Regardless of how you voted, at the end of the day for real estate in particular, does the election of President Trump radically change the trajectory of real estate? What happens to real estate volumes? Will interest rates rise or fall? What happens to values? Why have home sales dropped to 15 year low? What does the chart above allude to?

Does the election of Trump radically alter real estate one way or the other

Although voters are extremely passionate about their candidate at the end of the day will the president radically change what we are seeing in real estate?

Unfortunately the stage has already been set for this economic cycle well before this election with inflation continuing to run higher than historically seen and interest rate remaining high. At the same time both parties had touted huge spending plans that look to exacerbate our present conditions.

Regardless of your presidential candidate preference, there is one big theme that both candidates had in common, increased deficits. The way they would accomplish the increased deficits would be different.

President Trump will have lower revenue collection by lower taxes, but at the same time spending would stay elevated on the big drivers, social security, medicare, Medicaid, etc… There would be cuts to other spending to offset some of the tax increases, but there will still be a net increase in the deficit because the largest spending categories are SS, Medicare, and Medicaid along with defense spending.

Why care about deficit spending for predicting interest rates?

Remember the federal reserve does not set interest rates, the market “sets” long term rates like the 10 year treasury which is the driver of real estate mortgage rates. As deficits continue to increase the supply of bonds must also increase as the government will have to sell more bonds to finance the ever larger deficits.

As supply of bonds increases, just like everything else in economics prices decrease. The decrease in prices means that interest rates must increase or stay at the current lofty levels.

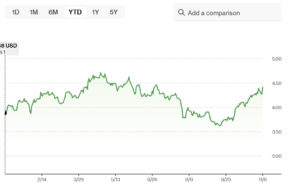

Bond yields surge on Trump election win

Here is a quick snapshot after the election:

“US Treasuries slid, with the 30-year bond falling the most since the pandemic struck, as investors piled back into bets that Donald Trump’s return to the White House will boost inflation.

While long bonds led the action — with 30-year yields surging 24 basis points, the biggest daily jump since March 2020 — losses extended across the curve as traders slashed wagers on the scope of interest-rate cuts by the Federal Reserve. Yields on the two-year note rose as much as 13 basis points.”

Remember bond yields ultimately set long term rates and the fed can only attempt to influence this through the rate setting of short term treasury rates.

What happens to mortgage rates as a result of the presidential election?

The Predicted Fed cuts are unlikely to change real estate in 2024. With the market pricing in two quarter point rate cuts this year, the impact will be muted. Even if I assume the market has not factored the second cut in, this will lead to mortgage rates in the 6.5%-7.5% range for the remainder of 2024 and through 2025.

Remember when the fed cut rates half a percentage, mortgage rates have actually increased considerably more than their cuts. Yields on 10-year Treasury notes ironically rose on Tuesday to 4.2%, the highest since late July and up from a 15-month low of 3.6% on Sept. 17 — one day before the Fed lowered borrowing costs by half a point. Before the fed’s surprise cut (the market was pricing in a quarter point cut), rates were trending towards 6%, fast forward and now rates have trended closer to 7%.

Furthermore I think the federal reserve will be very wary of possibly rocking the boat one way or another as the data is still showing persistent inflation and a strong economy.

What happens to real estate sales volumes because of the presidential election?

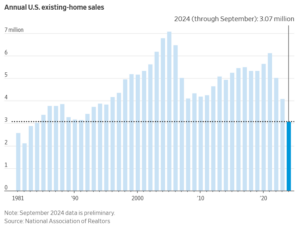

Sales of homes are already in the dumps. Sales of previously owned homes fell 1% in September compared with August, to a seasonally adjusted, annualized rate of 3.84 million units, the slowest pace since October 2010, according to the National Association of Realtors. Sales were 3.5% lower than in September 2023.

Sales of existing homes in the U.S. are on track for the worst year since 1995—for the second year in a row. Persistently high home prices and elevated mortgage rates are keeping potential home buyers on the sidelines. Sales of previously owned homes in the first nine months of the year were lower than the same period last year, the National Association of Realtors said Wednesday.

This cycle worse for real estate pros than 2008

First, the real estate woes we are in are not due to the election of Trump. The high rates have been a manifestation of huge government spending over the last 4 years. Look for the trend of low volumes to continue as the market is basically stuck as interest rates remain over double their pandemic lows and affordability remains a huge issue. Although we will likely not experience a 2008 redo in regards to foreclosures, for real estate pros (realtors, mortgage pros, title, real estate attorneys, etc..) this cycle will actually be worse due to huge drops in volumes. In this cycle very few if any are refinancing and without an impetus for people to move everyone is just staying put and stuck where they are due to the handcuffs of the ultra low rates.

Although the national association of realtors and others continue to say survive until 25, in all reality 25 looks to be a continuation of 24 but where the industry finally faces the music. Look for the real estate industry to finally come to grips with the new reality of low volumes in 25 and you will see massive layoffs from lenders, title companies, and real estate companies as they are drastically overstaffed for the current volumes and unable/unwilling to wait with their staff for the next cycle.

Summary

Regardless of the presidential pick, we are in store for higher mortgage rates due to increased deficit spending coupled with increased expectations for longer-term inflation. Both factors will keep rates substantially higher for considerably longer than the market is anticipating. This will lead to huge challenges in the real estate industry as it is woefully overstaffed for the new paradigm.

The most impacted segment will be commercial properties as we are already seeing this in the office market and spilling into the apartment market as rates make many of the deals done during the era of ultra low rates unworkable. The reset is just beginning in the commercial sector and look for this to accelerate into next year.

On the residential side, look for volumes to stay anemic and prices to basically kick along with maybe a slight downturn unless there is an economic shock which isn’t in the card right now, but increases in probability as rates stay higher for longer.

The key takeaway is that it looks like deficits are here to stay and in turn higher interest rates. Although 2008 is not in the cards, the longer interest rates stay high, the higher the probability of a larger reset especially in commercial real estate.

Additional Reading/Resources

- https://www.bloomberg.com/news/articles/2024-11-06/us-bonds-slide-most-since-pandemic-as-trump-renews-inflation-bet?srnd=homepage-americas

- https://www.cnbc.com/2024/10/23/september-home-sales-drop-to-the-lowest-level-since-2010.html

- https://www.wsj.com/economy/housing/home-sales-on-track-for-worst-year-since-1995-9a2029ae?mod=hp_lead_pos1

- https://coloradohardmoney.com/2024-colorado-elections-what-does-this-mean-for-you-and-your-real-estate/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender