The federal reserve bank of NY recently published a report showing consumer debt jumping to the highest levels ever recorded with every category growing from mortgages, autos, credit cards, lines of credit, etc… Is some consumer debt better/worse than others for the economy and real estate? What does the huge increase in consumer debt mean for real estate sales volumes and in turn prices? What does this mean for interest rates?

What was in the data on consumer debt from the federal reserve bank?

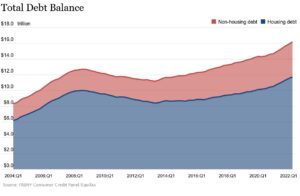

Total household debt rose $312 billion, or 2 percent, in the second quarter of 2022 to reach $16.15 trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances—the largest component of household debt—climbed $207 billion and stood at $11.39 trillion as of June 30. Credit card balances saw their largest year-over-year percentage increase in more than twenty years, while aggregate limits on cards marked their largest increase in over ten years. Furthermore, soared by $300 billion over the last year — the largest annual gain on record.

Why is total debt not the real story

When looking at statistics like consumer debt, looking at it in aggregate is basically useless as it hides data that will radically alter the economy in 2023. Fixed debt is not as problematic as variable debt especially in a rapidly rising rate environment. There are two main categories of consumer debt: credit cards, and home equity lines of credit.

- Credit cards: Credit card debt is rising at its fastest clip in more than 20 years, according to the Federal Reserve Bank of New York. Overall, Americans owe $887 billion on their credit cards, a 13 percent increase from a year ago. Now, with the Fed rapidly raising interest rates to contain inflation, families are feeling the pinch of higher borrowing costs, too. Average credit card rates, at 18.7 percent, are at their highest level in 30 years and will probably continue rising, according to Bankrate.com

- Helocs: Home-equity lending is on a roll this year, with the combined volume of home-equity lines of credit (HELOCs) and traditional closed-end home equity loans up 47% from January to May of 2022, compared with the same period last year.

Nearly $69 billion in HELOC credit limits and $27 billion in closed-end home-equity loans were originated over the first five months of 2021. That compares with $101 billion in HELOC volume and $38 billion in closed-end home-equity originations over the same period this year, according to a new report by the Urban Institute’s Housing Finance Policy Center. Another report by TransUnion shows the number of HELOC originations nationwide, based on the credit bureau’s analysis, jumped from 207,422 for second-quarter 2021 to 291,736 for the second quarter of this year — a 41% increase.

What do the sharp increases in credit card and Heloc debt mean for the economy?

- The bad news: As rates rise, the payments on credit cards and lines of credit will also rise substantially. In the past, these variable rates could be consolidated into a lower fixed rate. For example someone could refinance their house and payoff the variable debts. This party is over with 30 year fixed rates well above 7% which means that borrowers will have to pay the increased costs. These higher payments will no doubt lead to higher delinquency rates.

- The good news: As payments increase, this should eventually slow down the economy leading to lower long term inflation and eventually the federal reserve backing off on huge rate increases.

- The scary part: Unfortunately we do not know the true amount of consumer variable debt as buy now pay later lending has taken off the last two years. There likely is an additional hundreds of millions in short term debt that is not even on the radar. How this sector performs when there is a downturn could have a huge impact on the general economy. This is an area to watch as data is so limited and we have never been through a down cycle with this product.

What does this mean for real estate

With almost a trillion dollars in variable debt between credit cards and home equity lines of credit, the general economy is at much greater risk than even a year ago. Furthermore, consumers are spending a great portion of their income to service the debt and therefore will be less likely to qualify for a mortgage. One of the key factors in a mortgage is debt to equity ratio. As payments on debt continue to rise to almost 19% on credit cards, this ratio is going to come under increasing pressure and drastically reduce the number of available buyers and also force many buyers to lower their price expectations in order to quality for a mortgage. Long and short, the huge jump in consumer debt in a rising rate environment will reduce housing demand and in turn housing prices will need to adjust downward.

Summary

It is amazing that variable consumer debt like credit cards and lines of credit continue to rise even in a rapidly increase rate environment. As variable debt increases and the federal reserve continues to raise rates to fight inflation there is a pending shock that will occur in 2023 as many consumers will not be able to keep up with their payments. This will translate into lower real estate demand as many prospective buyers will no longer qualify and ultimately lead to lower housing prices. At some point consumers will have to pay the piper and ultimately real estate and the economy will feel the pain.

Additional Reading/Resources

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.housingwire.com/articles/heloc-volume-up-nearly-50-over-first-5-months-of-2022/

- https://www.bloomberg.com/news/articles/2022-09-26/consumer-debt-at-record-for-most-americans-except-the-wealthy

- https://www.washingtonpost.com/business/2022/10/17/credit-card-debt-interest-rates/

- https://www.newyorkfed.org/newsevents/news/research/2022/20220802

- https://www.cnbc.com/2022/11/15/household-debt-soars-at-fastest-pace-in-15-years-as-credit-card-use-surges-fed-report-says.html

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media and forward to your friends . I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, and Florida. We are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender