States have traditionally set rental regulations including zoning, evictions, etc… but that is all set to change with the president’s new proposal. The federal government will now be assuming many of the powers that were granted to the states. The biggest change is that the federal government will create rules for evictions throughout the country. What is in the new proposal and how will this impact property owners and renters. Will these proposals require approval from the legislative branch? How is this proposal similar to a recent law enacted in Colorado?

What is in President Biden’s rental housing proposal?

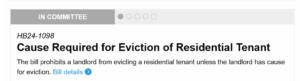

The biggest change in the President’s plan is a national “just cause” for eviction. It is pretty ironic that it is title just cause for eviction as the overwhelming majority of evictions are because of non payment of rent not other reasons. Below are the details that will greatly alter the evictions process throughout the country and lead to huge increases in costs for property owners without changing the dynamics as at the end of the day there is no dispute about nonpayment. Either the tenant pays or does not pay and below does nothing to change these facts.

Evictions: This is the cornerstone of the plan:

To prevent evictions, renters should have access to just- or good-cause eviction protections that require a justified cause to evict a tenant, and tenants need to receive adequate notice if their lease is not being renewed. Renters should be able to avoid an eviction filing through alternatives to the eviction system, such as eviction diversion and grievance procedures that prevent formal legal proceedings through negotiation, mediation, or arbitration. Resolutions from these processes could include: a grace period for late rent; the ability to preserve tenancy through curing the lease violation by paying rent or correcting the violation; access to a standardized, formal dispute resolution process prior to litigation; and opportunities to meaningfully participate in a pre- eviction diversion program. If an eviction is filed, tenants should be given 30 days’ notice of an eviction action and the right to counsel during an eviction proceeding. The eviction proceedings should be fair and provide: protection from extrajudicial evictions and lockouts; a hearing in a language the tenant understands or with qualified interpreters; a trained, competent, and independent hearing officer; due process protections, including a written record and the ability to present evidence, cross examine, and conduct discovery; and the ability for a tenant to appeal an eviction judgment without bond requirements.

Eviction case filings should immediately be sealed, including in cases of nonpayment of rent, thereby reducing the chance for people to be locked out of future housing opportunities without a chance to defend themselves. Eviction records –both filings and executed judgements—should remain sealed for any minors, for tenants who prevail in their eviction cases, and for tenants who reinstate their tenancy after the entry of judgment. Courts should only unseal eviction records after a judge decides against the tenant, though records listing minors as well as default judgements should remain sealed. Provisions for sealing tenant records should be tailored to state law and procedures.

National legislation for evictions:

The overwhelming majority of evictions are for nonpayment. There is not a legal dispute as the tenant did not pay. The new proposal above turns the eviction of a tenant for non payment into a year-long event where the tenant can continue staying in the property without ever making a payment. This will have huge implications for property owners as it will be next to impossible to evict and collect for nonpayment in a timely manner.

We are already seeing this in Colorado after they passed a just cause for eviction. This has caused eviction actions to cost a lot more time and money and has only worsened the housing crisis in cities like Denver as property owners are so cautious with their rentals that many prospective tenants no longer qualify and if they do, they are paying more to compensate owners for the huge costs associated with evictions. Long and short, Denver is the poster child for how this national proposal will work out and the proof is in the pudding with homelessness soaring in Denver!

Will these proposals require the approval of the legislative branch

It looks like the President is going to issue executive action orders to push these changes through. There will be litigation, but it will likely take years to reach and ultimately get resolved at the supreme court. We saw this with the national moratorium on evictions where after years and the damage had been done, the supreme court finally ruled.

Small property owners will not be able to absorb the costs of long term rentals

Small property owners will exit and sell rental properties. If someone owns a few rentals, it is not possible for them to continue to pay the mortgage, utilities, insurance, maintenance, etc.. while a tenant stays in the property for a year without paying. The economics do not work.

Colorado has tough eviction laws that I experienced first hand. I had a rental property with an unpaying tenant that took 12 months to evict and 4k in legal fees. At the same time, I was not getting rent and still paying the mortgage, utilities, maintenance on the property etc… It is difficult to absorb these costs and many small owners will opt to sell.

Large property owners will continue to get bigger. As costs of eviction and long term renting increases there will be huge consolidation. We have seen this in banking where small banks could not continue to be profitable due to increased regulation and in turn higher expenses. Large banks have thrived as they have the scale to ensure their profitability. The same trend will occur in the long term rental market and we are already seeing this today with larger corporate rental owners continuing to gain market share. This will ultimately lead to smaller property owners selling their properties or turning into short-term rentals.

Higher risk tenants will be unable to rent

The increased rules around evictions will ultimately lead to tighter rental standards where owners will not take the risk with a marginal tenant as the costs for eviction grossly outweigh any gain from signing a lease with them. This will ultimately lead to greater homelessness and other issues which is the exact opposite of the bill’s intention. We are already seeing this throughout Colorado with rent prices skyrocketing and marginal tenants unable to rent.

Summary National Rental Regulations

A “just cause” for eviction is a bad policy that will greatly increase the costs for property owners. In almost every eviction, the root cause is non payment. This is an indisputable fact that will now be dragged through a lengthy and costly legal process. These costs and delays will ultimately be borne by other paying tenants as rents will need to increase for property owners to remain profitable. At the same time marginal tenants will be unable to rent due to the increased risks of non-payment and the lengthy and costly eviction process.

This is a bad policy and will ultimately have an adverse impact on affordable housing and ultimately lead to more corporate ownership of long-term rental housing. Banking is a good template to watch where thousands of small banks closed and sold to larger banks as it was not possible to be profitable with the increased costs of regulation, this executive action will turbocharge the transition to more corporate ownership of long-term rentals.

Additional Reading/Resources

- https://www.whitehouse.gov/briefing-room/statements-releases/2024/02/29/fact-sheet-biden-harris-administration-announces-new-actions-to-boost-housing-supply-and-lower-housing-costs/

- https://www.irem.org/file%20library/globalnavigation/advocacy/coalitionletters/2024/coalition-letter-on-wh-fact-sheets-on-fees-and-bulk-billing.pdf

- https://www.whitehouse.gov/wp-content/uploads/2023/01/White-House-Blueprint-for-a-Renters-Bill-of-Rights.pdf

- https://coloradohardmoney.com/new-colorado-housing-bill-drastically-alters-property-owners-rights-strs/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg, personally writes all these blogs based on my real estate experience. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender