A market indicator watched by the Fed as one of the most accurate gauges of economic health is pricing in lower rates for the first time in more than a decade. It was the first time since March 2008 the gauge, seen as a roadmap for traders’ outlook on Federal Reserve policy, fell below zero. What does this mean? Why would the federal reserve cut rates? How will this impact real estate rates?

According to a federal reserve policy paper in July of 2018, “The predictive power of our near-term forward spread indicates that, when market participants expected—and priced in—a monetary policy easing over the next 12-18 months, this indicated that a recession was quite likely in the offing.”

What does “offing” mean?

Fed speak is always interesting. In their paper they reference a recession was “quite likely in the offing”. “Offing” is not a term that most people use daily! This means likely to happen soon. Unfortunately, the federal reserve paper didn’t define soon, is soon tomorrow or 2 years from now?

How soon is the next cycle?

This is the million-dollar question. Most economists are predicting sometime in the next 18 months there will be some sort of a correction in the markets. Is there another metric that can give provide a little tighter timeline for a recession?

Recessions typically start “soon after” an inversion of the yield curve.

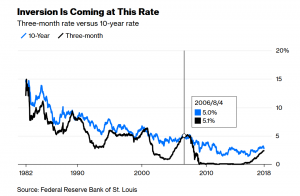

Another common predicter of recessions is when the yield curve “inverts”. Long term bond yields become cheaper than shorter term bond yields. Basically the “market” is saying that the long term economic outlook for growth and inflation is not good and therefore discounting the yields of longer term securities. In other words, the market is pessimistic about future growth prospects of the US economy. The St. Louis Federal Reserve did a nice video on the yield curve inversion.

The inversion of the yield curve provides a clue

If I look at the last recession, the yield curve inverted around August of 2016 and by December of 2007 we were in a full blown recession. This is approximately a 15-month time frame. The shorter term yield curve just inverted (the spread between 3 and 5 year securities) in December. The spread between 3-month and 10-year treasuries has yet to invert, but is predicted to invert sometime in Q1 of 2019.

According to a Forbes article recessions historically have begun 6-24 months after the curve inverts. Based on this information the recession/correction could occur at the earliest around Q3 of 2019 or at the latest towards the end of 2020. The last recession was 15 months after the curve inversion which would put us into the April to September time frame assuming the curve for 3-month and 10 year treasuries invert sometime in the first quarter of 2019

What is my prediction?

Unfortunately, the future is hard to predict. There are significant macro factors occurring that will change this timeframe including the timing of the next federal reserve hike, the rapid slowdown of China and other foreign economies, the housing slowdown, etc…. Each of these factors will alter the exact timing of a recession. My best guess is a slowdown in the economy could begin around June of this year through June of next year with the official “recession” starting somewhere in between.

How will Real Estate will be impacted in this cycle?

With a recession looking more imminent real estate will continue to be impacted. Residential sales should continue to slow, and values possibly decline in select markets. On the commercial side, rents should also slow/decline in many markets which will put downward impact on prices. 2019 is the year to “sit tight” as the market begins the next economic phase. Patience will be a virtue as more deals could be on the horizon depending on the severity of the recession.

Resources/Additional Reading

- https://www.forbes.com/sites/johnmauldin/2018/05/01/almost-all-recessions-began-6-to-24-months-after-the-yield-curve-inverted/#13e25a0e6742

- https://www.bloomberg.com/news/articles/2019-01-02/key-fed-yield-gauge-points-to-rate-cuts-for-first-time-since-08

- https://www.federalreserve.gov/econres/feds/files/2018055pap.pdf

- https://www.stlouisfed.org/on-the-economy/2018/september/why-yield-curve-invert-recession

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).