The economists forecasting the jobs data missed big time, with the recent jobs report almost double their predictions. Why is job growth still surging while interest rates hit 20 year highs. What does this mean for future interest rate increases? Does this change the soft landing narrative? How will real estate be impacted?

What was in the recent jobs report?

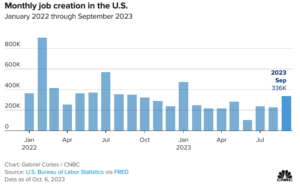

Employers added 336,000 jobs in September, the strongest gain since January and up sharply from the prior month’s upwardly revised 227,000 gain, the Labor Department said Friday. Job growth was also stronger in July than previously estimated.

Surging U.S. job growth shattered investors’ expectations, the latest sign of accelerating economic momentum stoking a bond market selloff that is sending longer-term borrowing rates to new highs.

Why the big miss on the jobs report

There is an assumption that recent moves by the federal reserve would slow the economy, what this shows is that there is still huge amounts of cash in the economy and businesses are feeling good enough to hire more workers.

What does this mean for interest rates?

The huge increase in jobs means that rates will have to go higher and also stay higher for longer in order to slow the economic train down sufficiently. Look for 30 year rates to stay in the 7% range and possibly breach 8% over the next quarter or so. Rates will remain high for an extended period before settling back down around 6% sometime late next year. The recent jobs report is not good news for real estate as it increase the possibility of much larger drop in the future due to higher rates.

How will the blowout jobs report impact real estate?

Look for real estate to muddy along with substantially reduced volumes and prices kicking around about where they are now. Eventually this scenario will change sometime next year as higher rates ultimately drive up unemployment which will loosen the market and cause selling. Furthermore higher interest rates make properties even less affordable as payments surge far higher than any wage gains. You will see this especially in higher cost markets like Denver where the median home price is well over 600k.

Does this change the soft landing narrative?

The soft landing for the economy is predicated on a slowing of job growth and an increase in unemployment to take some of the pressure of wages. Unfortunately, the opposite is occurring with job growth considerably stronger than the soft-landing narrative would suggest.

A strong jobs report shows that it will be much more difficult for the federal reserve to curb inflationary pressures without a major market reset. Even with interest rates the highest in 20 years, businesses are still hiring which means rates will either head higher or stay higher for longer or some combination of the two.

As rates remain high, the probability of something big in the economy increases exponentially. For example, think of commercial real estate. Cap rates must rise to the treasury rate as that is the risk-free rate of return. If Treasuries hit 6% that means the cap rates need to approach that same level.

Many apartments and other commercial properties were trading on 2 and 3 ap rates as borrowers feasted on low interest loans. Now interest rates are almost 3 times higher while at the same time cap rates have increased drastically reducing the value of commercial properties. Long and short, as rates remain higher for longer, the probably of a major “wreck” in real estate exponentially increases. Another example would be banks that hold treasuries or mortgages that are worth considerably less.

Summary

The recent jobs report is a sudden blow to the soft-landing narrative and greatly increases the risk of a much larger recession. With the recent jobs report almost double the predictions, the federal reserve will take rates higher and hold for considerably longer than the market anticipates. As rates remain high, the probably of an economic accident has increased exponentially. We are already seeing this in commercial real estate and banking. Look for economic cracks to begin in other parts of the economy.

The good news on the jobs front is terrible news for real estate as interest rates remain high thereby limiting purchases and refinances and putting further pressure on commercial real estate values. Furthermore, the recent report reiterates that mortgage rates will remain higher for the foreseeable future which further decreases affordability.

The federal reserve will have to put more brakes on the economy to induce a meaningful slowdown. Ultimately something will have to break in order to bring inflation back down to the 2% target. Real estate looks like it will ultimately reset due to higher rates, less affordability, and increased unemployment. Unfortunately, commercial real estate is already feeling the heat and will really be impacted as rates stay higher for longer. My prediction is the first half of next year, we will start to see the residential real estate pull back. The remaining question is whether we will see a 5% decline or up to a 20% decline as many are predicting for the stock market.

Additional reading/Resources:

- https://www.wsj.com/economy/jobs/jobs-report-september-economy-unemployment-d9409b8b

- https://www.cnbc.com/2023/10/06/heres-where-the-jobs-are-for-september-2023-in-one-chart.html

- https://www.cnbc.com/2023/10/06/jobs-report-september-2023.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender