by Glen | Jul 4, 2022 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, commercial hard money, Commercial Lending valuation, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, Hard Money Lending, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

Commercial real estate is showing the first signs of cooling in more than a year, disrupted by rising interest rates that are already causing some deals to collapse. What is causing the quick change in fortunes in commercial real estate? How will the recent fed...

by Glen | Jun 27, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Private Lending, Atlanta real estate trends, Denver Hard Money, Denver private Lending, General real estate financing information, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, Property Valuation, Real Estate economic trends, recession, recession impact on real estate

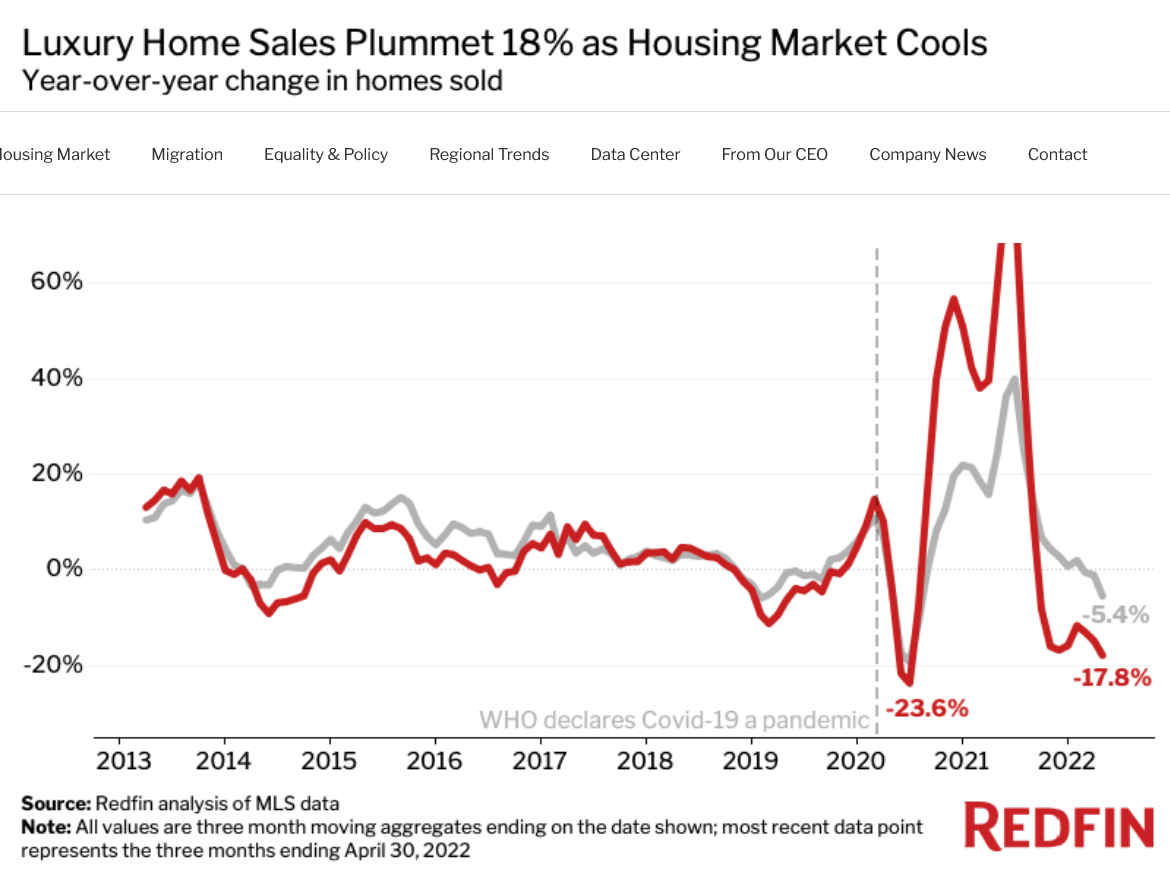

Most economists are convinced that there will be a recession soon, although nobody knows whether it is 3,6 or 12 months away. The good news is that this recession should not be a repeat of 2008. Which prior cycle will the next recession likely represent? Will it...

by Glen | Jun 15, 2022 | 2022 stock market correction, 2022 stock market correction impact on real estate prices, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado ski lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money, Hard Money Commercial Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

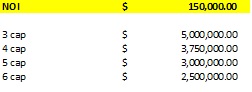

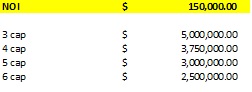

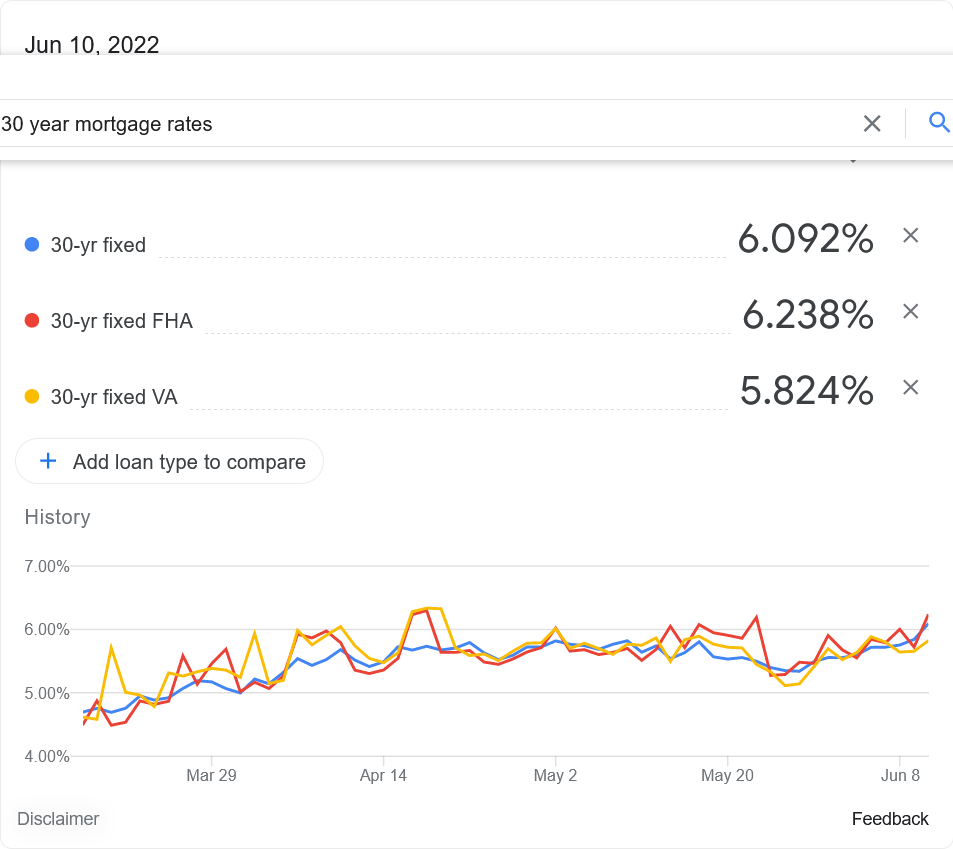

All I can say is wow. On a dime, the real estate market changed overnight. I was predicting mortgage rates around 6% over the course of the year. The change happened in one day with rates easily cresting 6.3%! What does this big surge in interest rates mean to real...

by Glen | Jun 13, 2022 | 2022 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial hard money, commercial property trends, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks

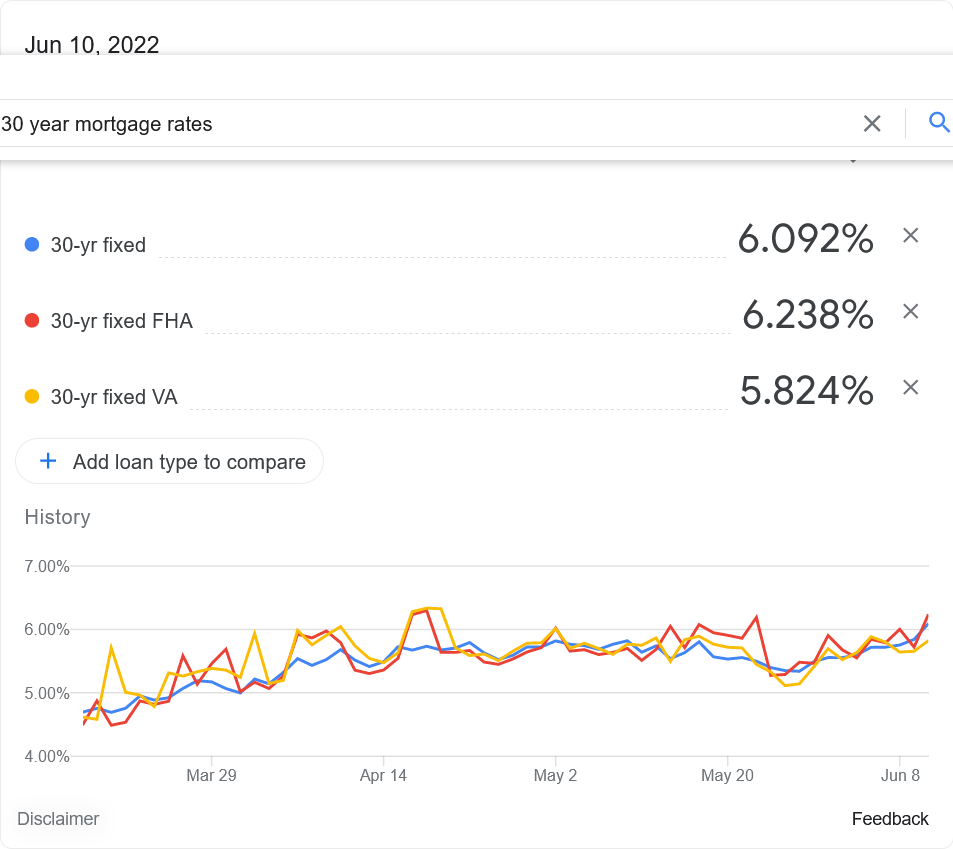

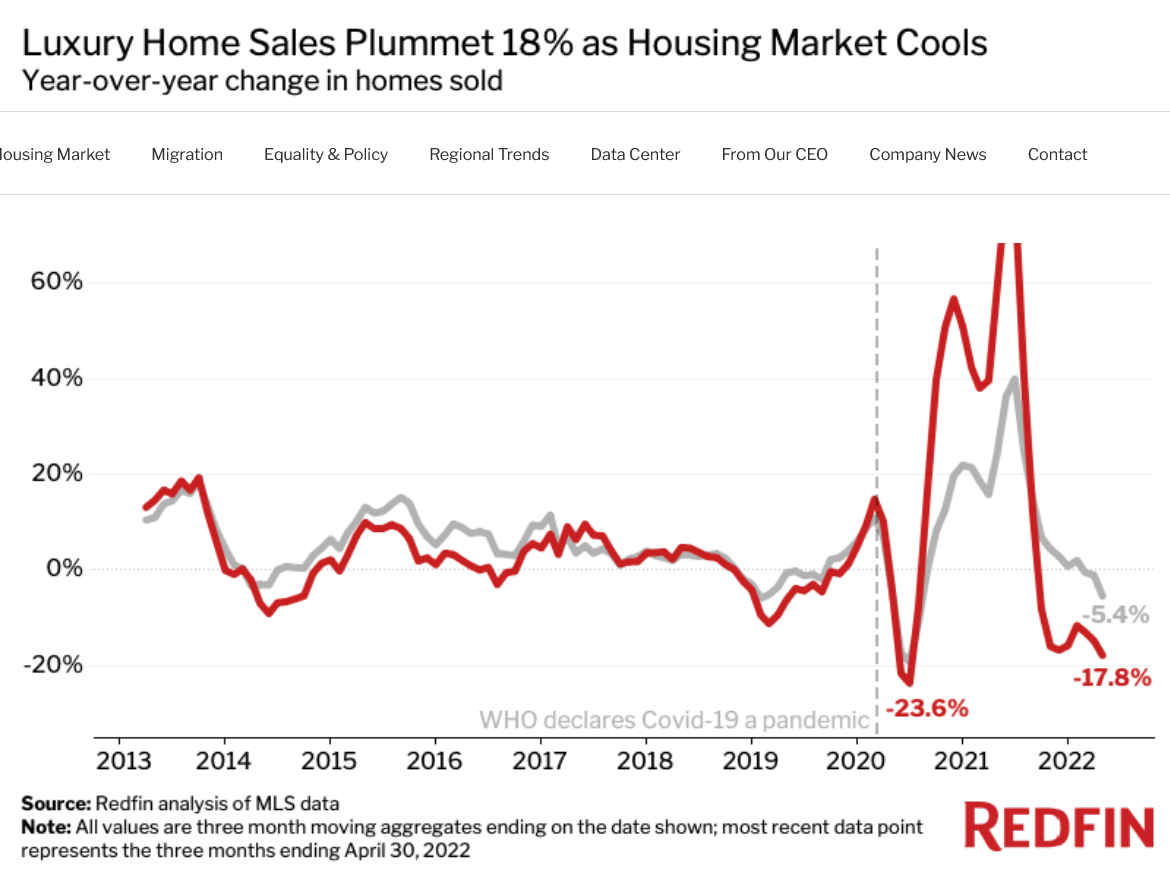

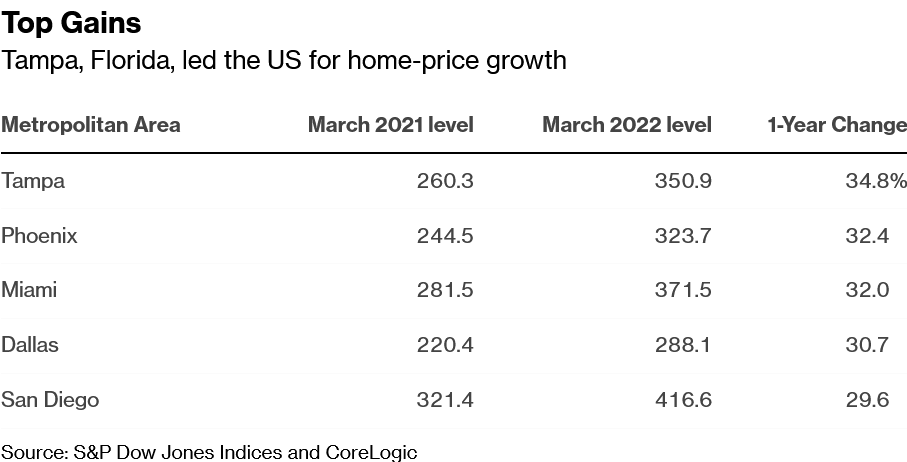

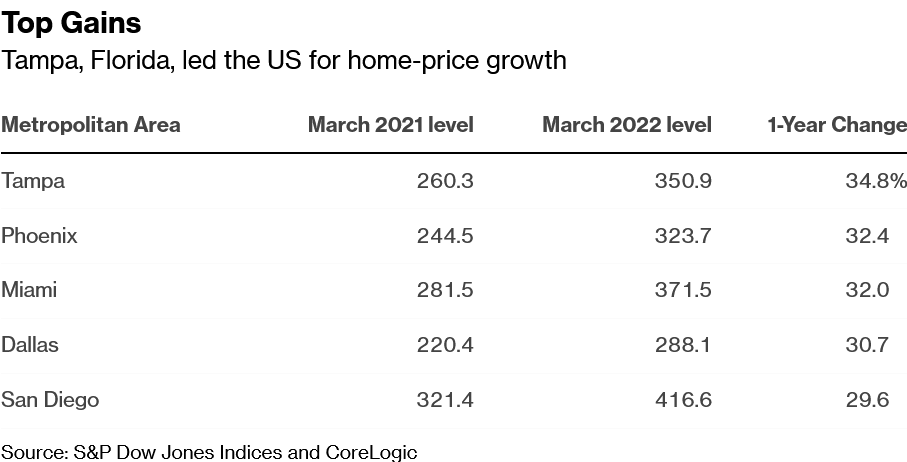

While in other countries real estate is slowing, home price growth in 20 US cities picked up for the fourth straight month with Tampa, Florida, showing the biggest gains. March’s reading was the highest year-over-year price change in more than 35 years of data,...

by Glen | Jun 6, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, Government Bailout, hard money, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

One of the world’s bubbliest real estate housing markets is tilting from sellers to buyers with dizzying speed. Canadian home prices fell for the first time in two years as a rapid rise in interest rates looks set to threaten one of the world’s hottest housing...