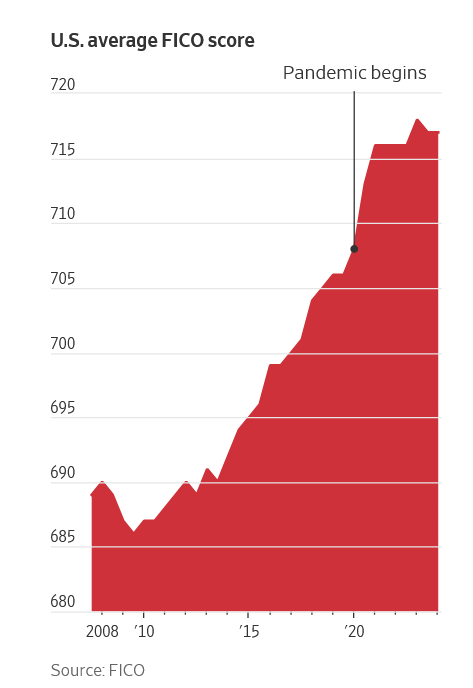

Wow, look at the huge increases in credit scores over the last 15 years. This has occurred even as student debt, auto debt, and credit card debt have all surged. Has the US all the sudden become much more credit worthy or has something else changed? What does this mean for real estate?

Why did credit scores increase so much?

Sorry to burst the bubble, credit scores have not increased due to any fundamental changes by Americans. Here are the three drivers:

- Pandemic stimulus: The government printed money and handed it out like candy to American’s that could use these funds to pay down credit card debt, car debt, etc…

- Less items on credit report: here are just a few items that no longer show on your credit reports:

- Judgements: for example someone didn’t pay their rent and the property owner go ta judgement, this does not show on the credit report

- Tax Liens

- Medical Debt

- Student Debt for the last 5 years

- Student loan payments: very few have paid student loans over the last 5 years, this has given a huge boost in cash flow to millions of borrowers.

Is a credit score like premiere status on airlines?

When I saw the chart above, the first thing that came to mind is premiere status on airlines. Historically very few had the top credit scores just like very few had top tier premier status on airlines, fast forward and go to the airport and now everyone has premier status on an airline just like as we can see from the chart, everyone now has a great credit score.

Scores are no longer indicative of actual risk

Unfortunately with the changes above to credit scores, they are no longer indicative of actual risk. Fannie/Freddi have not increased their minimum credit score standards to compensate for the “grade inflation” which means that riskier borrowers qualified for riskier products with lower down payments. Essentially the government by not increasing credit score requirements due to the inflation of credit scores has led to huge increases in risk.

Change the standards to increase homeownership

Just as in the last crisis, loose underwriting standards took down many banks, brokerages, homeowners, and investors. Are we going to make the same mistake again? Absolutely! To increase the homeownership rate, Fannie/Freddie (now effectively owned by the US government) have effectively been loosening standards due to “grade inflation” of credit scores. This has enabled more borrowers to make lower down payments due to a higher credit score.

How do we know standards are loosening?

70% of all purchases over the last 12 months were low down payment loans. Borrowers putting between 5 to 9 percent down grew at double the market average (source: Black Knight Analytics). Furthermore, over 35% of all lending by the government sponsored entities, Fannie/Freddie which are backed up by US taxpayers, was subprime (less than 10% down); this is up from 5% in 2010 (Bloomberg)

What is Subprime lending and why is this important?

Subprime lending (or non-prime) is basically any loan where the borrower puts less than 20% down and/or don’t meet traditional credit/income guidelines. Regardless of credit or other rations, in the last crisis, we saw that Loan to value was the number one indicator of a loss which should not be surprising to anyone.

Why is 20% the magic number?

Let’s look at what happened during the last recession. Remember prices can go decrease and decrease substantially. The last recession showed that borrowers with less than 20% down were substantially more likely to default on their loans. Why? In a recession with values dropping if you put only 5% down, the borrower is underwater almost immediately. In other words, the house is worth less than it is owed. It doesn’t take a deep recession to see a 5-10% drop in values. A little hiccup in the economy could knock prices down 5-10% especially in higher cost areas like the Colorado front range where borrowers are spending larger portions of their income on housing.

Wait, everything is different now in the mortgage market! We cannot have the same issues again with Dodd Frank, etc…!

I hear the arguments now, default rates are at the lowest since the recession, underwriting is tougher, credit scores are higher and the list goes on. Unfortunately, none of these arguments hold water, subprime is back and the new lender in town is you and I the taxpayer through our ownership in Fannie/Fredie.

LTV number one indicator of loss

Being a private lender and riding through the last mortgage crisis with no bailout from the government, we learned real quick what happens in a market downturn. The number one factor on whether a lender will take a loss is Loan to Value. As a private lender in the last crisis we had a unique perspective to see how our lending practices performed under stress. We lend our own funds, look at every property, and service our loans. We get to see the whole loan cycle as opposed to many banks that pool their loans and securitize them offloading the risk to other parties. As the crisis unfolded we spread out the portfolio based on credit, income, loan to value, etc… the primary indicator of whether we would take a loss or not was the amount of leverage the borrower utilized. The lower the loan to value, the higher probability of a positive resolution.

What happens in a downturn?

A cascading effect occurs; the market falls, dampens consumer confidence, decreases consumer spending and businesses in turn cut back to accommodate the lower spending level (layoffs, fewer purchases, etc…). Borrowers that have equity in their commercial or residential property are considerably more likely to make a payment. In the last crisis, there were a considerable number of “strategic defaults” where the borrower could make a payment but chose not to since the house was underwater. The theory goes “why throw good money away when I can go rent or buy another house for less than what I currently owe?”. This is a simplistic explanation of what happened in the last crisis and what will happen again. The depth of how this plays out in the next crisis is the question.

What does this have to do with Fannie/Freddie the largest purchasers of residential mortgages? With 35% of mortgages originated having less than 10% down, the probability of major defaults has been amplified. It is highly likely that there will need to be a huge bailout by U.S. taxpayers to the tune of 100 billion dollars (Bloomberg) or more (this doesn’t include bailouts of FHA or VA which also makes subprime loans with down payments less than 5%!).

We haven’t learned our lesson!

We are already starting to see the beginning impacts of inflated credit scores. Debt counselors across the country say their client bookings are equal to or exceed the number in 2019. Lenders catering to low- or middle-income people have taken a hit. Furthermore, nonprime borrowers monitored by FICO in April spent 13% more of their credit lines on average than when Covid-19 landed, while falling behind on bank card payments in the past year 28% more often.

By the government artificially increasing credit scores, we have created a huge risk to the economy that is hiding in plain sight! Furthermore, it is perplexing that we are repeating similar mistakes that led to the collapse of various banks a decade ago. GSEs (Fannie and Freddie), which we as the taxpayer are funding/guaranteeing, are the new risk in town. They have increased their subprime lending from 5% in 2010 to 35% in 2018. Furthermore, the grade inflation of credit scores has compounded the risk to the entire mortgage market and other debt markets that eventually will be paid as we are just beginning to see. The scary part is that there is no way to fully quantify the risk to credit quality due to grade inflation other than I know it is a big number. We will have to wait and see the exact figures when the economy resets.

Additional Reading/Resources

- https://www.lendingtree.com/home/mortgage/down-payment-help-survey/

- https://www.wsj.com/personal-finance/a-credit-score-hangover-is-hitting-americas-riskiest-borrowers-b292d08b

- https://www.experian.com/blogs/ask-experian/judgments-no-longer-included-on-credit-report/

- https://www.marketwatch.com/story/credit-scores-got-artificially-higher-during-covid-now-many-borrowers-cant-pay-their-debts-4e44136a

- https://www.fairviewlending.com/higher-credit-score-borrowers-pay-more-under-new-government-rule/

- https://www.fairviewlending.com/top-hard-money-questions-and-answers/

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. I’m not an armchair reporter/writer. We are an actual private lender, lending our own money. We service our own loans and own commercial and residential real estate throughout the country.

My day job is and continues to be private real estate lending/ hard money lending which enables me to have a unique perspective on the market. I don’t accept any paid sponsorships or ads on my blog to ensure accurate information. I’ve been writing this for almost 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending/ Private Lending with no upfront fees or any other games. We fund our own loans and provide honest answers quickly. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender