Commercial real estate is showing the first signs of cooling in more than a year, disrupted by rising interest rates that are already causing some deals to collapse. What is causing the quick change in fortunes in commercial real estate? How will the recent fed raise impact prices? What property types or more at risk and which ones will hold up better?

What was in the data on commercial property sales

Property sales were $39.4 billion in April, which was down 16% compared with the same month a year ago, according to MSCI Real Assets.

Now, some analysts are starting to ask whether the rally is running out of steam. Hotels, office buildings, senior housing and industrial properties recorded big drops in sales last month.

“The speed of that transition is shocking,” said Jim Costello, chief economist at MSCI Real Assets. A drop in sales can be an early indicator of stress in real-estate markets because prices are usually slower to change, he added.

What is the leading driver of the recent plunge in commercial property sales?

Interest rates. Commercial rates are pegged to treasuries or Libor and all of which are going up substantially. Similar to residential, higher rates, mean more money is needed to service the debt.

The primary way to value commercial real estate is the income approach:

Revenue- Expenses —> Net Operating income

Net Operating income/ Cap rate —>Value of property

Cap rate is the rate of return investors require to purchase a property. The higher the cap rate, the lower the value of the property. For example a class A credit tenant like Home Depot, might trade on a 4 or 5% cap rate, Moes second hand tools as a tenant could trade on an 8-10% cap rate.

As the yields on treasuries have gone up, Cap rates are going up. If someone could buy a risk free government bond and get a 4% rate of return, then cap rates will need to trade north of 4% to compensate for the risk of real estate. For example last year an apartment complex might have traded on a 3% cap rate, with the surge in rates, that apartment will likely trade on a 4 or 5% cap rate.

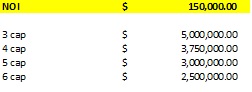

Here is a quick example

| NOI | $ 150,000.00 |

| 3 cap | $ 5,000,000.00 |

| 4 cap | $ 3,750,000.00 |

| 5 cap | $ 3,000,000.00 |

| 6 cap | $ 2,500,000.00 |

How will the recent federal reserve rate increase impact prices?

As the federal reserve continues to increase rates, cap rates will also continue to increase above the risk-free rate of treasuries. From the Federal reserve’s recent statements, it seems like we have a bit of a hike to go before reaching the top of this rate cycle. This puts current commercial real estate prices in jeopardy as cap rates rise.

What are the bright spots in commercial properties

Just like in residential, there will be some bright spots. Unfortunately, the bright spots will not knock it out of the park, they likely will perform “not as bad” as some of the other sectors.

- Multifamily: There still seems to be pricing ability to increase rents a bit further which should help offset somewhat the rising rates. My preference would be B/C properties as I think A properties have run their course

- Light Industrial: Light industrial will soften but with increased e-commerce and warehousing needs due to supply chains, the occupancy in light industrial should stay high and rents should hold up better than other property types.

Commercial areas of concern

- Retail: There is an oversupply of retail. As consumers continue to switch to services over goods, retail will continue to come under increasing pressure. Walmart, Target, Home Depot, etc.. have all announced slower sales. The next step is another wave of store closings/consolidation that will put pressure on lease rates and occupancy.

- Office: There will be a movement back to the office but the amount of space needed will be considerably less. We already are seeing a wave of layoff announcements in the real estate sector from banks, realtors, mortgage professionals, and title companies. This trend will continue as the economy cycles towards a recession. The downside in office has not been factored in yet so there is considerable risk of a price correction especially as rates jump higher and demand falls.

Summary

Gone are the days of free money that enabled commercial prices to soar. The federal reserve made it clear in their last meeting that inflation was their number one priority and they would take the steps necessary to reign in runaway inflation. This in turn will lead to higher borrowing costs, higher cap rates, and ultimately lower property values.

We are just in the first inning of the great deleveraging. Look for some substantial resets in prices throughout the commercial property sales spectrum with especially sharp corrections in retail and office. We have a long way to go before finding the true bottom in pricing of commercial real estate.

Additional Reading/Resources

- https://www.wsj.com/articles/commercial-property-sales-slow-as-rising-interest-rates-sink-deals-11654594380

- https://www.bloomberg.com/news/articles/2022-06-15/us-recession-risk-hits-72-by-2024-as-fed-hikes-rates-to-curb-inflation?srnd=premium

- https://www.bloomberg.com/news/articles/2022-06-16/mortgage-surge-toward-6-slams-brakes-on-red-hot-housing-market?srnd=premium

We are a Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linkedin, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is a hard money lender specializing in private money loans / non-bank real estate loans in Georgia, Colorado, Illinois, and Florida. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games).

Tags: Hard Money Lender, Private lender, Denver hard money, Georgia hard money, Colorado hard money, Atlanta hard money, Florida hard money, Colorado private lender, Georgia private lender, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender