As a private lender, my call volume and closings the first quarter have been off the charts as borrowers fall out of more conventional products. This trend is now playing out with the Mortgage Credit Availability Index showing substantial tightening of credit for all types of mortgages. What was in the data? Why the sudden shift in credit availability? Will credit availability decline further? What will be the impact on real estate prices and volume?

What is the Mortgage Credit Availability index?

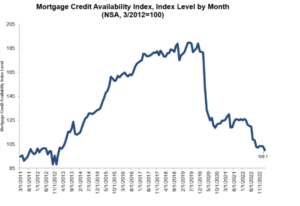

The Mortgage Credit Availability Index (MCAI) is a barometer on the availability or supply of mortgage credit at a point in time, using criteria from institutional investors who purchase loans through the broker and/or correspondent channels. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) using data made available by ICE Mortgage Technology. These metrics and the underwriting criteria for numerous lenders/investors are analyzed and, through a proprietary formula, MBA calculates the MCAI which include indices for Total, Conventional, Government, Conforming and Jumbo segments.

It is important to note that the index only started in 2011 so we don’t have historical reference to what happened to the metric before the 2008 crash.

What was in the recent credit availability data from the Mortgage Bankers Association?

Mortgage credit availability fell to just short of its 2012 benchmark level in February. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) dropped 3.0 percent from its January level to a reading of 100.1. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

“The conforming subindex decreased 4.3% to its lowest level in the survey, which goes back to 2011. This decline was driven by the ongoing trend of shrinking industry capacity as mortgage rates stayed significantly higher than a year ago,” Kan continued. “Additionally, in this volatile rate environment and potentially weakening economy, there was also a reduction in refinance programs offered for low credit score and high-LTV borrowers.”

Why the sudden shift in credit availability?

The credit availability index is a lagging indicator based on closed/purchased loans. Remember conventional loans take around 60-90 days on average to close and be sold. I would counter that the shift is not as sudden as the data suggests and that credit was tightening well before the index picked up the trend.

Will Credit Availability decline further?

We are at the tip of the iceberg with credit availability. With the recent banking turmoil, banks are running for shelter from any risk. Small to midsize banks were the only ones making loans a little outside of the box so look for this to come to a screeching halt further limiting credit availability.

What is the impact of decreased credit availability on real estate volume and in turn prices?

With credit being constrained it will be harder for marginal borrowers to get financing. This will drastically reduce volume as many new buyers will not be able to get financing.

On the pricing side, I don’t see a free fall in prices yet, but as credit continues to dry up the economy will cool leading to a reset in prices.

Summary

We are just at the beginning of the reset in the market. A decline in credit availability is just the tip of the iceberg. With the recent blow up in small banks and now spreading to some large institutions, look for credit availability to continue to decline. In the short term, real estate closing volumes will decline, but the real pain will be in the long term with a substantial reset in prices as credit continues to dry up which will ultimately lead to a cooling economy.

Additional Reading/Resources:

- https://www.mortgagenewsdaily.com/news/03142023-credit-availability

- https://nationalmortgageprofessional.com/news/mba-credit-availability-slumps-february

- https://www.mba.org/news-and-research/research-and-economics/single-family-research/mortgage-credit-availability-index-x241340

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender