by Glen | Sep 15, 2020 | interest rates, Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation, Small Balance Commercial Lending, Underwriting/Valuation

If you have been tracking interest rates in the mortgage market, your head is likely spinning. Mortgage rates hit a record low of 3% less than a week later rates have risen again. What is causing the drastic swings? Is now the time to lock in or refinance? What did...

by Glen | Sep 8, 2020 | Atlanta Hard Money, Colorado Hard Money, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, residential lending valuation

The Coronavirus has created a unique financial situation. Unemployment rates are at record highs, with companies announcing long term downsizing. At the same time residential real estate is hitting new records and continues to increase in the face of the economic...

by Glen | Sep 1, 2020 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, General real estate financing information, Housing Price Trends / Information

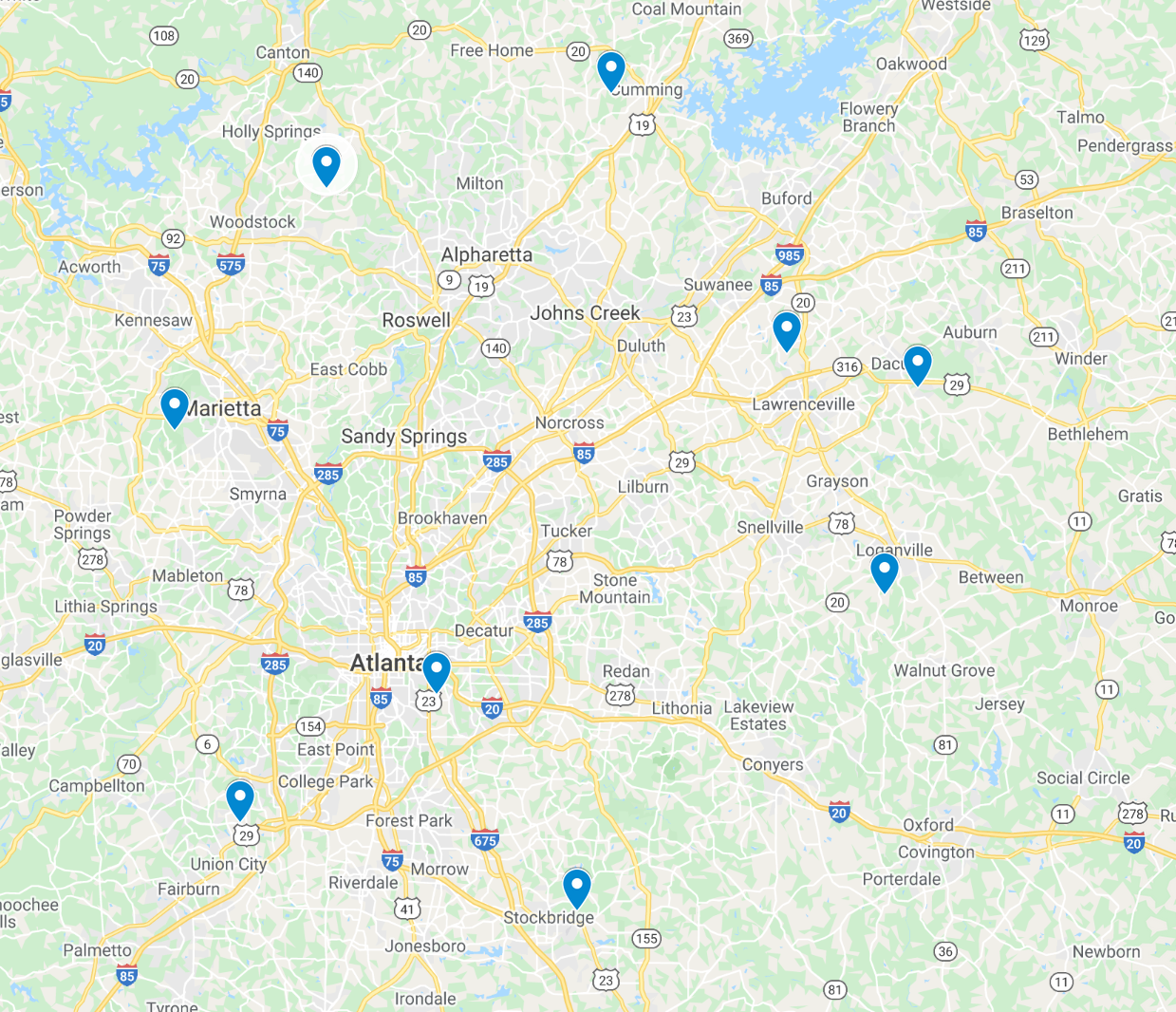

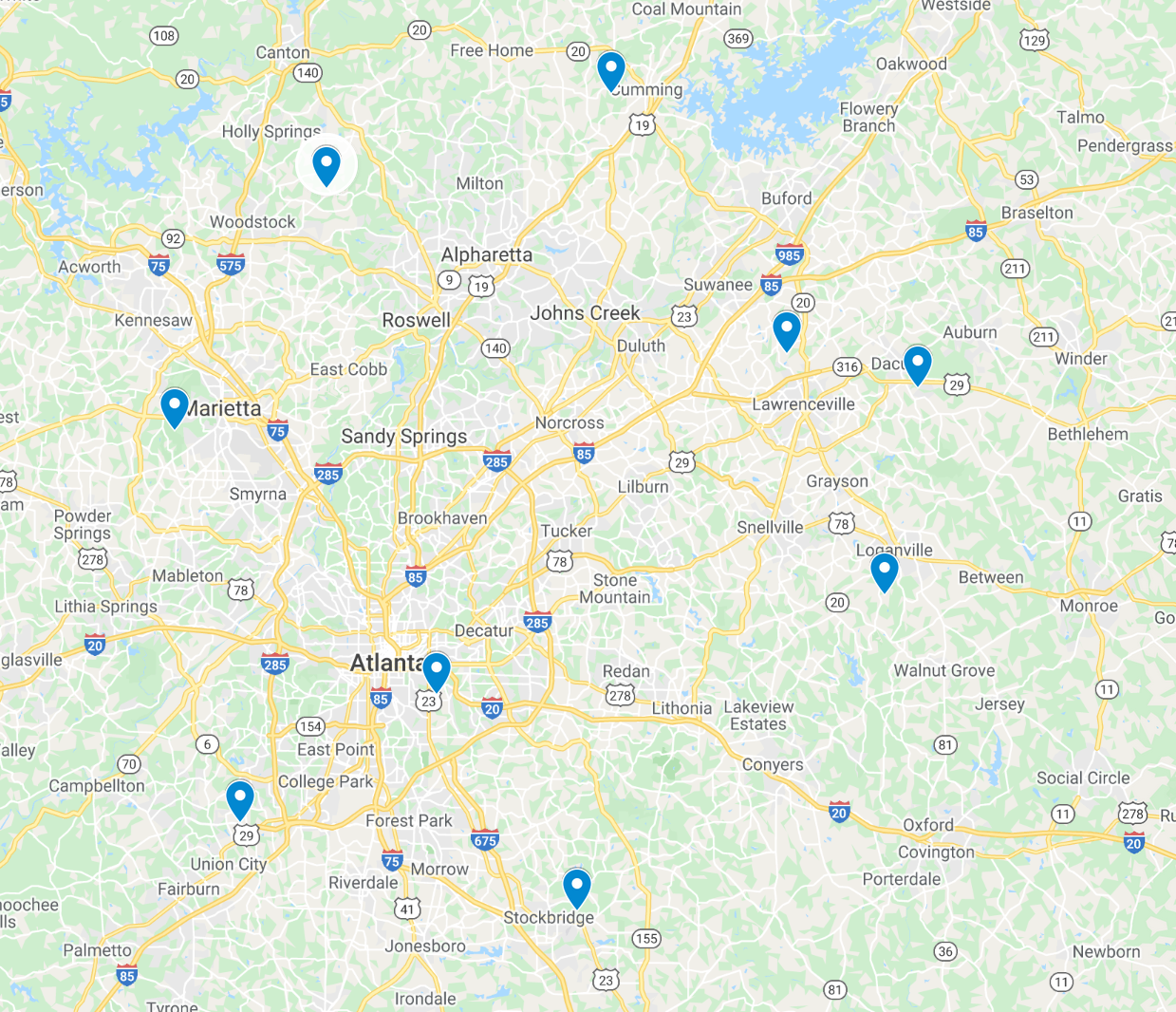

I wanted to highlight Atlanta, Georgia as it is one of the top ten metro areas in the country, we have an office there, and we are intimately familiar with the real estate market. Furthermore, it is a typical large city and a good indicator for the country as...

by Glen | Aug 19, 2020 | interest rates, Private Lending, Real Estate economic trends, real estate investing, Residential hard money

The mortgage market is an interesting animal. Long term mortgage rates traditionally track the 10 year treasury and historically trade in a very narrow band, approximately one percent higher than the 10 year treasuries. This would put mortgages today in the low 2%...

by Glen | Aug 13, 2020 | commercial hard money, Commercial Lending valuation, commercial private lending, Coronavirus 2020 real estate impact

Commercial property values were recently hitting peaks with investors rushing to invest in high quality commercial real estate as yields on other assets like treasuries continued to languish. Now the tides have turned with some high quality commercial property now...