What a week it has been in the economy. The federal reserve is still struggling to contain inflation and as a result increased the fed funds rate .75%. After the announcement stocks roared back in a huge “relief” rally and mortgage rates plummeted. Shortly after, GDP numbers came out that shows the economy is technically in a recession. What do all these differing indicators mean for the economy and in turn real estate. Are the stock and bond markets correct in their interpretation of where the economy is heading?

Federal reserve raises rates

The Federal Reserve continued a sprint to reverse its easy-money policies by approving another unusually large interest rate increase and signaling more rises were likely coming to combat inflation that is running at a 40-year high.

Officials agreed unanimously Wednesday to lift their benchmark federal-funds rate to a range between 2.25% and 2.5%. But markets rallied after the meeting because Fed Chairman Jerome Powell offered fewer specifics about the magnitude of upcoming rate rises and hinted at an eventual slowdown.

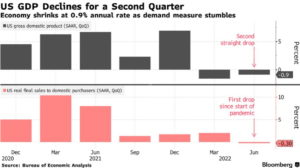

Technical recession as GDP falls

At the same time the federal reserve continued raising rates, the drumbeat of recession grew louder after the US economy shrank for a second straight quarter, as decades-high inflation undercut consumer spending and Federal Reserve interest-rate hikes stymied businesses and housing.

“The more important point is that the economy has quickly lost steam in the face of four-decade high inflation, rapidly rising borrowing costs, and a general tightening in financial conditions,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note. “The economy is highly vulnerable to slipping into a recession.”

Mortgage rates fall but demand also falls

Remember the federal reserve does not set mortgage rates. Mortgage rates are dependent on the markets pricing of long term treasuries. Mortgage rates in the US dropped for the first time in three weeks. The average for a 30-year loan slipped to 5.3% from 5.54% last week, Freddie Mac said Thursday in a statement. That’s a level last seen the week of July 7. This is off the highs of 6% seen a month ago which is not what I would expect in a rising rate environment. Typically, as short term treasuries rise, longer dated securities along with mortgage rates would also rise.

Furthermore, one would expect that a large drop in interest rates would increase demand for real estate. This is not happening: “Purchase demand continues to tumble as the cumulative impact of higher rates, elevated home prices, increased recession risk and declining consumer confidence take a toll on homebuyers,” said Sam Khater, Freddie Mac’s chief economist. “As the market adjusts to a higher-rate environment, we are seeing a period of deflated sales activity until the market normalizes.”

Are the stock and bond markets correct in their interpretation of the economy?

Unfortunately there is way too much optimism in the economy and the bond market is drastically underestimating the bumpy road ahead. Furthermore the stock market is pricing in a “soft landing” that will be near impossible to achieve. Below are three key items where the bond and stock markets are showing undue optimism.

- Inflation stickier than market pricing in: after the announcement of the recent federal reserve rate increases, the stock market rallied basically pricing in that the economy would soften enough that the federal reserve would need to start cutting rates sometime next year. Unfortunately this misses the mark on how stick inflation is. Just as the federal reserve continued saying that inflation was “transitory” for the last two years the bond and stock markets have not gotten the message of how entrenched inflation really is. Every time I look at any business news there is a story about rising prices from consumer goods to electric companies and everything in between. Furthermore rents continue to increase furthering inflation. None of these factors correct themselves easily which means the federal reserve will need to raise rates higher and longer than the markets are currently pricing in.

- Substantial stimulus still in the economy & more being added that will make fed job difficult: Currently congress and the president continue to increase stimulus in the economy from the 250 billion chips act to 400 billion for the build back better to billions not being paid on student loans. All of this money is entering a red hot economy which will keep demand and prices higher for longer than anticipated further adding to inflationary pressures and making the federal reserve’s job increasingly difficult as they work to decrease demand through higher rates.

- Supply situation still constrained & demand continues. Supply chains were supposed to be back to normal years ago, but still today there are issues from port strikes/closures, lockdowns in China, raw material shortages, labor shortages, etc… With supply issues continuing, prices will be hard pressed to fall nearly as quickly as the market is pricing in. The supply issues are now entrenched meaning that the issues are not even close to be resolved.

Real estate is in for a ride

Even with interest rates falling, the demand for real estate has declined at the same time inventories have also started to push higher. These factors are an economic recipe for price corrections. Look for nationwide prices to be off 10-15% in the next year or so and off considerably more in extremely hot markets like Boise that could see resets of 30-40% as demand dries up. How far prices fall will be dependent on how far the federal reserve must go in order to get inflation under control. Unfortunately I think it is going to be a lot farther than the market thinks which is why I assumed declines in real estate values.

Summary:

There are conflicting indicators going on in the economy. With GDP down one would expect that the stock market would decline as future earnings would be less due to a slower economy/recession. Weirdly, just the opposite has happened. Bond prices have a similar story, as the federal reserve highlights inflation will take more rate hikes to tame, the bond market is now pricing in a slowdown in rate hikes before the hiking is even complete leading to declines in long term rates. Unfortunately both the stock and bond markets are pricing in a bit too much optimism.

Over the next several months, I expect mortgage rates to increase as the market finally realizes that even if inflation has peaked, it is going to decline rapidly which will lead to further federal reserve increases as opposed to rate cuts that are anticipated next year. Furthermore stock prices have substantial downside risk as the economy slows considerably due to higher rates and profits become crimped.

Although there is considerable “noise” with the conflicting economic indicators, the main signals of a slowing economy, decreasing demand, and higher inventory are coming through loud and clear. Unfortunately the “sunshine” scenario the markets are currently pricing in will not last long as the market fundamentals are painting a drastically different picture. Look for real estate to continue slowing with corrections in pricing throughout the country and steeper corrections in hot Covid markets like Boise that got way ahead of themselves.

Additional Reading/Resources:

- https://www.cnbc.com/2022/07/28/gdp-q2-.html

- https://www.bloomberg.com/news/articles/2022-07-27/stocks-bonds-jump-on-glimpse-of-slower-fed-hikes-markets-wrap?srnd=premium

- https://www.bloomberg.com/news/articles/2022-07-28/us-mortgages-rates-dip-to-5-3-in-first-decline-since-early-july?srnd=premium

- https://www.wsj.com/articles/fed-raises-interest-rates-by-0-75-percentage-point-11658944935

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender