I rarely say that Covid caused radical changes in behavior but the commercial property sector is bucking this trend. This is not because of return to office or lack thereof, but leverage and the central bank. In every cycle in recent memory as the economy started to swoon, one thing occurred. In this cycle the opposite is happening which will lead to some dangerous outcomes. How will this impact commercial and in turn residential real estate? Why is this cycle different?

What was in the data on commercial property values?

I’ve written in the past few months about commercial real estate and the upcoming losses due to rising rates We are now seeing this play out throughout the world as the global housing market slump is spreading to commercial real estate, threatening to unleash a wave of debt turmoil.

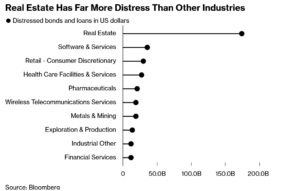

- Almost $175 billion is already distressed and lenders in some markets are warning borrowers of a growing risk of foreclosure.

- Global spiral. US commercial property values fell 9% in the second half, Green Street said. UK assets dropped more than than 20%. And one study suggests distress levels in Europe are the highest in a decade.

- Inevitable hit. The fall in transactions and development is bound to affect spending in the real economy and, in turn, jobs and growth.

The signs of a downturn are mounting in the US. But despite a dip, commercial property values “are still moderately overpriced,” said Michael Knott, head of US REIT Research at Green Street, who expects another 5% to 10% decline this year. “Appraisers are behind the curve, transaction activity has slowed down considerably.” This is on top of about a 13% decline that has already occurred.

Several US banks predict that credit losses will grow this year. In its fourth-quarter results, Bank of America Corp. flagged an additional $1 billion of office property loans with an elevated risk of default or missed payments, while Wells Fargo & Co. expects more stress to emerge in that market as demand weakens.

Why are commercial property prices falling faster than residential properties?

Commercial properties are more sensitive to interest rates than residential properties. The overwhelming majority of commercial mortgages are variable rates where the rate is fixed for 1-7 years and then adjusts after that which means the cash flow of commercial properties will be impacted much sooner than on a residential property that could have a 30 year fixed mortgage.

Furthermore, the primary method to value a commercial property is the income approach Net Operating income/Cap rate (rate of return). As cap rates rise due to higher treasury rates, property values fall (more on this below)

Will commercial property prices fall further?

Yes, we are just at the beginning of the readjustment in the commercial property market. Below are 4 reasons that prices will continue to fall heading into 2023

- Variable rate mortgages: With the majority of commercial loans based on variable rates, the more interest rates increase and/or stay at lofty levels, the lower the value of the property will be. Property owners cannot raise rents high enough to offset the huge jump in debt service. For example, last year an apartment could get a loan of 3%, now that same loan is around 5%, when the loan rolls over to the variable rate, cash flow will be impacted.

- Treasury yields are higher than cap rates: Treasuries are seen as the “risk free” base return and investor requires. As Treasury yields rise, the yields on alternative investments will also need to rise in order to compensate for the risk. For example, if the 10 year treasury is at 5%, most investors would want a return on a safe commercial asset greater than that rate. Remember the higher the cap rate the lower the value of the property so as cap rates increase due to treasuries increasing, commercial property values will fall.

- Lots of excess supply currently: There is currently allot of excess supply especially in office and large industrial. The market will need to reset to the new paradigm of demand which will eventually increase inventory especially in the office sector

- More on the way: it is impossible to accurately time the markets so inevitably you have increased inventory of new properties coming on the market as the market is turning. There are millions of square feet of office, retail, industrial, etc… that were begun before the real estate market turned. These properties will come on the market just as demand wanes.

Why is this current economic cycle different than past cycles?

In past cycles when a slowdown occurred or looked likely, the federal reserve adjusted rates downward to help “soften the landing”. Unfortunately with inflation running around 10% the central bank will not have the ability to quickly adjust rates and ironically just the opposite is happening. With Inflation “sticky” the federal reserve continues raising rates with another ½% on the table for the February meeting along with another ¾% in this cycle. This is occurring as the economy is starting to weaken.

Unfortunately the fed has gotten themselves stuck with sticky inflation due to lax monetary policy along with quantitative easing for way too long and now the economy has to pay the price. We saw in the 1970’s a double dip where inflation started to ease, and the federal reserve basically took it’s foot of the pedal which led to a double dip recession and an extremely painful inflation fight. The federal reserve does not want to repeat these mistakes and plans to keep rates at a high level for longer.

Will Commercial property woes spill over to the broader economy?

The last recession was caused by loose money on the residential side, this recession is going to be focused on the commercial side as rates make many properties unprofitable. Furthermore, historically commercial real estate was seen as a very safe asset class and gobbled up by pension funds, life insurance, property insurance, family offices, etc… With such a widespread holding of commercial real estate and commercial paper there is bound to be some spillover impacts into the broader economy.

Adam Tooze, a professor at New York’s Colombia University who has written about the 2008 crash, sees reasons to worry again. “Property is a major recession variable,” he said. “It’s the biggest asset class and is directly linked to household budgets, which means it carries consequences for consumption. It’s a large recession risk,” he said.

Larry Summers summed up our situation nicely at his recent speech in Davos: “Inflation is down, but just as transitory factors elevated inflation earlier, transitory factors have contributed to the declines that we’ve seen in inflation and as in many journeys, the last part of a journey is often the hardest.”

Summary

The commercial property blow up is just beginning. Cap rates are rising, vacancy is increasing, lease rates are falling, and lenders are putting the brakes on financing. This is leading to a dangerous situation in commercial real estate that is just starting to unwind. We will see a wave of strategic defaults and in turn foreclosures as many properties no longer make sense in a higher interest rate environment. Even as the economy weakens, interest rates are still remaining at high levels and look to remain this way for at least another year or so which will put continued pressure on commercial values and in turn defaults. We know that eventually, just due to the huge size of commercial real estate holdings, this will “infect” other parts of the economy. Unfortunately at this stage, we just don’t know if this will be a blip that is contained or a pandemic where other seemingly healthy parts of the economy quickly become infected. Regardless of the outcome, the impending commercial property debt situation will need to be monitored as residential and other areas could quickly become infected.

Additional Reading/Resources

- https://www.fairviewlending.com/commercial-property-prices-slide-13-from-peak-biggest-since-08-where-do-prices-go-from-here/

- https://www.bloomberg.com/news/features/2023-01-20/global-real-estate-is-sitting-on-a-175-billion-debt-time-bomb?

- https://www.cnbc.com/2023/01/20/summers-greatest-tragedy-would-be-if-central-banks-dont-finish-the-job-on-inflation.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender