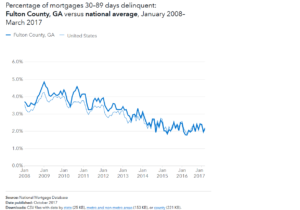

Is Georgia a good indicator of the overall national real estate economy? From the graph above Georgia is trending in lockstep with the national average of delinquencies. What can this tell us? The graph comes from new federal database by the CFPB that tracks delinquencies. Not only can you look at national data, but also the delinquencies by county. When you look at the Atlanta metro area things start to get more interesting in the data. Why are some areas double the national average in delinquencies between 30 to 60 days?

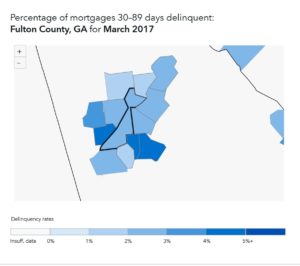

The map of Georgia looks eerily familiar to the last recession. For example, Henry and Douglas counties (in metro Atlanta, darker blue) have twice the delinquency rates of Fulton and the national average. Henry and Douglas counties were hit very hard in the last recession with foreclosure and values subsequently plummeting.

Why is this important? 30-90 day delinquencies are a leading indicator of a market that could have issues going forward. It signifies that more borrowers are “stretched” financially and therefore are at least one payment behind on their mortgage

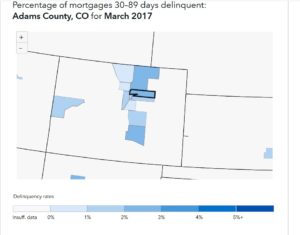

Is there a deeper meaning? If counties like Douglas and Henry are double the national average on short term lates, what happens when there is an economic downturn. Areas like this will get hit considerably hard as more borrowers are prone to financial issues before any economic hiccup. Ironically, I saw this same trend when analyzing the Denver metro area. One county, Adams County, had 5 times more short term lates than the adjacent county.

What does this mean for the nation? To see over 4% of all mortgage borrowers have short term lates in one area is a bit concerning. This shows that on a national basis the data is concealing cracks in the real estate market. If you look at Georgia or Atlanta, they are right in line with the national average, but there are big outliers. I noticed the same thing in Colorado with Denver and the state of Colorado below the national average, but yet when you drill down into the data there are clear signs of duress in various submarkets.

What should you do? If you are a real estate owner or investor, you need to look at the particular county you are interested in to see how they are faring economically today. Areas with defaults now above the national average are at much great risk for a correction down the road when the economy hiccups. As Mark Twain said: History doesn’t repeat, but rhymes. We are starting to see rhyming from the last meltdown.

Sources/Additional reading:

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-launches-new-mortgage-performance-trends-tool-tracking-delinquency-rates/

- https://www.consumerfinance.gov/data-research/mortgage-performance-trends/

I need your help!

Don’t worry, I’m not asking you to wire money to your long lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles it would be greatly appreciated.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games).