Big changes are ahead for automated appraisals. The government feels that automated models show bias in valuation so they have proposed a new rule that will radically alter appraisals. Unfortunately, the new rules will have some large unintended consequences for banks, lenders, secondary markets, appraisers, and ultimately homeowners. What is the new rule and what does it mean for you?

What is in the new rule to eliminate AVM bias?

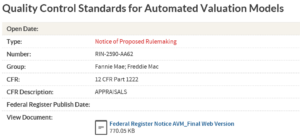

The various federal financing groups have gotten together to propose a new rule to combat biases in automated valuation models. It is a bit perplexing as the objective of an automated valuation model is to take the human bias out of the valuation process and base the valuation solely on hard variables like square footage and sales close to the subject. Below is what the housing financing groups have proposed.

From the Federal Housing finance Association:

“Specifying a fifth factor on nondiscrimination would create an independent requirement for

institutions to establish policies, practices, procedures, and control systems to specifically

address nondiscrimination, thereby further mitigating discrimination risk in their use of AVMs. The proposed fifth factor on nondiscrimination may include an array of tests and reviews, including fair lending reviews, which would support the general requirement for random sampling testing and review in section 1125.”

On a side note, the new rule spans 141 pages but above is the crux of what the rule proposes. Essentially they want lenders and others to ensure that automated models are not biased. It is a bit ironic as fair housing laws already cover bias and one of the primary objectives of an AVM is to remove possible human bias from appraisers. Essentially the government is “blaming” lower values in certain areas on “bias” as opposed to the true facts of actual sales in the area.

What is an Automated Valuation Method (AVM)

AVMs are defined by statute as “computerized model[s] used by mortgage originators and secondary market issuers to determine the collateral worth of a mortgage secured by a consumer’s principal dwelling.” Any computer model is considered an AVM. For example, Zillow, redfin, etc… use AVM models to value properties. Lenders, in many cases use third party providers for AVM modeling like Black Knight.

How do AVM’s work?

In a typical AVM, the models take the most recent sales in a tight radius of the subject property and compares above grade footage and put in a factor for below grade square footage (50% of above grade) to determine a property value. There is not much mystery in the algorithm as it focuses on neighborhood sales and recent sales in a tight radius.

This is similar to how Zillow uses AVMs but adds in a factor of current listings to try and predict the value of a property. Remember an appraisal done with an AVM is a bit different as the goal is to determine the value on a specific date, not predict what the property might sell for at some point in the future.

New rule change to prevent bias is a solution looking for a problem

I would disagree with the conspiracy theories that the algorithms are innately biased. Unfortunately this new rule is a solution looking for a problem. There is no doubt that values in certain areas are lower than others, but this is not bias, this is what the market is saying via lower sales prices.

A good example is that in areas with high crime and low performing schools there is less demand leading to lower sales prices. This is relayed in automated valuation methods as lower sales have led to lower valuations. AVMs pick this up in the neighborhood sales.

There is a misconception that AVMs somehow have a racial bias. Quite the opposite is true as AVMs have considerably less bias than physical appraisal methods as they do not factor in who the borrowers are. The AVM doesn’t have feeling and does not care!

Rule change reduce the use of AVMs and has unintended consequences

It is easy to see where this new rule is heading. With the new 5th rule requiring non discrimination in AVM’s lawsuits will be following shortly. Someone will produce a statistic that shows lower values in a particular part of the city and find someone who says they were denied a loan based on the valuation by an AVM.

It will hit the news and on paper the data looks bad, for example a particular neighborhood will be valued considerably lower than one down the road. But this is not the real story. The model is showing a lower value due to lower sales, but lawsuits will still come. This will ultimately lead to the reduction in AVMs due to liability of perceived bias and the new rule gives a roadmap for litigation. Ultimately you will see a steady drumbeat of lenders exiting the conventional mortgage space due to litigation and increased regulatory requirements.

Summary

With all the lawsuits, you will see companies try to “factor” in other variables to attempt to make the models fairer. Unfortunately, at the end of the day, a property valuation is not about fairness, it is about what is the correct value of a particular property on a given day. Introducing other factors will muddy what the true value of the property is and lead to huge losses down the road for government entities and in turn taxpayers.

Furthermore, many large lenders will pull back on the use of AVM’s and use more appraisals thereby introducing even more human bias and raising costs for all homeowners. This new proposal is a solution looking for a problem. The irony is that this new rule tries to ensure accurate bias free valuations and it does just the opposite as there now will be larger problems with values and this rule will do the opposite and increase bias through more full appraisals. The real solution would be to make a new rule requiring a check of all appraisals using an AVM model to ensure fairness and accurateness as opposed to discouraging the use of AVMs.

Additional Reading/Resources

- https://www.fhfa.gov/SupervisionRegulation/Rules/Pages/Quality-Control-Standards-for-Automated-Valuation-Models.aspx

- https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/Federal%20Register%20Notice%20AVM_Final%20Web%20Version.pdf

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender