“Our model really works in upmarkets, it’s going to work in flat markets, it’s going to work in downmarkets,” chief financial officer Carrie Wheeler told analysts just 6 short months ago. Unfortunately today this statement could not be further from the truth. Opendoor like its competitor Zillow is now getting crushed in the changing market. What does this mean for future ibuyers? How bad will it get for OpenDoor and others?

What is happening with Opendoor?

The US housing market’s sharp downturn has been bad for builders, flippers and almost anyone who had plans to sell a home when rising mortgage rates shut down the pandemic buying frenzy.

The slump has been especially harsh for Opendoor Technologies Inc., pioneer of a data-driven spin on home-flipping known as iBuying.

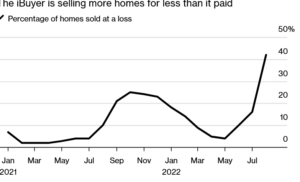

The company, which sells thousands of homes in a typical month, lost money on 42% of its transactions in August, according to research from YipitData. Opendoor’s performance — as measured by the prices at which it bought and sold properties — was even worse in key markets such as Los Angeles, where the company lost money on 55% of sales, and Phoenix, where the share was 76%. Look for these numbers to quickly get much worse as the real estate markets adjusts to the new interest rates above 7%.

Does the ibuying model work?

It is ironic that 5 months ago Opendoor was highlighting how they were considerably better than Zillow with their ibuying algorithm. It now looks like Zillow was the smartest by exiting early and limiting their losses.

Like many leading-edge market changes, the first iterations typically fail like we are seeing today. Companies like Opendoor and Zillow paid within about 5% of market value of a property in order to buy a property. This model only works in up markets as the margins are way too small to handle any hiccups. There is not nearly enough room to compensate for the risk, ibuyers should be buying 10-20% below market to ensure profitability.

I think the ibuying model “could” work. An ibuyer today would do great but they would have to start fresh without the baggage of prior purchases that were made above market. Ironically the ibuying frenzy took off during the height of the real estate market. This is just the opposite of what should have happened as ibuyers had to pay essentially market rates for properties and shouldered huge risks as a result. In down/declining markets there are more opportunities where ibuyers can pick up properties with the margins needed to be profitable.

The future of ibuying

I suspect you will see a whole new round of ibuyers backed by wall street emerging as the market corrects but this new crop of buyers will be different than Opendoor and Zillow.

- Larger discounts: as Opendoor and Zillow have demonstrated paying market value does not provide enough margin even with large volumes. The new ibuyers will need to buy properties at 10-20% discount to compensate for the risk

- Distress situations: In the past ibuyers were not focused on distress; the goal was to buy large quantities of properties, so they had to cast a wide net. Now in a declining market, there will be more situations that require the services of an ibuyer.

- Longer term holds/rentals: The new ibuying model might not be for a short term hold and a quick flip, it likely will be a buy, fix, and then hold/rent until the market recovers then sell or decide to hold as a rental long term.

Summary

I’ve been in real estate for over 25years and have seen numerous cycles. Just before the peak in prices, everyone appears to be a winner and brilliant in real estate. Unfortunately, the real test is when the market changes. Although both Zillow and now Opendoor have unfortunately fallen victim to the changing market I don’t think ibuying is dead. Ibuying will adapt their model to buying properties 10-20%+ below market value to ensure profitability. With stricter underwriting, it is not possible for ibuying to scale like they had in the past, but they will develop a sustainable business model and be profitable.

Additional Reading/Resources

- https://www.bloomberg.com/opinion/articles/2021-11-11/opendoor-does-ibuying-better-than-zillow-but-there-s-still-a-lot-to-prove

- https://www.bloomberg.com/opinion/articles/2021-11-11/opendoor-does-ibuying-better-than-zillow-but-there-s-still-a-lot-to-prove

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender