Over the years there have been a lot of theories that nightly rentals are increasing long term rents of full-time residents. Recently NY analyzed nightly rentals in various boroughs to calculate the increase in lease rates. This is the first real study I have seen on the topic. What did NY find? Are nightly rentals driving up long term rents? What does this mean for the future of nightly rentals? What major city has opted to ban nightly rentals outright? What happens to real estate values?

What was in the data on New York rental rates

New York City has been suffering through an affordable housing crisis for years. Between 2011

and 2017, New York City lost nearly 183,000 affordable units of housing renting for less than

$1,000 – larger than the entire public housing stock.

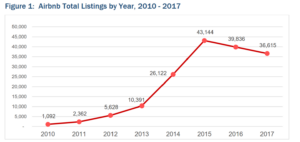

The New York City comptroller’s office found that roughly 9.2% of the rent increases imposed by landlords from 2009 to 2016 were attributable to the effect of Airbnb alone. It is important to note that the 9.2% is an average so many neighborhoods were impacted substantially more, and many had less of an impact. Below are the top areas that were impacted by nightly rentals.

How accurate was this study on rental increases due to nightly rentals.

I’m always skeptical of bold new studies, but this study seems to pass the smell test as they isolated nightly rentals from normal neighborhood appreciation. On the surface the study seems reasonable but I’m sure the nightly rental industry will be going nuts trying to blow holes in their methodology. Below are more details on how they isolated nightly rentals in the data.

“ Rental rate data comes from the annual American Community Survey (2009-16). We use average monthly gross rent for all renters as our rent measure. We also control for neighborhood level economic and demographic characteristics using data from the American Community Survey.

We pooled eight years of data for 55 neighborhoods, bringing our total number of observations to 440. The dependent variable is the logarithm of average monthly gross rent by neighborhood in a given year. The independent variable with the coefficient of interest is the share of residential units listed on Airbnb which is calculated by dividing annual unique Airbnb listings in the neighborhood by total residential units in the same neighborhood.

We also control for demographic and economic changes in neighborhood level by including average household income (in log form), population (in log form), and the shares of college-educated and employed residents in the neighborhood. We also included year and neighborhood-level fixed effects (dummy) variables to control for otherwise uncontrolled-for trends and neighborhood characteristics.”

Here is a link to the full study if you want to read all the details: https://comptroller.nyc.gov/wp-content/uploads/documents/AirBnB_050318.pdf

A big caveat from the study on nightly rental impacts to long-term lease rates

It is important to note that although NY found a high correlation between nightly rentals and increases in long term rents, the same might not be true for other cities. Take a city like Atlanta that is not space constrained like NY. I doubt that nightly rentals would have as large of an impact in metro Atlanta as in NY due to the total quantity of housing and the percentage of nightly rentals. On the flip side a city like Breckenridge, CO would likely have similar results to the NY study.

What city is banning nightly rentals and why?

Barcelona officials plan to ban short-term tourist apartment rentals by 2028, mirroring policies that have bubbled up across Europe in recent years.

“We are confronting what we believe is Barcelona’s largest problem,” Barcelona Mayor Jaume Collboni said at a city council event. Barcelona will look to eliminate all rentals by the 2028 deadline. The city will scrap all 10,101 apartment licenses approved as short-term rentals, Reuters reported.

More supply of housing is needed, and the measures we’re presenting today are to provide more supply so that the working middle class does not have to leave the city because they can’t afford housing,” Collboni said. “This measure will not change the situation from one day to the next. These problems take time. But with this measure we are marking a turning point.”

Could a US city implement a similar ban similar to Barcelona?

Yes, NY has essentially banned short term rentals without the owner present which has essentially eliminated 80% + of all short term rentals in the city. The next question always comes up, is this legal for cities to state what you can and cannot do with your property. The short answer is yes. Courts throughout the country have upheld the ability of cities/counties to regulate short term rentals via zoning, caps, etc… The case law is well established that cities/counties have this ability.

How does banning/regulating nightly rentals impact real estate prices?

Fortunately, in the markets with high demand for short term rentals like Barcelona, NY, or Breckenridge, CO there is also high demand for real estate in general. In core tourist markets, I do not see a bottom falling out scenario as demand far outstrips supply in most of the major markets.

On the flip side, in tertiary markets, the ban will absolutely impact real estate prices. Take a market like Silverthorne Colorado (about 40 minutes from the ski town of Breckenridge, CO). The county moved to severely restrict nightly rentals outside of the core ski markets. This has led to substantial declines in values in Silverthorne. In summary, the impact will depend on the particulars of each market so some markets will be fine like NY or Barcelona while other non-core markets will definitely feel the impact of nightly rental regulations through substantially lower prices.

What happens going forward with nightly rentals?

The NY study adds further fuel to the nightly rental regulation camp and will be widely cited to further increase regulation on nightly rentals. We are just in the first inning of nightly rental regulations and as Barcelona’s actions show it is hard to predict exactly where we go from here other than to say that there will be considerably more regulation of nightly rentals.

Property owners must be on notice that these increased regulations can/will radically alter or even eliminate their business models. Think of the 10k short term rentals in Barcelona, they were likely making 2-3 times what they could make with a long-term rental and they still had the ability to use the property. The business models will not work with long term rentals and many will be forced to sell.

Fortunately in the markets with high demand for short term rentals like Barcelona, NY, or Breckenridge, CO there is also high demand for real estate in general. In core tourist markets, I do not see a bottom falling out scenario as demand far outstrips supply in most of the major markets but non-core markets will feel a substantial reset in prices.

Regardless of the current regulatory environment, anyone investing with the sole intention of nightly renting a property should be well aware that the only certainty is increased regulation, and this is even more critical in non-core tourist areas that will experience a big reduction in prices if/when regulation is increased.

Additional Reading/Resources

- https://comptroller.nyc.gov/wp-content/uploads/documents/AirBnB_050318.pdf

- https://www.bloomberg.com/news/articles/2024-07-09/airbnb-abnb-vrbo-expe-why-cities-are-cracking-down-on-short-term-rentals?srnd=homepage-americas

- https://www.bloomberg.com/news/newsletters/2024-06-24/barcelona-to-ban-vacation-rentals-in-blow-to-airbnb-citylab-daily

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender