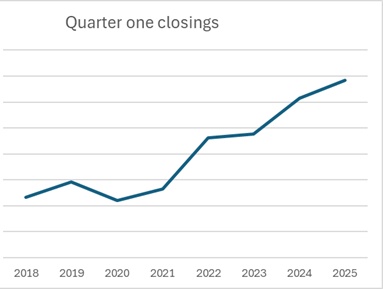

Look at the graph above, what has caused my closing to surge in 2025 while overall real estate closing volumes have plummeted? What does this mean for real estate? Don’t get me wrong, I like to think the surge in closings is because I’m an amazing lender and a great guy , but the reality is that there are two profound shifts occurring in the real estate industry that I’m noticing that will have far reaching consequences in 25 and beyond. The irony is that I have yet to see any mainstream media talking about the profound changes so you will be the first to know!

Real Estate Closings down nationally

Before talking about my closing volume, it is important to highlight the huge reductions in sales on a national level on both residential and commercial properties. Pending home sales retracted 5.5% in December – following four consecutive months of increases – according to the National Association of REALTORS®. All four U.S. regions experienced month-over-month losses in transactions, with the most significant fall in the West. Year-over-year, contract signings reduced in all four U.S. regions, with the Midwest seeing the largest decrease.

Hard money closings at Increase

Before getting into the data, Fairview is unique in that we are a privately funded hard money/bridge lender and hold and service all of the loans we originate. We also service loans for others which gives us a unique perspective in the market to identify trends based on actual data. Please note, I intentionally left of the dollars closed as we are privately held and don’t disclose this information but the graph itself shows the huge trend of increased closings as I compared q1 closings over the last 7 years. The last three years we are looking at between 15-25% increases each year on closing volume. During this time, we have done nothing different with advertising, our programs, etc… which means there is something else bigger happening in the broader market.

Why are closings up profoundly at Fairview

Although closings overall are down nationally, on both residential and commercial we are seeing a surge in activity due to primary reasons.

- Huge pullback by community banks: I’ve written about the huge issues community banks are facing with liquidity as a result of their “extend and pretend” mentality that basically allows banks to hold onto commercial loans and not recognize losses (here is an extensive article I wrote on the subject). Long and short many community bank balance sheets are full of underperforming commercial loans which are sapping their funds to make new loans. Historically smaller lenders were more apt to lend to qualified borrowers that don’t quite fit the mold as the lenders knew their businesses, could see their accounts, etc… On the flip side the mega banks are basically plug and play on lending either the numbers line up perfectly or they don’t. Here is an example. I did a loan in a Colorado ski town to a borrower that was purchasing a property, he had excellent credit, and more than enough assets but being in real estate his tax returns didn’t reflect the full picture due to deductions, depreciation, etc… Long and short the borrower had over 10 million in real estate assets and needed a loan of 2 million secured by a free and clear property at around 55% loan to value. The smaller community bank he was working with was unable to close the loan and we stepped in to save the deal. Historically this type transaction would be a no brainer for a small bank and yet time and time again I am seeing the smaller/midsize banks pull back on their fundings.

- Lack of liquidity by our competitors: Along with banks pulling back, the secondary markets for non prime real estate loans has also pulled back/softened. Many of our competitors are facing serious cash issues as they would fund with a line at a small bank and/or rely on the secondary markets. This funding source has greatly diminished, leaving many lenders out of cash. Fortunately, we learned a great lesson about leverage in 08 and decided after that ride to fund only with our own cash and focus on our core markets of Georgia, Colorado, and Florida.

What does a pullback in community bank lending mean for the economy?

It is not a good sign to see community banks and midsize banks slam the brakes on lending. The smaller banks are key to the economy as they focus on small businesses and commercial real estate. Furthermore, smaller banks provide loans that larger institutions will not especially to borrowers that don’t perfectly fit the traditional box. Eventually this lack of liquidity will slow down small business hiring, expansion, real estate purchases, etc.

Will 2025 see any improvement in liquidity?

Unfortunately this trend looks to continue and more than likely accelerate as there is no end in sight for commercial real estate with treasuries remaining high. This will keep smaller bank balance sheets full with commercial loans that have nowhere to go. Long and short, the liquidity crunch is just in its infancy.

Summary

Although the big changes in commercial banking have been a boon to my business as we have picked up a ton of loans that should have been closed by a community/small bank, the pullback by community banks is not good for the economy. I think many underestimate how important smaller banks are especially too small/midsize businesses. As liquidity continues to dry up for lending, small businesses will ultimately pull back on hiring, expansion, real estate purchases, etc. Unfortunately unless there is a sudden shift in interest rates that frees up commercial real estate, this liquidity crunch looks to only intensify in 25.

Additional Reading/Resources

- https://www.nar.realtor/newsroom/pending-home-sales-fell-5-5-in-december

- https://www.fairviewlending.com/will-commercial-real-estate-fall-2025/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender