Last week, the president announced an action that will save homebuyers and homeowners with new FHA-insured mortgages $1500 per year (assuming a 500k home), lowering housing costs for an estimated 850,000 home buyers and homeowners in 2023. On the surface, the change sounds innate, but the details tell a different story. What is in the new proposal? How will the fee reduction impact the spring selling season? Long term is this the best solution?

What is in the new presidential action on the FHA?

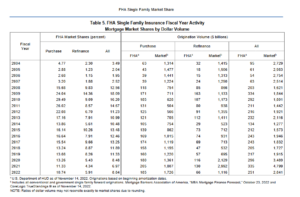

HUD, through the Federal Housing Administration (FHA), will reduce its annual mortgage insurance premium by 0.30 percentage points, from 0.85% to 0.55% for most new borrowers. The mortgage insurance premium is the monthly fee that homeowners with FHA-insured mortgages pay to insure their mortgages, which they pay on top of their monthly principal and interest payments.

What is the purpose of mortgage insurance?

Mortgage insurance sets up a fund that allows FHA to absorb losses due to default. Mortgage insurance is required for FHA loans as they are riskier due to looser underwriting and low down payment requirements. Two factors make FHA loans at much higher risk of default:

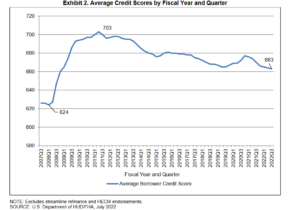

- Credit score: For FHA the average credit score is a 630 in the last congressional update; this is clearly considered subprime due to the much higher risk of default

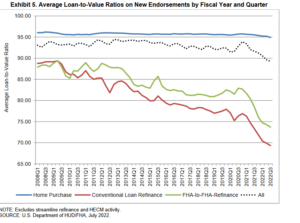

- Loan to value: the average loan to value is 94% on new home purchases for FHA loans, this is a very risky loan with so little down especially as prices flatten

LTV number one indicator of loss

Being a private lender and riding through the last mortgage crisis with no bailout from the government, we learned real quick what happens in a market downturn. The number one factor on whether a lender will take a loss is Loan to Value. As a private lender in the last crisis we had a unique perspective to see how our lending practices performed under stress. We lend our own funds, look at every property, and service our loans. We get to see the whole loan cycle as opposed to many banks that pool their loans and securitize them offloading the risk to other parties. As the crisis unfolded we spread out the portfolio based on credit, income, loan to value, etc… the primary indicator of whether we would take a loss or not was the amount of leverage the borrower utilized. The lower the loan to value, the higher probability of a positive resolution.

What happens in a downturn?

A cascading effect occurs; the market falls, dampens consumer confidence, decreases consumer spending and businesses in turn cut back to accommodate the lower spending level (layoffs, fewer purchases, etc…). Borrowers that have equity in their commercial or residential property are considerably more likely to make a payment. In the last crisis, there were a considerable number of “strategic defaults” where the borrower could make a payment but chose not to since the house was underwater. The theory goes “why throw good money away when I can go rent or buy another house for less than what I currently owe?”. This is a simplistic explanation of what happened in the last crisis and what will happen again. The depth of how this plays out in the next crisis is the question.

What does this have to do with Fannie/Freddie the largest purchasers of residential mortgages? With 35% of mortgages originated having less than 10% down, the probability of major defaults has been amplified. It is highly likely that there will need to be a huge bailout by U.S. taxpayers to the tune of 100 billion dollars (Bloomberg) or more (this doesn’t include bailouts of FHA or VA which also makes subprime loans with down payments less than 5%!).

Bad idea to cut mortgage insurance premiums at the peak

This is a terrible idea to cut mortgage insurance premiums as the market remains close to its peak. As prices reset, the amount of defaults will skyrocket. Take a market like Denver, if someone bought a house in April of last year and now needs to sell the property, they are substantially underwater as prices have come off 8%, if you add a realtor commission on top the equity in the house is around -8% assuming they put an initial 5% down. This will lead to strategic defaults as we saw in the last cycle.

The current administration touts a huge “cushion” in the mortgage insurance fund. Unfortunately what we saw in the last cycle is that around 10% of loans defaulted; unfortunately it will be considerably higher in this cycle as FHA drastically increased its loan portfolio after the last crisis and credit scores have continued declining in their portfolio. Long and short, it will not take much for this cushion to quickly evaporate based on prior default rates.

Better solution would be to provide more down payment assistance

So what is the correct solution to help first time homebuyers? It would save taxpayers billions if instead of reducing the monthly payment by a rate reduction to reduce the monthly payment by a lower loan to value via down payment assistance. This would give borrowers an equity cushion and provide incentive to keep the loan and house even under financial distress (or sell the house).

Summary:

Reducing the mortgage insurance premium is a gimmick that will ultimately lead to more losses for taxpayers. Historical default rates show that the mortgage insurance fund will quickly be depleted in a downturn. Furthermore reducing the fee while increasing the riskiness of the portfolio is a foolish decision that will ultimately lead to substantially more defaults and losses. At the peak of the cycle, the government should be doing just the opposite by tightening credit and requirements to reduce losses. This is a terrible idea that will ultimately lead to less homeownership as more affordable houses are lost to foreclosures and bought by investors.

Additional Reading/Resources

- https://www.whitehouse.gov/briefing-room/statements-releases/2023/02/22/fact-sheet-biden-harris-administration-announces-action-to-save-homebuyers-and-homeowners-800-per-year/

- https://www.bloomberg.com/news/articles/2023-02-22/us-to-cut-mortgage-insurance-costs-for-some-new-homeowners

- https://www.usatoday.com/story/money/personalfinance/real-estate/2023/02/22/mortgage-insurance-premium-new-homeowners-fha/11324173002/

- https://www.wsj.com/articles/housing-subsidies-federal-housing-administration-mortgages-taxpayers-biden-administration-5f7194d4?mod=hp_opin_pos_6#cxrecs_s

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends 😊. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender