Data from AirDNA, a short-term rental analytics firm, show as of October 2022, the number of future nights booked—a real-time indicator of the health of the short-term rental industry—was up 15.8% year-over-year. At the same time, anyone in the short-term rental business has noticed a substantial drop in bookings. How can nights booked be up 16%, while property owners are seeing a huge drop in demand? How does this scenario relate to the Colorado Pot market?

What was in the data on nightly rentals?

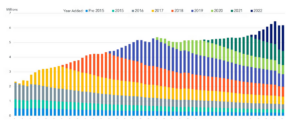

However, while the absolute number of bookings has risen, there has also been a sharp rise in supply of available short-term rental listings in the U.S., up 23.3% in October 2022 compared with October 2021. “That’s massive growth,” Mr. Lane says. In the spring, at the peak of the short-term rental supply increase, there were between roughly 80,000 and 88,000 short-term rentals being added per month.

There has been some pullback since then—it is normal to see more new supply added ahead of the summer high season and some slowdown in the fall—but between about 66,000 and 70,000 new listings have still been added per month since August.

Furthermore, Worldwide: Recent data from AirDNA reveals that 54 per cent of global Airbnb listings have been added since 2020, leading to record levels of active listings. In September 2022, global listings on Airbnb reached 6.1 million. Overall in Q3, listings increased 22 per cent compared to 2019 with a shift away from urban centers towards destination markets.

How can nights booked be up, but bookings for nightly rental owners be down?

In Q3 of 2022, year-over-year supply growth was greater than demand growth in all U.S. location types except coastal resorts, which explains the widespread decline in occupancy levels that many operators have been feeling.

Nightly rentals entering a race to the bottom

- Minimal barriers to entry: anyone with a property in a good location (assuming no licensing issues) can nightly rent their property. All that is needed is a computer and some pics and you can get a listing going with the Airbnb or VRBO. Note areas with substantial limitations on nightly rentals will perform better (a good example is Breckenridge or Aspen where licenses are capped)

- More supply coming online: As the economy slows, more supply is coming online especially in areas with little to no restrictions on nightly rentals. Many who have locked in rock bottom interest rates will decide to rent to wait out the market as prices adjust and still make money. This will lead to considerably more listings coming online.

How does what we are seeing in nightly rentals relate to the Colorado pot market

What we are seeing in the nightly rental market is eerily similar to what we saw in Colorado when Marijuana was first legalized.

- Initially high profits: it was a new product with lots of demand and there were not that many people selling it leading to huge profits.

- Substantially more entrants: As others got wind of the insane profits more sellers got into the business and now there are Marijuana stores all over the state. For example in Steamboat there are the same number of Marijuana stores as there are liquor stores.

- Race to bottom on prices: A race to the bottom has occurred with prices on the retail and wholesale side plummeting.

The nightly rental industry is following an eerily familiar path to the Colorado Pot industry where supply was initially constrained and now everyone and their cousin is involved in the industry. We are in an unprecedented time with travel demand at the highest levels in decades and yet many nightly rental hosts are barely scraping by while at the same time supply continues to increase substantially higher than the elevated demand.

Summary

We are just at the beginning of the upcoming “bloodbath” for nightly rentals. As the economy slows the industry will need to brace for a double whammy of more supply and reduced demand. We are currently seeing just the beginning of the supply that will come on the market. Look for this to accelerate rapidly as the economy weakens and revenue from nightly rentals is required to pay a mortgage or car payment.

Furthermore, currently demand is high, but as happens in prior recessions discretionary purchases, like vacations, are the first to go. Look for the forces of increased supply while at the same time demand falls sometime late next year leading to a race to the bottom on pricing. The nightly rental industry has never experienced a recession so we don’t know exactly how low prices will go, but anyone counting on nightly rental revenues is in for a wild and dangerous stay.

Additional Reading/Resources

- https://www.wsj.com/articles/the-housing-slowdown-is-wreaking-havoc-on-the-short-term-rental-market-11670518837?mod=hp_featst_pos4

- https://shorttermrentalz.com/news/airbnb-listings-supply-airdna/

- https://www.airdna.co/blog/short-term-rental-supply-reaches-record-levels-in-2022

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender