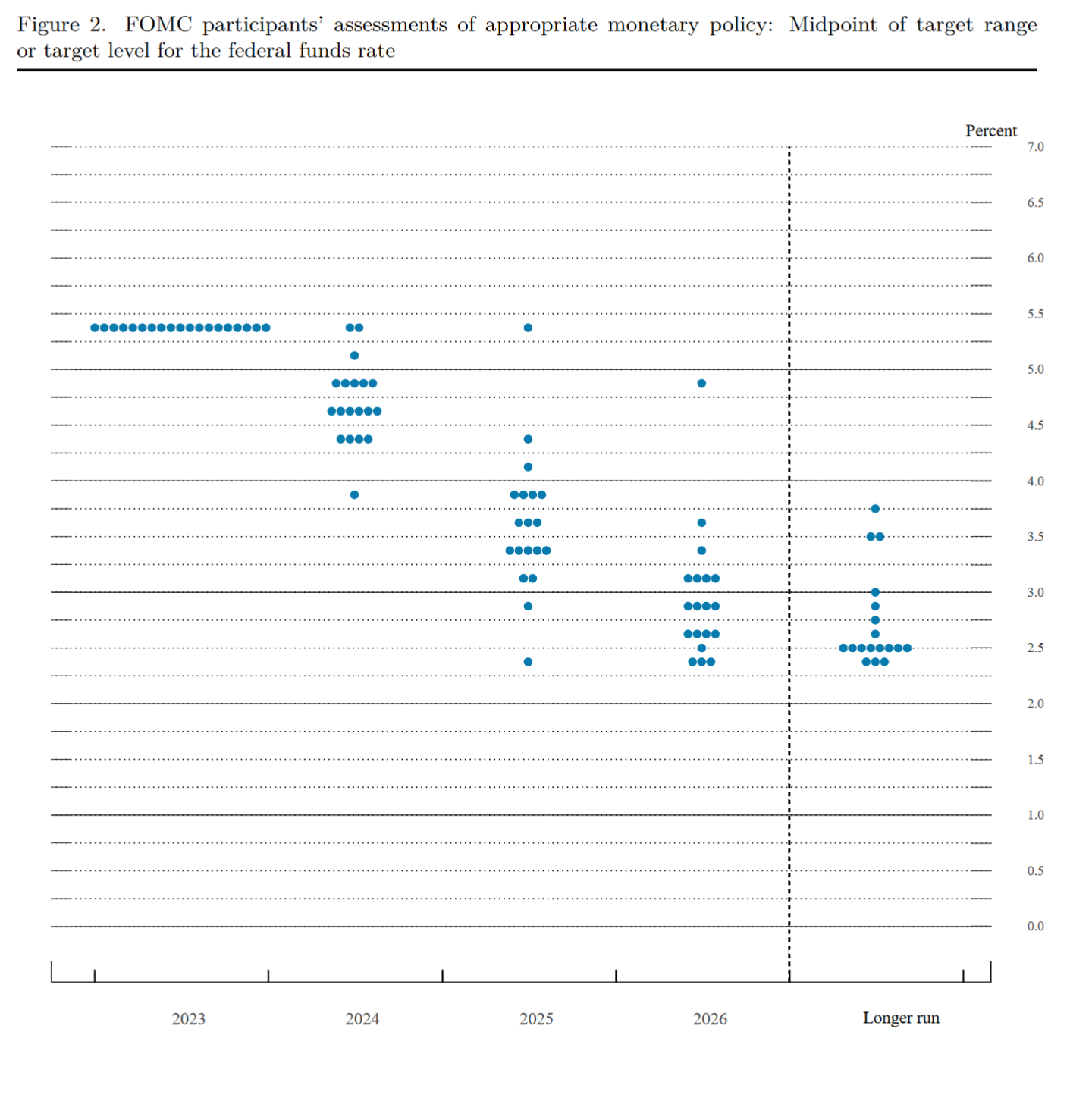

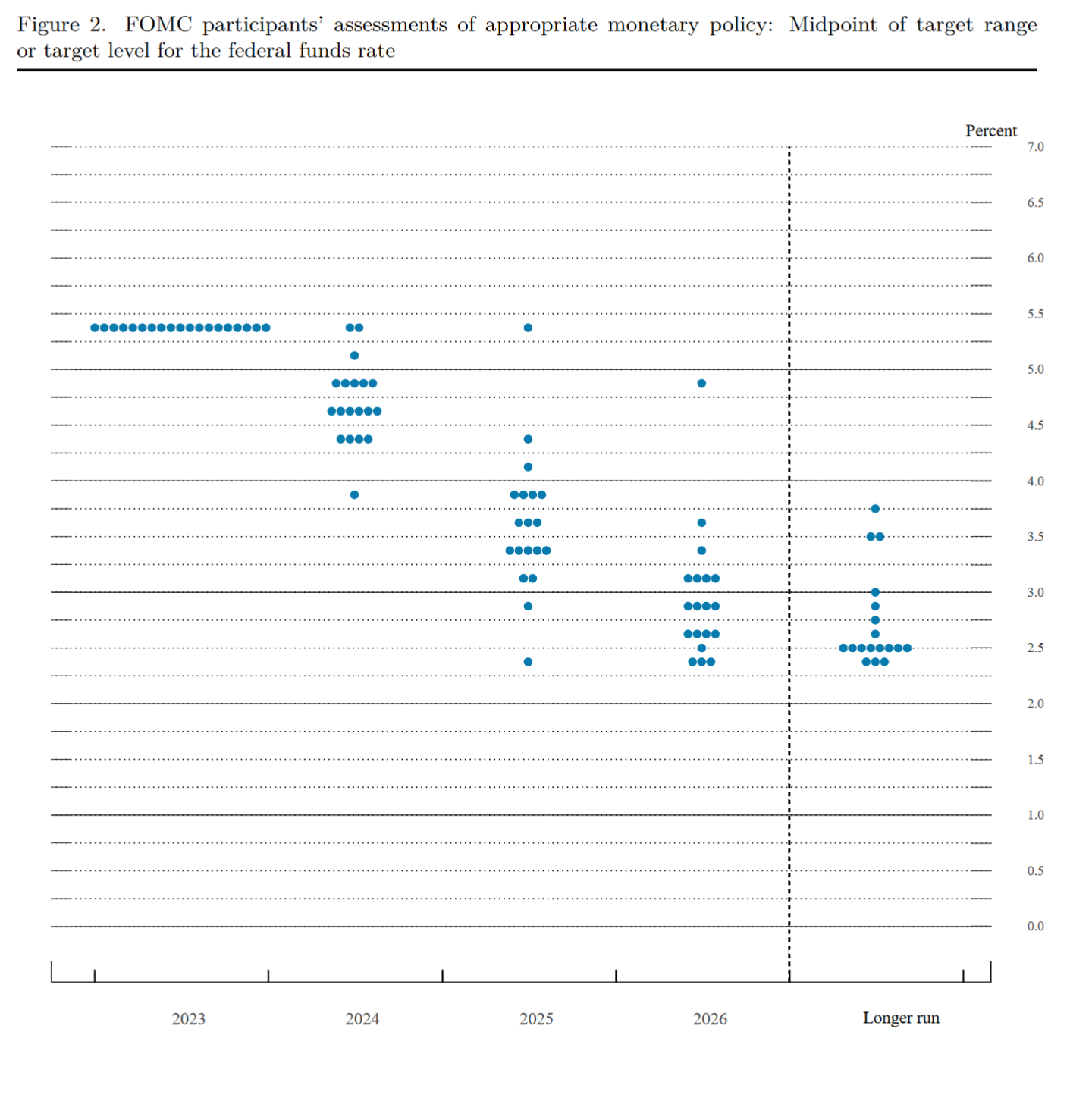

Although the graph above looks like an old Atari game, it is the Federal reserve dot plot which shows a profound shift. Ironically, just a few weeks ago the Federal Reserve was touting higher rates for longer. Now the federal reserve has done a 180 and has...

by Glen | Dec 25, 2023 | 2024 mortgage rates, 2024 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Bank failures, CO hard money, Colorado Hard Money, Colorado private lender, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money

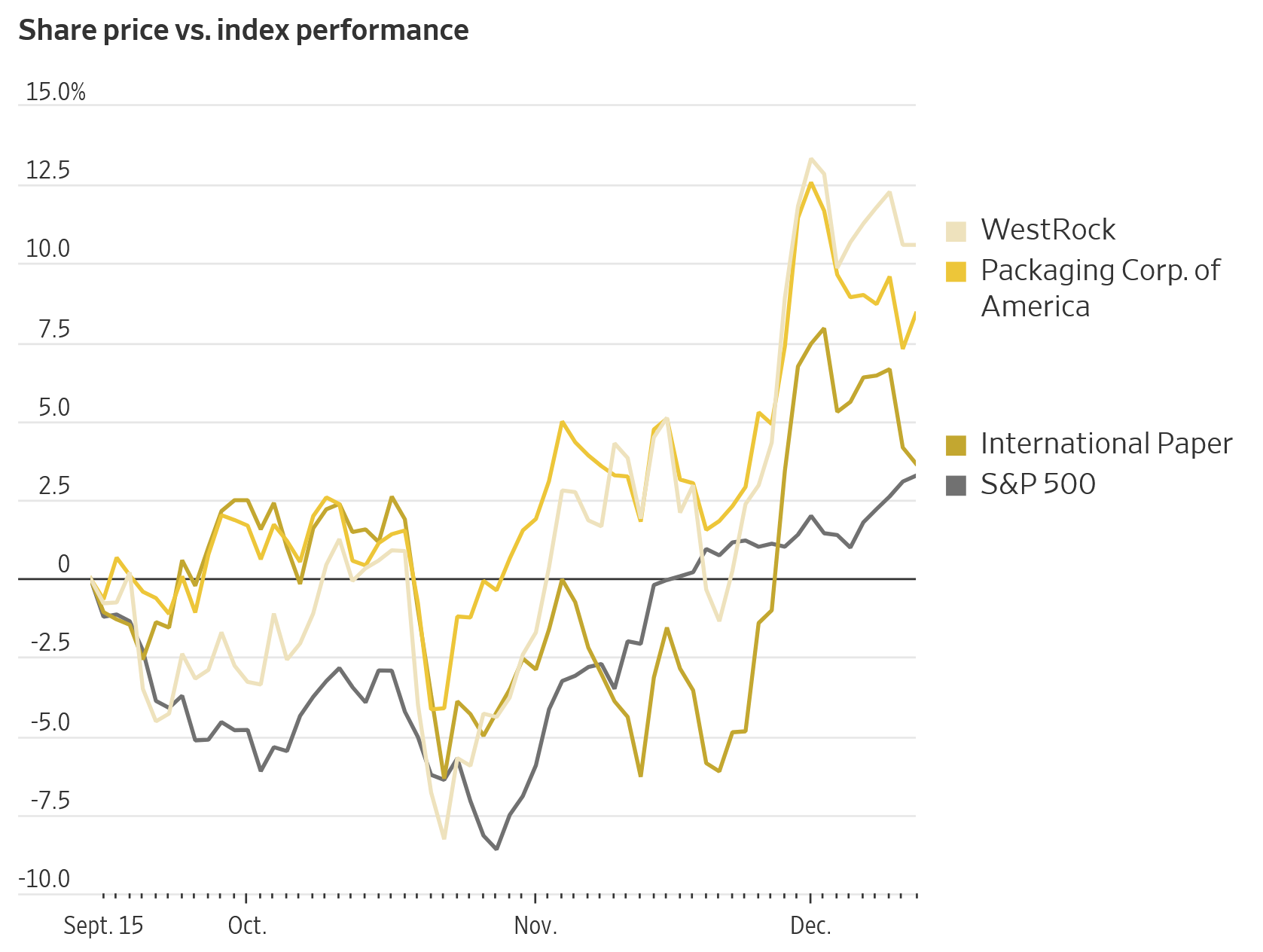

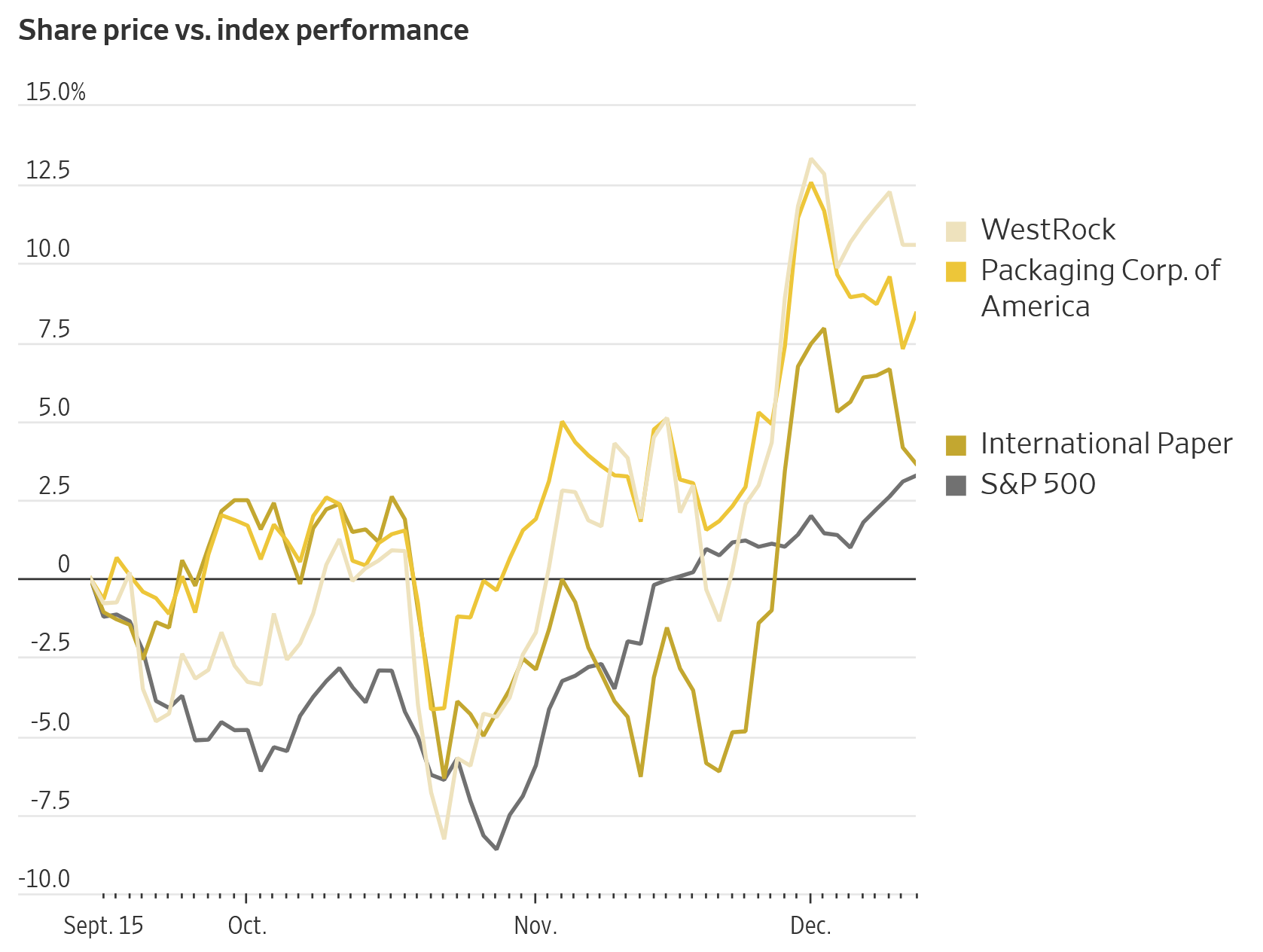

Before getting into my predictions, the chart above is indicative of the mixed signals in the economy. Prices are rising on cardboard due to increased consumer demand. How is demand for cardboard rising if consumer spending is slowing along with inflation? The answer...

by Glen | Dec 18, 2023 | 2023 real estate predictions, 2024 mortgage rates, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Georgia hard money, private lender, Private Lending

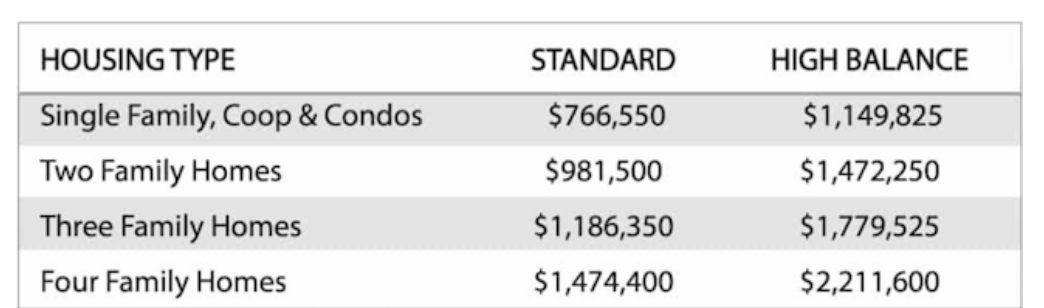

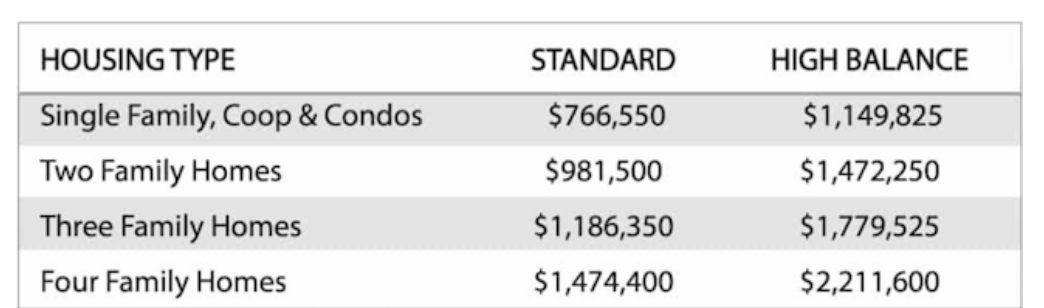

What do the increased conforming loan limits mean for real estate? The federal government (aka you the taxpayer) now backs mortgages up to 1.15m. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac has jumped sharply over the...

by Glen | Dec 11, 2023 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, commercial private lending, Denver Hard Money, Denver private Lending, Georgia hard money, Government Bailout, Housing Price Trends / Information, if there is a recession what happens to real estate, interest rates, mortgage rates

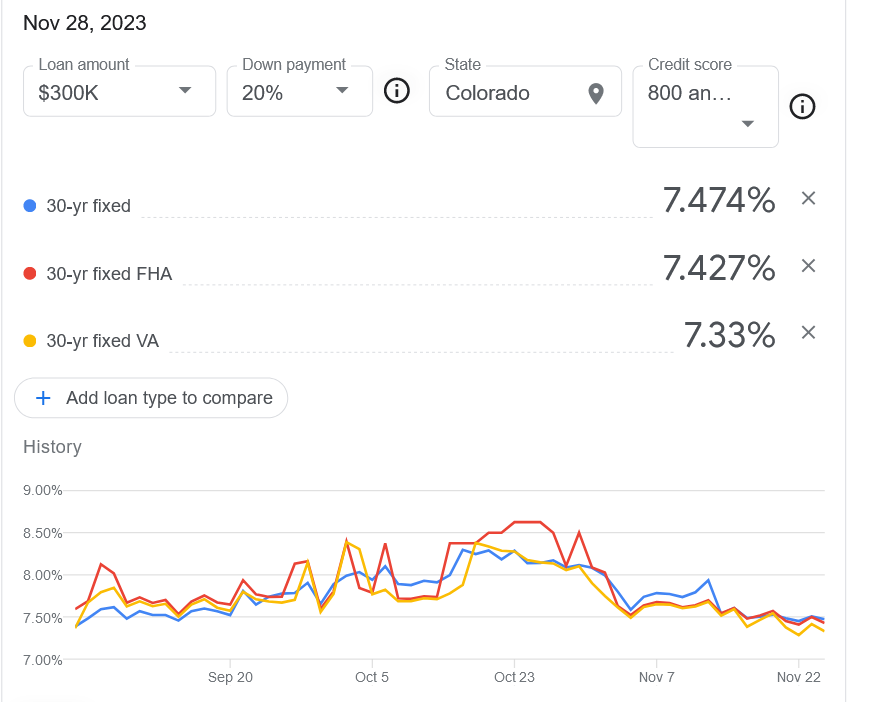

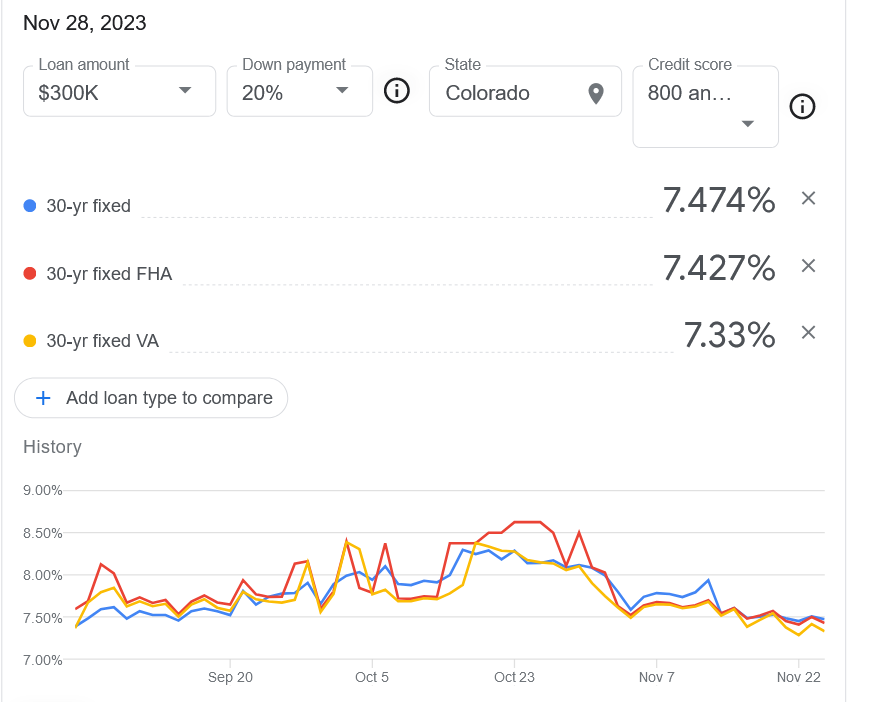

In a WSJ survey, economists lower recession probability below 50% and say Fed is finished raising interest rates It has been quite a ride for mortgage rates over the last two years. As of this writing mortgage rates were around 7.5% (with no points) which is quite...