Inflation plowed ahead at its fastest 12-month pace in nearly 40 years during January and substantially higher than any estimates according to a closely watched gauge the Labor Department released Thursday (CPI). The stock and bond markets are continuing to awaken, with mortgage rates skyrocketing to 4.25% from a low of 2.75%. What is causing the sudden jump in rates? What does this mean for real estate values and sales?

What was in the recent inflation/Consumer Price Index (CPI) data?

The consumer price index, a gauge that measures costs across dozens of items, increased 7.5%, according to the department’s Bureau of Labor Statistics.

Consumer prices surged more than expected over the past 12 months, indicating a worsening outlook for inflation and cementing the likelihood of substantial interest rate hikes this year.

The consumer price index for January, which measures the costs of dozens of everyday consumer goods, rose 7.5% compared with a year ago, the Labor Department reported Thursday.

That compared with Dow Jones estimates of 7.2% for the closely watched inflation gauge. It was the highest reading since February 1982.

That combination of higher food and housing prices “underlines our view that a rapid cyclical acceleration in inflation is underway and, with labor market conditions exceptionally tight, it is unlikely to abate any time soon,” wrote Andrew Hunter, senior U.S. economist at Capital Economics.

What is happening to mortgage rates as a result of the CPI data?

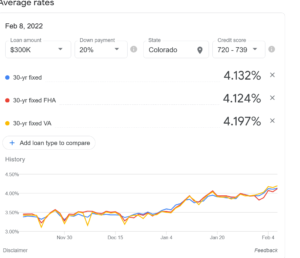

The chart above tells the story with interest rates. The market is pricing in the fact that inflation is not transitory and that the federal reserve will increase rates faster to get inflation down to a more reasonable number. The consensus amongst economist is between 4 to 7 rate hikes, but the market appears to be pricing in around 3 at this point. Assuming 4 hikes, as suggested by Goldman Sachs, this puts mortgage rates closer to 5% by the end of the year. This is a huge increase in payments from just last year when rates were 2.75%.

Will other rates also accelerate because of the CPI data?

Although I focus on real estate rates since they will most directly impact real estate prices, it is important to note that all rates will go up from credit cards, auto payments, lines of credit, etc… as they are typically pegged to prime which will be increasing significantly over this year. As rates go up, this will further crimp consumer buying power and disposable income.

Quick example of the impact of higher rates on prospective borrowers:

I assumed the bottom of the mortgage market was around 2.75% and took the current rate of about 4% to compare the impact to borrowers in 3 cities based on median home price. Furthermore, based on the prospective hikes, that should put rates around 5.25% sometime in 2023. Below is the cost to individual borrowers.

| Median home price | 2.75% rate | 4.5% rate | 5.25% rate | 2022 increase | 2023 increase | |

| Denver | $ 690,000 | $2,816.86 | $3,496.13 | $3,810.21 | $679.26 | $993.34 |

| Atlanta | $ 337,000 | $1,375.77 | $1,707.53 | $1,860.93 | $331.76 | $485.15 |

| Salt Lake City | $ 425,000 | $1,735.03 | $2,153.41 | $2,346.87 | $418.39 | $611.84 |

| 24% increase | 35% increase |

As you can see, the increased rates will have a huge impact on borrowers in all markets, but even more so with borrowers in high-cost markets where mortgage payments will jump around 1k/month for the median home in Denver. This is on top of all the inflationary pressures owners are feeling from higher insurance rates, property taxes, utility bills, maintenance costs, etc…

What is the magic number for rates that will cause the real estate market to slow/fall?

At some point rates rise high enough that sales begin to decline, and prices adjust as a result. Unfortunately, there is no hard and fast rate that anyone has done substantial research on that will cause the market to suddenly slow but there is a range that will alter the market. From the data above, when rates hit North of 5%, I suspect consumer behavior will start to change. Rates above 5% will lead to a 35% increase in payments for borrowers. The last wage report showed and average increase in salaries increasing around 5%, yet at the same time, mortgage payments could jump 35%. I’m doubtful the market would absorb this increase without seeing some lower prices or at the very least no further price appreciation for a while. Furthermore, if rates touch 5%, there are predictions by many economists of a 10-20% decline in prices. With the recent inflation numbers, 5% rates will come substantially faster than the market expects.

Summary

The recent CPI numbers put a nail in the coffin that rates will rise substantially with many predicting as many as seven hikes this year. Housing prices and mortgage rates have a historical correlation. As rates rise, sales tend to slow. Furthermore, other rates like credit cards and auto loans will further crimp consumer spending leaving less funds available for housing.

At the same time if rates rise high enough values will soften as less people can now afford the same property. We are already seeing a jump in rates from a low of 2.75% to around 4.25% today. Unfortunately, this recent upward march in rates is just the beginning. As rates cross the 5% threshold, which could happen later this year, look for housing to feel the impacts. The higher march of rates is just beginning. How broad these impacts are will be dependent on how high above 5% rates get.

Additional Reading/Resources:

- https://www.cnbc.com/2022/02/10/january-2022-cpi-inflation-rises-7point5percent-over-the-past-year-even-more-than-expected.html

- https://www.bloomberg.com/news/articles/2022-02-10/u-s-inflation-charges-higher-with-larger-than-forecast-gain?srnd=premium

- Will Rising Interest Rates Cause Home Prices to Crash in 2022? | The Motley Fool

- Housing market: Experts debate what rising mortgage rates mean for 2022 home prices | Fortune

- Goldman Sachs now thinks the Fed will hike rates four times in 2022 and start slashing its balance sheet in July (msn.com)

- Equity Index Futures Pick Up Steam After Stunning CPI Data (forbes.com)

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).