Wow, the last several days have been brutal in the stock market. At the same time interest rates have started to come down and yet sales are still down substantially from last year. For years, myself, and many others have thought that interest rates were the predictor of housing prices. Fast forward to post covid where interest rates have doubled and yet housing prices remain high and are heading higher in many markets. Why was I off on my predictions for a flat/declining market in 2024? What other metric do we need to watch to see where housing prices are heading?

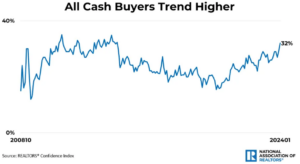

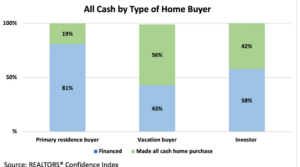

Looking at the data, there is an interesting trend occurring. The percentage of all cash buyers continues to increase especially for vacation/second home. Why are cash buyers increasing and what does this mean for real estate prices? Furthermore, how is the wealth effect impacting prices?

All Cash buyers increase

While mortgage interest rates have more than doubled in recent years, the share of all cash buyers is growing. all cash home buyers have trended up significantly in recent months. Since October 2022, all cash home buyers who did not finance their recent home purchase have been more than one-quarter of the real estate market. In January 2024, all cash buyers now stand at 32% of home sales. The last time the share of all cash buyers was this high was June 2014. From the chart it is easy to see why many vacation markets have been supercharged as over half of the buyers are cash. This also explains why interest rates have had less of an impact with so many properties being bought with cash.

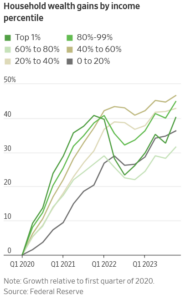

High correlation between stock market and real estate prices

Along with cash buyers, the stock market has been on a tear continuing to reach records. In the past, interest rates were the primary driver of real estate prices, as rates moved substantially higher, property values dropped. This has not occurred in this cycle because as rates moved substantially higher so did almost every other asset from stocks to bitcoin to many commodities. This has created a substantial wealth effect for most Americans as shown in the chart below. The amount of wealth created in this cycle is astounding.

This wealth has allowed more people to buy properties all cash and/or absorb higher prices. As the stock market remains high so have housing prices and the correlation between the two has only increased during the post pandemic cycle.

High real estate prices creating a positive reinforcement loop

Along with the stock market, the high value of houses themselves is now keeping prices high creating a loop effect. If you are going to sell your house, you can get substantially more than five years ago, this will enable many buyers to buy their next house in cash especially if they move to a lower cost area. This in turn is driving up prices in less expensive markets as there is more demand from other areas.

Interest rates high for longer than market thinks

Housing is the number one driver of inflation comprising over a third of the consumer price index. As housing prices stay higher along with rents, it will be difficult to see a major reset in inflation. The market is currently pricing in several cuts to rates later this year. I don’t foresee a huge movement in rates based on the wealth effect highlighted above.

Prices will continue to increase/stay high until stock market reset

Prices of houses will continue near their peak until there is a stock market reset and people “feel” less wealthy. Currently interest rates today are likely not high enough for this to occur which will keep the federal reserve on a path for higher for longer until there is a reset in asset prices. Without a reset in the stock market and in turn housing the economy will be stuck where it is today for a bit longer.

More correlation means greater downside risk

Although the wealth effect has created huge positives for the housing market with stable to rising prices in face of higher interest rates, the party cannot last forever. The downside risk of the huge run ups in wealth and the strong stock market is that there is now a higher correlation between housing and the stock market. As one goes down so will the other. As we have seen throughout the years in economics, high correlations are great when markets are increasing but when the winds change and there is a reset, the downside risk is amplified.

Currently with everything continuing to power forward real estate values will continue at records until there is a reset in the stock market. The last several days should be a wake up call that there is considerably more downside risk in the stock market than further upside potential. This will ultimately lead to a much greater reset in real estate values than in the past due to the higher correlation. The million dollar question is if the recent reset is a blip or the beginning of a longer term trend and how much will housing prices drop. My gut says that later this year or early next year, the reset will be much deeper as consumers run out of credit and cash and the market resets further, but we will have to wait and see.

Additional Reading/Resources:

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender