Even with falling interest rates, inventory has quickly increased. We have gone from a supposed shortage of housing to an inventory surplus in many hot markets. Home sales in July were at the lowest recorded level. What is driving the increase in inventory? Will this trend last? What does this mean for prices? What can Colorado tell us about the future of housing prices?

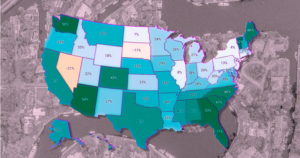

Inventory surging in most markets throughout the country

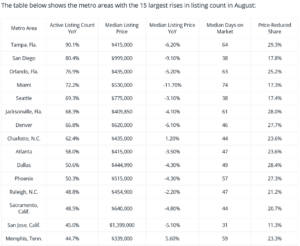

There were 35.8% more homes actively for sale on a typical day in August compared with the same time in 2023, marking the tenth consecutive month of annual inventory growth and the highest count post-pandemic. This is a deceleration from July, which was up 36.6% year-over-year. The total number of unsold homes, including homes that are under contract, increased by 20.9% compared with last year.

The typical home spent 53 days on the market this August, which is seven more days than the same time last year and three more days than last month. August marks the fifth month in a row where homes spent more time on the market compared with the previous year as inventory continues to grow and home sales remain sluggish.

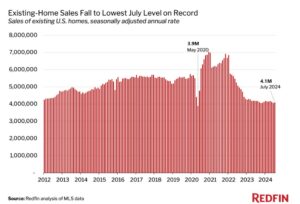

As supply increases, sales are slowing

Sales of existing homes rose 0.6% month over month in July, but fell 2% year over year—to a seasonally adjusted annual rate of 4,094,991. That’s the lowest July level in records dating back to 2012.

When you look at the chart below, this is a huge drop. The narrative from the media is that as rates drop there will be huge demand unleashed. The irony is that as rates have dropped substantially inventory has actually increased and sales have also declined.

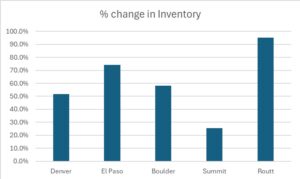

What can Colorado tell us about the future of housing prices?

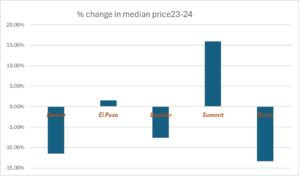

Colorado is one of our biggest lending markets. When I look at the data for Colorado some interesting trends come to light. Below are two graphs showing condos in 5 counties throughout Colorado. We can see that as inventory has surged prices have dropped as a result.

Let’s look at Routt County where prices are down 13% (Routt is home to Steamboat Springs) they have seen a huge surge in inventory almost doubling year over year. The same trend is happening in a larger market like Denver with prices down around 11% on condos and inventory up 51%. (Note if you are interested in Colorado real estate I also do a weekly Colorado real estate blog, sign up here)

Will we see a drop in housing prices?

I’ve read hundreds of articles all professing that this cycle is different and that prices will continue rising as there is still a shortage of housing. Regardless of all the theories, eventually gravity and basic economics prevail. As supply increases and demand stays flat/declines, the only outcome is declining prices.

We are seeing this scenario play out today. Even with interest rates dropping and supply increasing, the number of closed sales is also decreasing which means eventually prices will come down. If we look at the Colorado data, we can already see how this transitions through the market, huge jumps in the supply of condos have led to a drop of 13% in the median sale price.

Summary

Although the headlines continue to tout that prices will increase into perpetuity due to a shortage of houses, the reality is far different. Almost every major market is now seeing double digit increases in inventory. Even with rates falling closer to their long term historical range, sales have remained anemic reaching lows not seen since 2012.

At the same time, prices have continued to increase and defy basic economics. We are already seeing cracks in the high prices for longer theory throughout Colorado with most major markets experiencing a decline in median prices as inventory has surged.

This same trend of falling prices will eventually promulgate throughout the country. We are just at the beginning of the new paradigm with housing inventory. Look for inventory to continue to grow considerably more through the end of the year which will ultimately lead to lower prices in almost every major market throughout the country.

Additional reading/resources

- https://www.cnbc.com/2024/07/09/why-home-prices-are-still-rising-even-as-inventory-recovers.html

- https://www.fairviewlending.com/fed-cuts-rates-why-are-mortgage-rates-rising/

- https://www.bloomberg.com/news/articles/2024-09-24/home-price-gains-in-us-slow-as-affordability-pressures-buyers?srnd=homepage-americas

- https://www.redfin.com/news/existing-home-sales-july-2024/

- https://www.realtor.com/research/august-2024-data/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender