by Glen | Oct 30, 2020 | commercial hard money, Commercial Lending valuation, commercial property trends, Property Valuation

It is ironic in 2007 and 2008, I was asked by our accountant to value properties and loans on our books due to the last cycle. I told her I had no clue, there were too many unknowns. Commercial real estate is starting the same cycle that residential real estate saw...

by Glen | Oct 21, 2020 | hard money, Hard Money Commercial Lending, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

We are seeing interesting economic times; throughout the economy there is huge consolidation within industries as the big get even bigger. Real estate is following a similar trajectory to big technology companies. What is causing the huge changes in real estate? ...

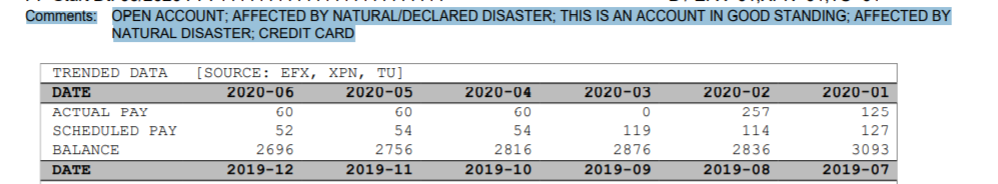

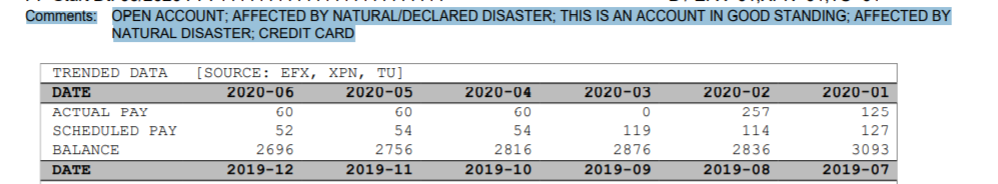

by Glen | Oct 6, 2020 | credit scoring, General real estate financing information, Hard Money Lending, Housing Price Trends / Information, interest rates, Private Lending

The Urban Institute think tank says nearly two out of three loans made in 2019 would fail to meet at least one of the stricter standards lenders have imposed since March. Banks are tripping over themselves to be the first to hedge against future downside risks and...

by Glen | Sep 30, 2020 | Property Valuation, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Residential hard money, residential lending valuation

There is a new legislative proposal to radically alter the appraisal industry. Should the use of comparables be arbitrary when establishing appraised value? Do appraisers need to better “appreciate” a neighborhood (what does this even mean?) Should an appraiser use...

by Glen | Sep 24, 2020 | Colorado Hard Money, Georgia hard money, Real Estate economic trends, real estate investing, Real Estate Trends, Real estate Valuation, Realtor, Residential hard money, residential lending valuation

FHA has placed a moratorium on foreclosures from mortgage loan defaults and offered any borrower that requests it an extension to not make payments for a year (HUD). This effectively kicks the can down the road and pushed out any impending actions until March of...