by Glen | May 23, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Atlanta Hard Money, Atlanta real estate trends, CO hard money, Colorado Hard Money, commercial private lending, commercial property trends, Denver Hard Money, General real estate financing information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates, Private Lending

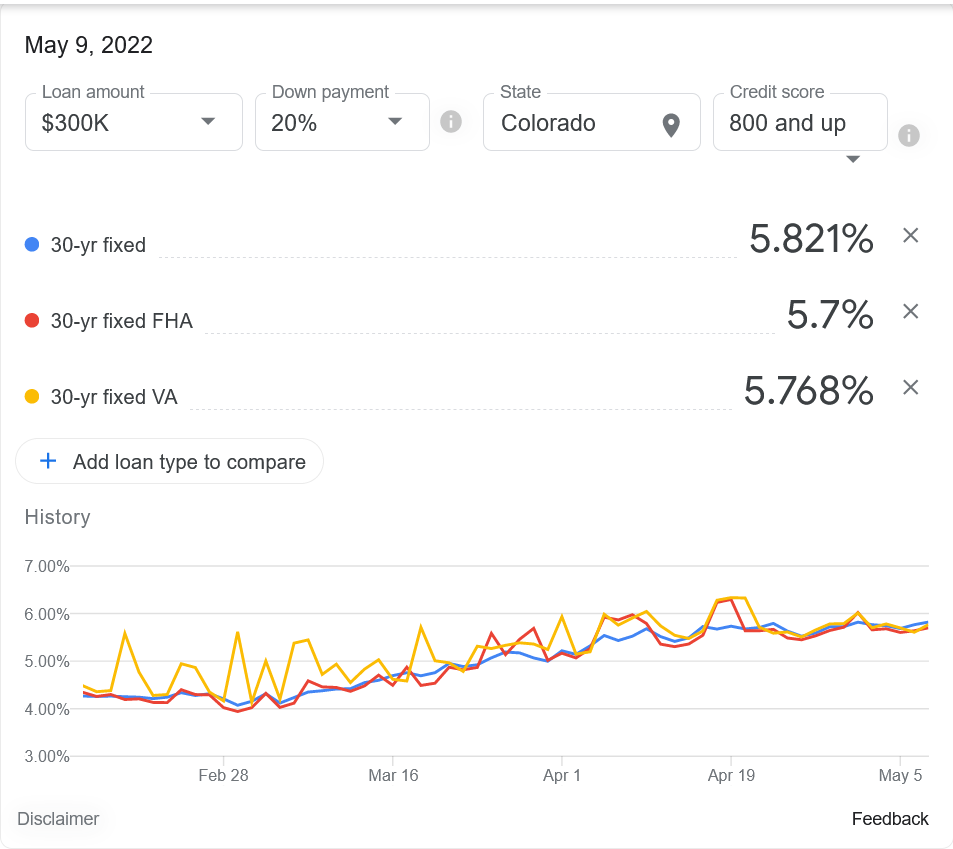

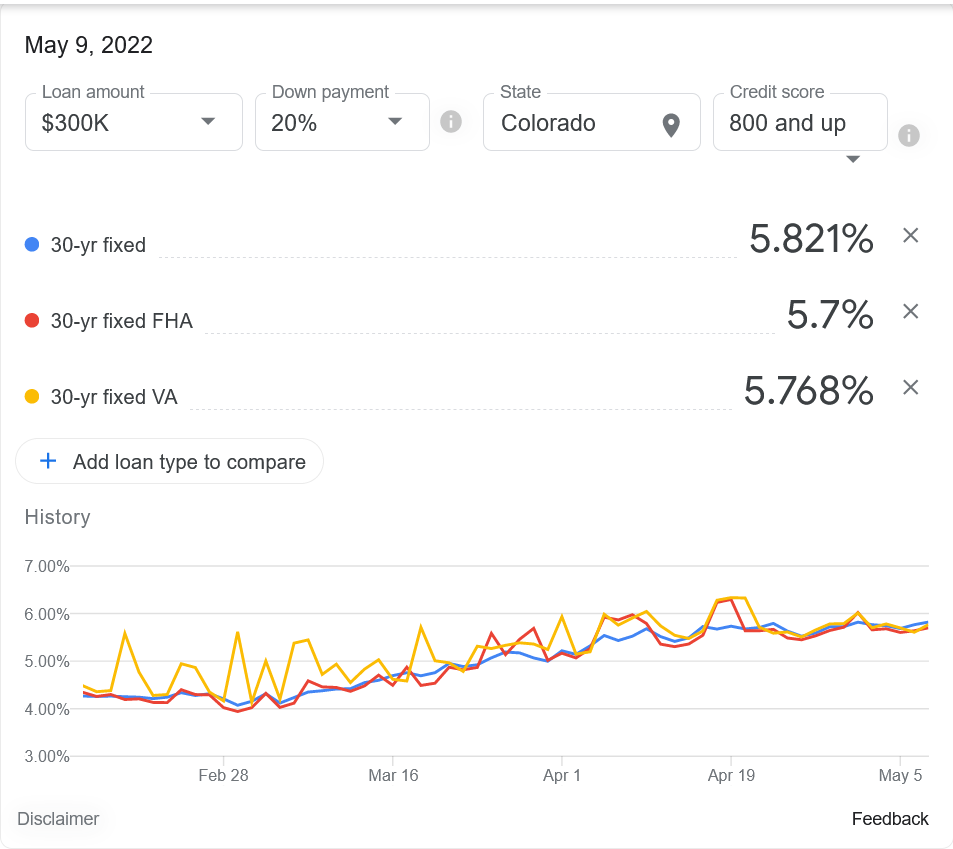

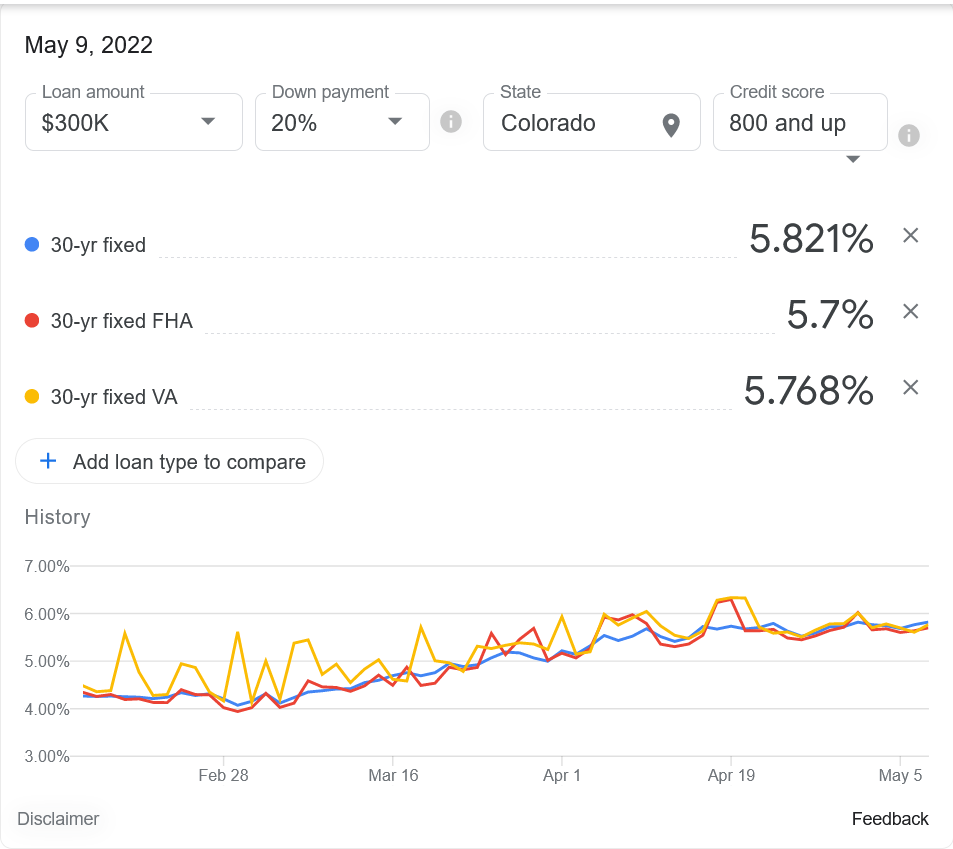

Where mortgage rates are heading seems to be the biggest question on everyone’s mind in real estate. As of this writing rates were around 5.821% which is substantially higher than any economists had predicted even a few months ago. What is causing the jump in...

by Glen | Feb 2, 2022 | 2022 real estate predictions, 2022 stock market correction, 2022 stock market correction impact on real estate prices, Colorado Hard Money, Commercial Lending valuation, commercial private lending, Denver Hard Money, Georgia hard money, Hard Money Commercial Lending, Hard Money Lending, hard money loans, Housing Price Trends / Information, how will real estate prices be impacted by falling stocks, interest rates, mortgage rates

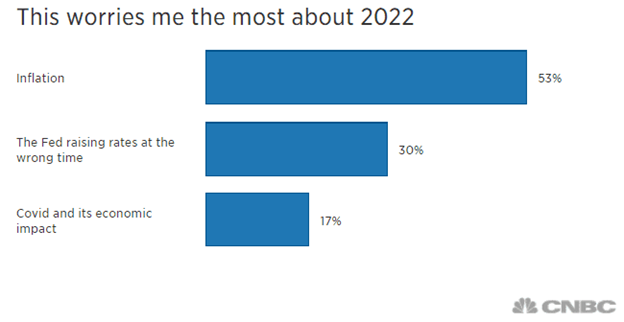

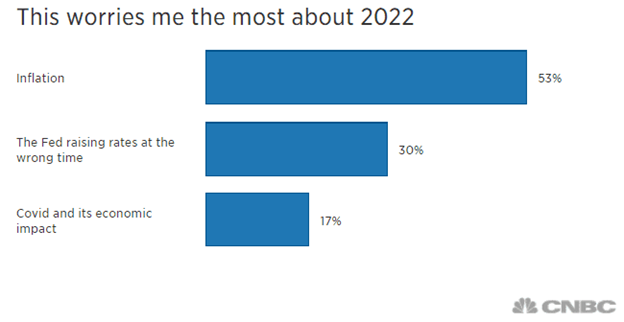

Wall Street investors believe inflation will remain a major roadblock for the markets in 2022 and stocks will only see muted returns, according to the new CNBC Delivering Alpha investor survey. What does this mean for interest rates and in turn real estate? What was...

by Glen | Nov 24, 2021 | Atlanta Hard Money, Atlanta Private Lending, Atlanta real estate trends, CO hard money, Colorado Hard Money, Colorado ski lending, Colorado ski real estate, Denver Hard Money, Denver private Lending, General real estate financing information, interest rates, mortgage rates

The federal government is about to back mortgages of nearly $1 million for the first time. The maximum size of home-mortgage loans eligible for backing by Fannie Mae and Freddie Mac is expected to jump sharply in 2022, a reflection of the rapid appreciation in home...