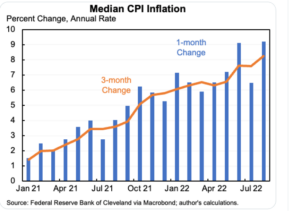

Once again, the recent CPI report came in much higher than expected. Why did the market drastically miss this prediction? I’m not even an economist and figured out months ago inflation would be higher for longer as everything I buy from groceries, dining out, airline tickets, oil changes, etc.. is drastically higher! Furthermore, there is one item in the CPI that makes up over 30% of the index that continues to crest higher.

What does the recent CPI number mean for real estate? Will the federal reserve stop their aggressive hiking next year as inflation peaks? Will interest rates finally return to their lows and in turn prices start to moderate as predicted? Sorry to burst the bubble, but inflation has a long way to go before retreating. We should hold off on any street parties for now as one metric continues to haunt the fed and in turn the inflation debate.

Why focus on rents and housing for inflation predictions?

In the Consumer Price Index “Shelter” is the largest variable in the index. Rents have always been important in measures of inflation, due to their outsize share in most household budgets: They comprise a little over 30% of the headline consumer price index, and about 40% of the core index.

The CPI does not directly measure housing price increases but attempts to capture this indirectly via rents. As housing prices rise, rents in turn must rise to keep up (or vice versa as rents rise, housing prices rise). Regardless of which happens first there is a historic link between housing prices and rents. You see this link most profoundly on commercial properties as the key metric to evaluate commercial properties is the income approach (revenue-expenses)/cap rate. As rents rise, property values rise as the net operating income is higher.

On the residential side, the same is occurring. As residential housing prices have risen profoundly rents in turn have risen to keep pace. This is intuitive as one would expect to pay more to rent a home that is worth 200k vs. 400k. With rents rising due to rising home prices, inflation in turn is remaining high

What was in the data about rents?

Month-over-month changes in rent prices increased more than 4 percent for one-bedrooms in July. Two-bedrooms were up just under 3 percent, a shift from prices that remained flat in June and a signal that rent prices may take longer to moderate than previously expected.

| Unit Type | Average Rent | MoM % Change | YoY % Change |

| 1-Bedroom | $1,770 | 4.1% | 39.0% |

| 2-Bedroom | $2,106 | 2.8% | 38.3% |

The bad news is it will take a while to settle back down to anything resembling pre-coronavirus norms.

Where will rents go in 2022 and beyond?

The measure of rents in the CPI tends to lag private-sector measures of new-lease inflation, because most tenants don’t move from one year to the next. So, forecasters have some visibility.

After surging in 2021, proxies using data on new-lease inflation from companies like Zillow and Apartment List topped out earlier this year and are now moderating, said Alan Detmeister, an economist at UBS Securities in New York.

The consumer price index measure of rental inflation should follow, though with a long lag. Detmeister sees rental inflation climbing north of 7% early next year — and even by the end of 2024 it will remain elevated, at about 4.5%, above the pre-pandemic norm.

“In many cases, you don’t get the jump up to those market rates until the tenant moves out, and that could be a year from now, two years from now, five years from now,” Detmeister said. “It’s going to take a few years to get back to the pre-pandemic pace.”

Other inflation metrics are also becoming more “sticky”

Along with rents, food costs and medical costs also to stay stubbornly high. The food index increased 0.8% in August and shelter costs, which make up about one-third of the weighting in the CPI, jumped 0.7% and are up 6.2% from a year ago.

Medical care services also showed a big increase, rising 0.8% on the month and up 5.6% from August 2021. New vehicle prices also rose, increasing 0.8% though used vehicles fell 0.1%.

What does this mean for interest rates and in turn real estate prices?

The hiking cycle by the fed will be higher and longer than is currently priced into the markets. With rents/shelter, food, medical, and other categories continuing to run higher the federal reserve will have a harder time taming inflation. Currently the recent interest rate hikes have done little to cool the economy as the president and congress continue to provide stimulus which is counteracting recent rate increases.

How does this cycle ultimately end?

We will see a .75% increase at the next meeting with continued hikes the rest of the year and possibly into next year. The 30 year fixed rate will easily clear 6% and march steadily towards 7%. I don’t see a reversal in this trend of rising rates until 2024 at the earliest.

“It tells you that it’s going to take a longer time, and will require higher rates — and in macro language, maybe even require more demand destruction,” as in higher unemployment and slower growth, said Torsten Slok, chief economist at Apollo Management. “It raises the probability of a recession.” With the federal funds rate remaining high, the likelihood of a soft landing is looking highly unlikely.

Summary

The recent CPI is indicative of a much larger problem that the federal government (federal reserve, congress, and president) have failed to acknowledge. This recent report shows that rents, wages, travel, etc… are all still running at 300%+ of the federal reserve’s target. All these factors are very “sticky” and unlikely to abate in the short term.

The federal reserve will have to “slam” on the brakes harder in order to stop the runaway overheating economy which will lead to much higher interest rates, lower stock prices, and ultimately a much slower economy. The odds of a “soft landing” are becoming substantially smaller. Now is the time to “fasten your seatbelts” as it is going to be a very bumpy ride in real estate.

Additional Reading/Resources:

- https://www.wsj.com/articles/us-inflation-august-2022-consumer-price-index-11663017630?mod=hp_lead_pos2

- https://www.bloomberg.com/news/articles/2022-09-12/if-you-want-to-know-where-us-inflation-is-heading-look-at-rents

- https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.htm

- https://www.apartmentguide.com/blog/apartment-guide-annual-rent-report/

- https://www.dallasfed.org/research/economics/2021/0824

- https://www.cnbc.com/2021/12/13/rent-is-going-up-again-heres-why.html

- https://finance.yahoo.com/news/frigid-future-ahead-housing-market-100000037.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender