by Glen | Jan 2, 2023 | 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Commercial Lending valuation, commercial private lending, commercial property trends, Denver Hard Money, Denver private Lending, General real estate financing information, Georgia hard money, hard money loans, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate

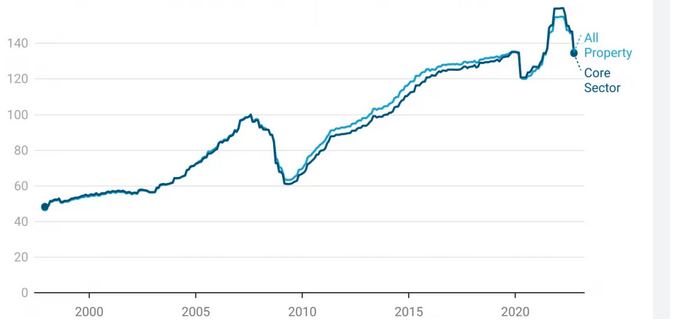

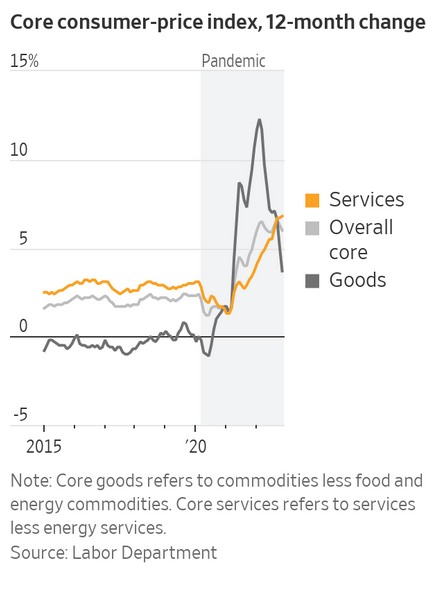

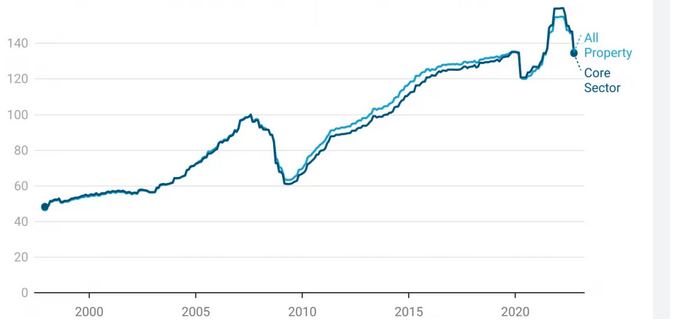

US commercial real estate prices have plunged 13% from a peak this year, the biggest drop since the global financial crisis of 2008. What is causing the decline in commercial property prices. Is this a blip or will the slide in commercial property prices worsen in...

by Glen | Dec 26, 2022 | 2022 real estate predictions, 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, Colorado Hard Money, Colorado private lender, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, interest rates, mortgage rates, private lender, Private Lending, Property Valuation

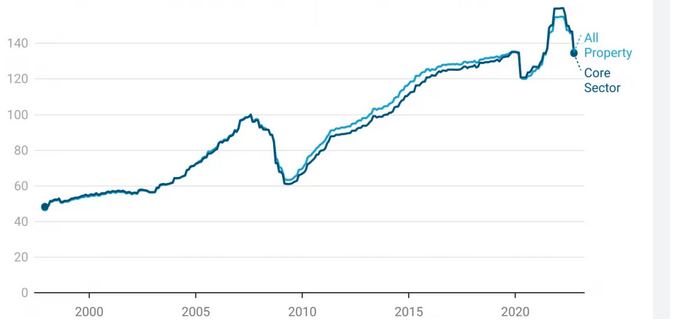

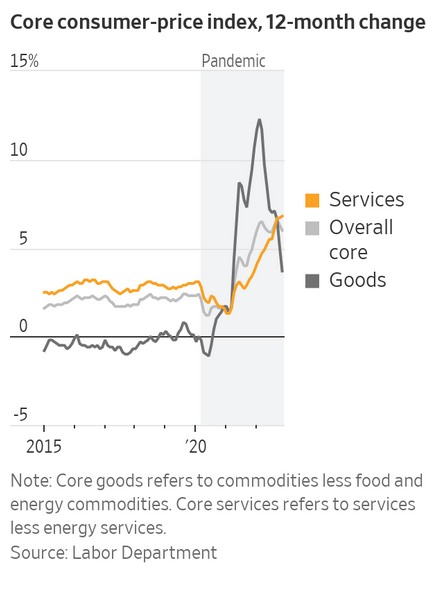

I hope everyone is having a happy holiday season. Before getting into my predictions for next year, there are three crucial factors to discuss that will shape the real estate market in 2023 and beyond: Interest rates, inflation, and consumer sentiment. All three are...

by Glen | Dec 19, 2022 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, General real estate financing information, hard money

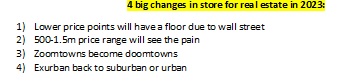

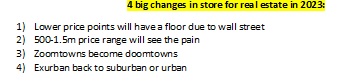

There is definitely allot of doom and gloom heading into 23 with interest rates double their lows, inventory increasing, and prices coming off their highs. In every cycle there will be winners and losers. Where will the real estate opportunities be? Are their certain...

by Glen | Dec 12, 2022 | 2023 real estate prediction, 2023 real estate predictions, 90s real estate recession, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Colorado ski lending, Colorado ski real estate, Commercial Lending valuation, Denver Hard Money, Denver private Lending, Georgia hard money, hard money, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, if there is a recession what happens to real estate, private lender, Private Lending, Property Valuation

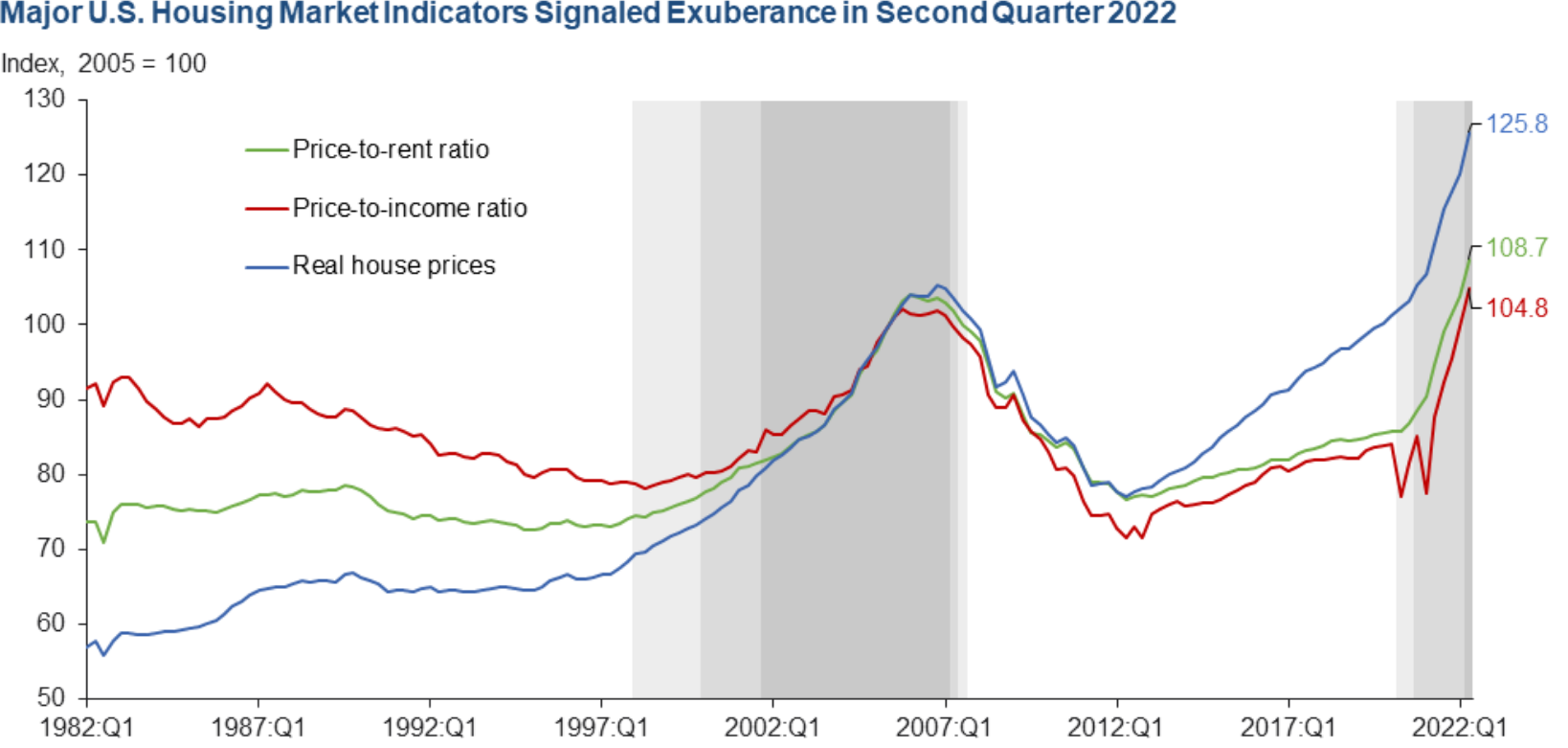

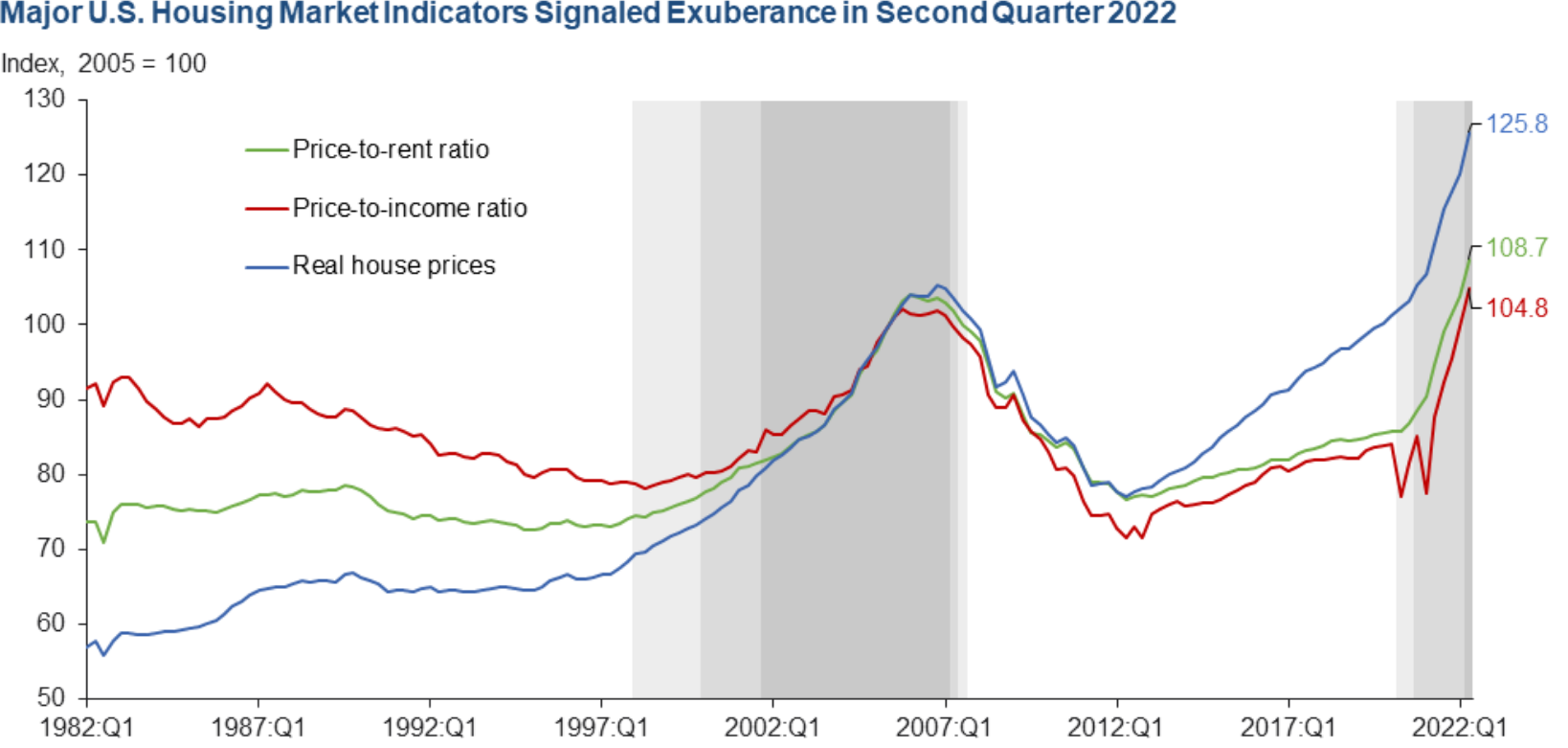

In 2023, NAR Chief Economist Lawrence Yun expects home sales to decline by 7%, while the national median home price will increase by 1% in his recent 2023 market update. On the flip side the most recent federal reserve economic commentary classifies the current...

by Glen | Dec 5, 2022 | 2023 real estate predictions, Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado private lender, Denver Hard Money, Denver private Lending, Georgia hard money, interest rates, mortgage rates, private lender, Private Lending, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, recession, recession impact on real estate, Residential hard money, Underwriting/Valuation, what does this real estate recession look like

Since Covid it seems like traditional patterns have been broken. I hear time and time again that X or Y is different and there have been fundamental changes. Is this true, is everything “radically” different now? Is a bear walking around in the snow a sign (zoom in...