The mortgage industry should be prepared for large increases in insurance premiums up to 50% according to the Situs Whitepaper. Jennifer Rasmussen, one of the reports authors stated that the average homeowner “was not cognizant of the sheer magnitude of these insurance rate increases.” What should you do if your premiums jump or you get dropped? Will premiums continue to increase?

Why the huge jumps in insurance costs?

“People just aren’t aware that these natural disaster risks are occurring everywhere. It’s not just where the headline news points you to in terms of where natural disasters are occurring.” The report said the US was seeing an increase in the number and severity of natural disasters, including hurricanes, tornadoes, and wildfires which had “greatly increased the short and long-term risk for insurers and led to increases in insurance costs and reductions in coverage for property owners”.

Furthermore, insurance losses continue to increase as houses are constructed in higher risk areas from coastal areas in Florida to urban/wildfire interfaces throughout the mountain west.

Will insurance costs continue to increase?

Unfortunately costs will continue to increase. If we look at areas where housing is booming, most of these areas are subject to extreme weather events. For example, one of the fastest growing areas in the country is Boise, ID which is surrounded by forests. The continued growth in housing continues pushing further into higher risk fire areas. This is occurring throughout the west from California to Montana and everywhere in between. Furthermore, the fastest growing state is Florida which has the risk of hurricanes, wind, and water events.

Insurance companies are national companies that sets rates based on national losses, so everyone’s rates are going to go up to pay for the increased losses in higher risk areas. I am already seeing this in our portfolio as policies come up for renewal, the increases are huge for many borrowers.

Insurance losses continue to add up leading to higher premiums

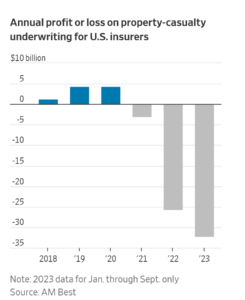

Along with more higher risk events like wildfires or hurricanes, even minor events like hail are adding up to huge losses for insurance companies. Look at the chart below, it shoes huge losses for insurance companies that must be compensated for with higher rates.

Just like everything else post covid, materials and labor costs have skyrocketed in the housing market. These costs make even minor events more costly. Furthermore almost every major city has further updated their building codes increasing energy efficiency and resiliency. For example, an impact resistant roof is about 30-50% more expensive than conventional shingles. Someone has to pay for this upgrade to be compliant with the new building requirements.

What can you do if your insurance is dropped, or you face a substantial increase?

I was dropped on my property insurance even though I’ve never had a claim, live close to a fire station, have a hydrant in my yard, and have a non combustible roof. Living in Colorado, these items are typically a guarantee for property insurance but I was still dropped.

Initially I was ticked off, but as I thought about it, I haven’t requoted my insurance in a while; was I really getting the best deal? I knew I had to move quickly since my mortgage company was not excited about having an uninsured property and if I didn’t get a replacement policy the mortgage company would force place which would cost 4 or 5 times what I was paying. Here are 5 tips to help you navigate the process and actually get better coverage and save money.

- See who the primary carriers are in your area. It likely will surprise you who the primary carrier is. In my case, I found out state farm was the largest carrier which shocked me since I had seen state farm in my last neighborhood drop all their policies. This is important since you will want to make sure you quote whomever has a large market presence.

- Use a local agent. If your property is not in an area like downtown Denver, it is important to use someone with local expertise that understands your market and the carriers and their requirements. This is particularly important when you get into the mountain communities.

- Make sure you are comparing apples to apples. Insurance is complex, make sure you are comparing like policies to like policies, for example coverage amount, deductible, covered items, etc…. The lowest price is not always the best choice (for example if coverage is less you could be grossly underinsured). When you are quoting, you can typically get a discount if you bundle auto with your property insurance

- Raise your deductible. Your homeowner’s insurance should be used for catastrophic events. Raising your deductible will save you substantial money

- Shop every 2 or 3 years. I’d been with the same carrier on home and auto for 15 years since it was always such a pain to shop around. This event forced me to shop and ultimately saved me money with better coverage. This is a good reminder that at least every 3 years you should take the time to shop around for coverage since carrier’s policies change, new entrants come into the market, etc…

Based on the steps above, I got quotes from 2 different carriers as many carriers now refused to bind policies in my area. I ended up raising my deductible a little and saved almost 30% on my annual premium. Ironically not only did I save money from my prior carrier that dropped me I also got substantially better coverage from a much better provider.

Fast forward since I was dropped and the savings have evaporated as every carrier in the area has raised rates between 30% to 50% due to huge losses throughout the state. Also more carriers are pulling out of the market increasing pricing power with the remaining carriers.

Summary

Housing costs are going up substantially for borrowers. At the same time insurance premiums are increasing, property taxes are also jumping due to increasing values. These huge jumps in costs will be directly paid by homeowners and will be passed on the tenants as well. There is no free lunch and the increases in insurance costs will be paid with heavy increases in rates in 2024 and beyond.

There isn’t an easy solution to the insurance crisis we are facing as carriers must be profitable to stay in business. Unfortunately, It is going to take a few more years of large increases on property insurance premiums before the market comes back into balance. At the end of the day, homeowners are on the hook as you are required to have insurance if you have a mortgage and even without a mortgage it is good practice to still have insurance to protect against a catastrophic loss.

Additional Reading/Resources:

- https://info.situsamc.com/hubfs/Burgeoning%20Insurance%20Costs%20for%20Real%20Estate_Final.pdf

- https://blog.situsamc.com/real-estate-investors-cant-ignore-rising-insurance-costs

- https://www.mpamag.com/us/mortgage-industry/industry-trends/homeowners-unaware-of-looming-insurance-hit/318571

- https://www.thisoldhouse.com/roofing/reviews/impact-resistant-roof

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender