Housing industry urges Fed to stop raising rates, does it even matter?

Top real estate and banking officials are calling on the Federal Reserve to stop raising interest rates as the industry suffers through surging housing costs and a “historic shortage” of available homes for sale. Is the federal reserve still calling the shots on interest rates? What are the 4 real causes for the huge run up in rates?

What was in the letter to the Federal Reserve from various real estate groups?

The National Association of Home Builders, the Mortgage Bankers Association and the National Association of Realtors said they wrote the letter “to convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility.”

The groups ask the Fed not to “contemplate further rate hikes” and not to actively sell its holdings of mortgage securities at least until the housing market has stabilized.

The letter notes that the rate hikes have “exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume. These market challenges occur amidst a historic shortage of attainable housing.”

Federal Reserve does not “control” 10 year treasuries (longer term rates)

First, it is important to note that the federal reserve does not directly control longer term rates and in turn mortgage rates. The fed controls the “federal funds rate”. The federal funds rate is the rate at which banks and credit unions lend reserve balances to other banks and credit unions overnight (very short term rates). In a nutshell this is the rate banks get on the money they are holding in cash/reserves. Here is a more detailed explanation from Wikipedia .

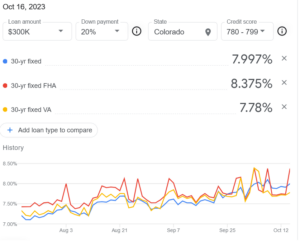

So how are mortgage rates set? Unfortunately, mortgage rates are not “set”. There is no government or private party that can set rates per se. Mortgage rates are typically based on the 10-year treasury yield. So how does this work?

Before discussing rates, it is important to understand how bond yields work. The most important piece of this equation is the relationship between a bond price and its return. For treasuries, it is critical to note that a bond price and its yield move in inverse. What this means is that a higher bond price results in a lower yield and vice versa where a higher yield results in a lower bond price. For simplification purposes, I will not get into the full details of why bonds function the way that they do. Rest assured that it works this way and will always work this way.

With this key piece of information, we can now understand why mortgages do not move in direct correlation with the federal funds rate and they are “pegged” off the 10 year treasury.

What are the real causes for the run up in rates?

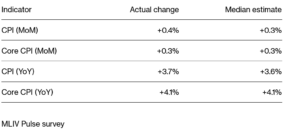

- Future inflation expectations: This is the biggest driver of higher treasury yields. The market is not buying that inflation is over as wages continue to increase, productivity falls, labor participation is stuck and host of other factors. Long and short, the market thinks that inflation will take a while to come back to a 2% target. The numbers are backing this assumption with recent consumer price index exceeding expectations. Both Core inflation and overall inflation are still running almost double the federal reserve’s target and are still increasing.

- Future growth expectations: The recent jobs report was double what economists had predicted which shows the legs the economy still has to keep on growing. We are seeing this play out in the data with payrolls increasing.

- Deficits substantially increasing supply: Washington is running the highest deficits ever recorded which means they will have to sell even more bonds which will further impact prices. Bonds are like anything else in economics, as supply increases and demand stays the same, prices will fall. As mentioned above prices and yields move in inverse so lower bond prices equal higher interest rates.

- Geopolitical issues/flight to safety: On the flip side of the supply issue, we are seeing a little flight to safety due to geopolitical issues which have recently slowed down the rise in treasuries. I don’t think this will be enough to stop the run up in treasury yields but it should help slow the pace of appreciation.

Housing/Real estate will feel the pain from higher rates

The letter from various real estate groups highlighted what anyone in the industry already knows. Volumes are at historic lows due to the huge jump in interest rates. In turn affordability is also at the lowest rate in history. Unfortunately as rates stay higher for longer eventually residential real estate will crack. I do not see a plausible solution where real estate prices do not come down due to high rates.

Federal reserve no longer calling the shots.

The letter from the various real estate entities is a bit misguided. The federal reserve is no longer calling the shots in the market. The treasury market has taken on a life of its own due to future inflation, strong growth, and huge deficit spending. These factors will continue to drive the market even if the federal reserve says they are done hiking.

The market no longer buys the notion that inflation will naturally come down without interest rates remaining high. This will keep treasuries high while mortgage rates continue trading in a narrow window. Unfortunately there is nothing the federal reserve can do at this point. To lower rates, they can cut the fed funds rate, but that in turn would stoke inflation and require further hikes in the future.

Summary

The federal reserve has painted itself into a corner and has no options that lead to better solutions than what we are experiencing today. They have little ability to cut rates and they have little ability to raise rates without causing further problems.

The letter urging the federal reserve to not raise rates further is misguided as the market has taken up the inflation fight leading treasuries substantially higher. The federal reserve is stuck. They essentially have created a boat with no oars that is at the mercy of the markets. The best the federal reserve can do at this point is to hope that a storm doesn’t wipe the boat out and cause too many problems. Unfortunately, we have seen how this plays out, eventually with the waves (aka higher interest rates) something always breaks.

Warren Buffet summed up our situation nicely: “Only when the tides go out do you find out who is swimming naked” or up a figurative creek without a paddle. We are just beginning to see this play out regardless of what letters are written or what the fed does at this point, we will soon be finding a lot out about the economy as the easy money dries up and the “tide goes out”.

Additional Reading/Resources

- https://www.cnbc.com/2023/10/10/housing-industry-urges-powell-and-fed-to-stop-raising-interest-rates.html

- https://www.wsj.com/economy/central-banking/higher-bond-yields-likely-to-extend-fed-rate-pause-53aa56fc?mod=hp_lead_pos1

- https://www.bloomberg.com/news/articles/2023-10-12/us-core-cpi-posts-second-straight-monthly-increase-of-0-3

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender